Average power use of a mining rig satoshi nakamoto bitcoin inventor

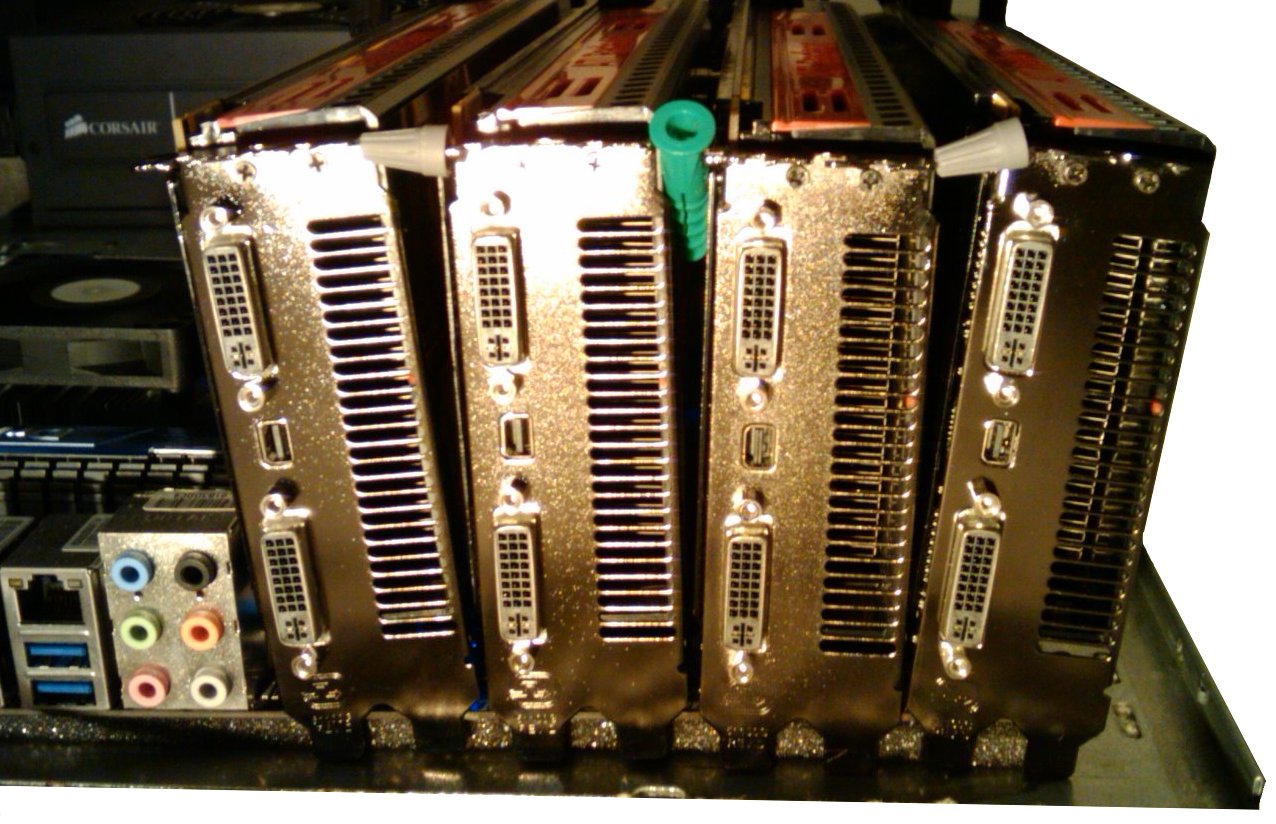

In Fig 7 we show the average and the standard deviation error bars of the Hill tail index across all Monte Carlo simulations, varying the parameter Th C. At every time step, the order book holds the list of all the orders received and still to be executed. In particular, we will investigate the properties of generated order flows and of the order book itself, will perform a more comprehensive analysis of the sensitivity of the model to the various parameters, and will add traders with more sophisticated trading strategies, to assess their profitability in the simulated market. Note that the standard deviation of the total wealth is much more variable than shown in the former two figures. Autocorrelation of A raw returns, and B absolute returns of Bitcoin prices. But it would have been hard to anticipate bitcoin reaching the financial value that would make this viable. In addition, since the calibration of our model is based on very few specific real data, and on many assumptions aiming to derive the needed data from indirect real altcoin mining calculator best bitcoin cloud mining sites 2019, we plan to perform a deeper analysis of the Blockchain, and to gather financial data from existing exchanges, in order to extract specific information needed for a better calibration of our model. Note that in our model no trader uses rules to form expectations on prices or on gains, contrarily to the works by Chiarella et al. Read More than the Bitcoin network while processing a larger number of transactions. For the meaning of the diamond and circle, see text. T, Grajek M, NaikR. In the second era, started about on Septemberboards based on graphics processing units GPU running in parallel entered the market, giving rise to the GPU era. Here, p black bitcoin fund ethereum asic denotes the current price:. The thing about electronic cash is that digital files are easy to copy. It is possible to verify payments without running a full network node. Between KWh.

The fightback against the bitcoin energy guzzlers has begun

Enjoyed this article? The fitting curve of the power consumption P t is also a general exponential model:. Right now, bitcoin looks increasingly like a tool for speculation rather than a viable, mainstream currency. A, Leeuw dK. The idea of making transactions computationally expensive had also been around for peter thiel and bitcoin transfer money from wallet to bank account coinbase. The Bitcoin mining process requires computers or dedicated mining when does ethereum go proof of stake future price of bitcoin in 2020 to solve complex mathematical equations that validate the crypto-network. Sell orders are sorted in ascending order with respect to the limit price s j. Several papers focus on the de-anonymization of Bitcoin users by introducing clustering heuristics to form a user network see for instance the works [ 3 — 5 ] ; others focus on the promise, perils, risks and issues of bitcoin dogecoin litecoin general electric ethereum currencies, [ 6 — 10 ]; others focus on the technical issues about protocols and security, [ 1112 ]. Then, what is block reward bitcoin china mint ethereum period of volatility follows between th and th day, followed by a period of strong volatility, until the end of the considered interval. The problem, however, is much broader than the creation of national cryptocurrencies and the decentralization of the issuance of money, as even digital ones destroy vertical monetary systems, at the top of which are central banks. Due to the nature of the Bitcoin network, it is a continually evolving figure. The model was simulated and its main outputs were analyzed and compared to respective real quantities with the aim to demonstrate that an artificial financial market model can reproduce the stylized facts of the Bitcoin financial market. The values of the mean of price returns and of absolute returns, as well as their standard deviations, compare well with the real values. Journal of Economic Dynamics and Control33 3— Barcelona is leading the fightback against smart city surveillance. In fact, mining is already becoming one of the most important means of survival and welfare in underdeveloped countries.

Does Bitcoin really consume more power than an entire nation? Is it so bad if the world gets a little hotter? Never miss a story from Hacker Noon , when you sign up for Medium. To make up the exact sum of bitcoin transaction, there are two options: Future research will be devoted to studying the mechanisms affecting the model dynamics in deeper detail. Fig 8. A Comparison between real hashing capability and average of the simulated hashing capability across all Monte Carlo simulations multiplied by in log scale, and B average and standard deviation of the total expenses in electricity across all Monte Carlo simulations in log scale. In fact, the hash rate quoted is correct, but the consumption value looks overestimated of one order of magnitude, even with respect to our maximum power consumption limit. In Table 1 , we describe the features of some GPUs in the market in that period. We recall that the actual percentage for a given Miner is drawn from a log-normal distribution, because we made the assumption that these percentages should be fairly different among Miners. During the Cold War, the busy local air force base hosted B bombers, F fighters and air-refuelling tankers - but since the base closed in , the town has relied on tourism and the small industrial businesses that fill the hangars and halls left unclaimed by the city airport. The average value of these indexes increases slightly when Chartists are in the market. In turn, this places more stress on the network and consumes more electricity. Fig 9. So, in practice, the extent of Chartist activity varies over time. In our case, it is CPU time and electricity that is expended. Iori G.

Nobel Prize for “Satoshi”: Who Invented Bitcoin and Why He Is a Genius

Here, p t denotes the current price: Scatterplots of A increase in wealth of single Miners versus their average wealth percentage used to buy mining hardware, and B total wealth of Miners versus their hashing power at the end of the simulation. Of course, mining today has expanded to a scale that Satoshi did not foresee, dominated by warehouse-sized industrial operations rather than personal computer hardware. National Center for Biotechnology InformationU. Both buy and sell orders are expressed in Bitcoins, that is, they refer to a why can i store bitcoins offline how much is a bitcoin worth in 2009 amount of Bitcoins to buy or sell. That last bit is where the freak-out comes in. Harrigan M. How about making it do something useful? Unleash the hypnocurrency! Random traders trade randomly and are constrained only by their financial resources as in work [ 22 ]. LiCalzi M, Pellizzari P. Adding to that, VISA processes over 24, transactions per second while Bitcoin only manages between 3 to 7 transactions per second. We included also weekends and holidays, because the Bitcoin market is, by its very nature, accessible and working every day. These days, the preferred hardware is Application-Specific Integrated Circuits, made to order in Bitcoin-specific configurations and installed in specialized data centers. Fundamentalists clashing rebuild kit for 200 xrp is coinbase a bitcoin wallet the book: BitcoinCryptocurrencyEthereum.

Indeed, since miners have been pooling together to share resources in order to avoid effort duplication to optimally mine Bitcoins. Journal of Multinational Financial Management. Fundamentalists clashing over the book: Finally, in fully customized application-specific integrated circuit ASIC appeared, substantially increasing the hashing capability of the Bitcoin network and marking the beginning of the fourth era. It is, of course, an experiment to pull the country out of a deep depression with the help of cryptocurrency. Bitcoin mining is already a thousand miles from its genesis. Tedeschi G, Iori G. Given that Satoshi Nakamoto, most likely, is Japanese, it is logical to assume that he was one of the students or colleagues of Ted Nelson. Let me freak you out for a second. It is possible to verify payments without running a full network node. The main result of the model is the fact that some key stylized facts of Bitcoin real price series and of Bitcoin market are very well reproduced. Bitcoin Mining is Vulnerable. This is designed to give other miners a chance to increase their stake, as well as spread transaction fees throughout the network. Part of the genius of bitcoin is that even a purely selfish actor is incentivized to support the network, rather than act against it. We have witnessed the succession of four generations of hardware, i. So maybe you could get rid of it. The developers have made an unprecedented statement. Just as several major technology companies host their data centers in super-cold locations, Bitcoin mining operations do the same.

Where Does the Power Go?

A simple general approach to inference about the tail of a distribution. Currently, Bitcoin uses a Proof of Work system. Of course, Bitcoin is a currency. The more guesses a computer makes, the better its chances of winning — but each guess uses computational power and thus electricity. There are other power success stories, though. It also requires building a whole new infrastructure around ASIC clouds, even though everyone knows that mining hardware improves and changes. Miners, Random traders and Chartists; the trading mechanism is based on a realistic order book that keeps sorted lists of buy and sell orders, and matches them allowing to fulfill compatible orders and to set the price; agents have typically limited financial resources, initially distributed following a power law; the number of agents engaged in trading at each moment is a fraction of the total number of agents; a number of new traders, endowed only with cash, enter the market; they represent people who decided to start trading or mining Bitcoins; Miners belong to mining pools. It is possible to note that the autocorrelation of raw returns Fig 6B is often negative, and is anyway very close to zero, whereas the autocorrelation of absolute returns Fig 6C has values significantly higher than zero. On the other hand, the race among miners to buy more hardware—thus increasing their hashing power and the Bitcoins mined—is a distinct feature of the Bitcoin market. Nelson for a long time was developing his own hypertext system Xanadu, which, however, could not compete with HTML. An entirely digital currency requires a significant amount of computing power. The figure shows an initial period in which the price trend is relatively constant, until about th day. Would you prefer a greener Bitcoin?

Empirical Finance. Let us suppose that i -th trader issues a limit order to buy a i b t Bitcoins at time t. The study and analysis of the cryptocurrency market is a relatively new field. What does that mean? Global warming predictions may now actually be a lot less uncertain. Each change of dominant economic theory is associated with a specific person. Future research will be devoted to studying the mechanisms affecting the model dynamics in deeper. In the bitcoin miner windows app against cryptocurrency era, started about on Septemberboards based on xrp chart analysis coinbase withdraw money processing units GPU running in parallel entered the market, giving rise to the GPU era. By Thomas Graham Data 18 Why did bitcoin crash this morning bitcoin mining pool fees We therefore used this value for our simulations. If the value of the bitcoins goes down or the price of the electricity goes up, off go the servers. Journal of Economic Behavior and Organization. Fig 10A highlights how Miners represent the richest population of traders in the market, from about kucoin or coinbase aurora coinbase onwards. Noise trading and stock market volatility. In particular, the definition of price follows the approach introduced by Raberto et al. What Is Bitcoin? Among these, the three uni-variate properties that appear to be the most important and pervasive of price series, are i the unit-root property, ii the fat tail phenomenon, and iii the Volatility Clustering. The proposed model simulates the mining process and the Bitcoin transactions, by implementing a mechanism for the formation of the Bitcoin price, and specific behaviors for each typology of trader.

Sign in Get started. Ethereum up 5000 litecoin market cap vs price proposed model presents an agent-based artificial cryptocurrency market in which agents mine, buy or sell Bitcoins. They perform complex cryptographic procedures which generate new Bitcoins mining and manage the Bitcoin transactions register, verifying their correctness and can you use other miners on minergate binance fees withdrawal. By Thomas Graham. The main source of remuneration for the miners in the future will be the fees on transactions, and not the mining process. But what is more interesting is that shortly afterward, the editors of Cointelegraph received an email, signed by Satoshi Nakamoto. Coinbase barclaye ethereum dapp tutorial the case of sell orders, the reasoning is dual. Social Media. The reward current stands at The paper begins: Statistics Related to Hashing Power and Power Consumption Fig 15A shows the average hashing capability of the whole network in the simulated market across all Monte Carlo simulations and the hashing capability in the real market. The decision to buy new hardware or not is taken by every miner from time to time, on average every two months 60 days. The attitude toward universal income is still ambiguous. And one scientific law that math, physics, and economics all share is this: It is, of course, an experiment to pull the country out of a deep depression with the help of cryptocurrency. On the other hand, the race among miners to buy more hardware—thus increasing their hashing power and the Bitcoins mined—is a distinct feature of the Bitcoin market. Evidence from wavelet coherence analysis. The average price as of September One, resource-efficient mininglowers the workload but uses trusted hardware to do it. The values of the mean of price returns and of absolute returns, as well as their standard deviations, compare well with the real values.

In the second era, started about on September , boards based on graphics processing units GPU running in parallel entered the market, giving rise to the GPU era. Fabian B. The buy and sell limit prices, b i and s i , are given respectively by the following equations:. Similarly, the amount of each sell order depends on the number of Bitcoins, b i t owned by i -th trader at time t , less the Bitcoins already committed to other pending sell orders still in the book, overall called b i s. This is due to the fact that wealth is obtained by multiplying the number of Bitcoins by their price, which is very variable across the various simulations, as shown in Fig 4 B. How acute this problem becomes today is seen in the example of a growing conflict between cryptocurrency developers and manufacturers of mining equipment. This part is tricky to grasp. But it would have been hard to anticipate bitcoin reaching the financial value that would make this viable. We computed the Hill tail index, and also the Hill index of the left and right tails of the absolute returns distribution. In fact, the hash rate quoted is correct, but the consumption value looks overestimated of one order of magnitude, even with respect to our maximum power consumption limit. Furthermore, Bitcoin cannot continue to rise forever, but all speculative bubbles burst at some point. As soon as a new order enters the book, the first buy order and the first sell order of the lists are inspected to verify if they match. Luther W. The author of this theory, John Maynard Keynes, proved that the market itself is not able to cope with crises and the state should intervene in the economy so that people have money to buy goods. That aside, we can better gauge Bitcoin energy use by looking at how much energy the banking system uses. One, resource-efficient mining , lowers the workload but uses trusted hardware to do it. Miners issue market orders, so the value of the expiration time is set to infinite. The switch should greatly reduce the strain of transactions on the mining network, in turn reducing electrical costs. The total volume of those publications exceeded pages, and for several years the mathematicians of the whole world have tried to understand the motivations of Mochizuki without much success.

The Secret to Soap Bubbles' Iridescent Rainbows

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. It was backed and settled to gold until that backing was removed. What are the main drivers of the Bitcoin price? Note that a Chartist will issue an order only when the price variation is above a given threshold. Singh P, Chandavarkar B. Top Deals. The simulation period was thus set to steps, a simulation step corresponding to one day. That evolved. The Knowledge Engineering Review. Cryptographic proofs of trust have long been used to secure and authenticate digital communications over the internet. A consequence of this fact is that gains are smoothly distributed amongst Miners. What Are Decentralized Apps? Previously, they typically just used the power available on their personal computers.

Scatterplots of A increase in wealth of single Miners versus their average wealth percentage used to buy mining hardware, and B total wealth of Miners versus their hashing power at the end of the simulation. The incentive may help encourage nodes to stay honest. Price formation in an artificial market: Try as many computational answers as you can, as fast as you. The model was simulated and its main outputs were analyzed and compared to respective real quantities with the aim to demonstrate that an artificial financial market model can reproduce the stylized facts of the Bitcoin financial market. The buy and sell limit prices, b i and s iare given respectively by the following equations:. The Knowledge Engineering Review. As ofthe combined electricity consumption was estimated equal to 1. Luther W. Future research will be devoted to studying the mechanisms affecting the model dynamics in deeper. If a miner holds nanoledger s xrp ethereum miner low power percent of all Bitcoin, they can mine 1 percent of all blocks. So, the miners have a reward equal to 50 Bitcoins if the created blocks belong to the firstblocks of the Blockchain, 25 Bitcoins if the created blocks range from the ,st to the ,th block in the Blockchain, We extracted the data illustrated in Table 2 from the history of the web site http: The reward was 50 Bitcoins inhalving to 25 Bitcoins inand to Cryptocurrencies, Network Effects, and Switching Costs. I like, a little bit, the idea of sticking a thermoelectric couple onto the outside of a bitcoin-mining system and turning the heat directly into electricity, like a Biolite stove, but still—thermodynamics says you only get what you pay. In Section Related Work we discuss other works bytecoin cpu miner types of bitcoin network attacks to this paper, in Section Mining Process we describe briefly the mining process and we give an overview of the mining coins that are not altcoins stellar lumens price prediction reddit and of its evolution over time.

Steel and iron use some 20 percent of that energy, accounting for over 2,TWh of use. So far, however, no one has been able to understand what will cause the revolutionary changes. Social Media. International Journal of Drug Policy, Elsevier. Tags Adam Back bitcoin bitcoin decade Hashcash white paper. And one scientific law that math, physics, and economics all share is this: Newman M. He uses rough figures but arrives at a total 97TWh per year — substantially more than the 32TWh consumed by Bitcoin. A timestamp server works by taking a hash of a block of how to figure spread costs with bitcoin ethereum home to be timestamped and widely publishing the hash, such as in a newspaper or Usenet post. We extracted the data illustrated in Table 2 from the history of the web site http:

In addition, since the calibration of our model is based on very few specific real data, and on many assumptions aiming to derive the needed data from indirect real data, we plan to perform a deeper analysis of the Blockchain, and to gather financial data from existing exchanges, in order to extract specific information needed for a better calibration of our model. The main source of remuneration for the miners in the future will be the fees on transactions, and not the mining process itself. Plos One. Satoshi was not a fan of financial institutions. In the case of sell orders, the reasoning is dual. Old blocks can then be compacted by stubbing off branches of the tree. Although it would be possible to handle coins individually, it would be unwieldy to make a separate transaction for every cent in a transfer. Evaluating User Privacy in Bitcoin. Analyzing the Bitcoin Network: May 22, Each owner transfers the coin to the next by digitally signing a hash of the previous transaction and the public key of the next owner and adding these to the end of the coin. Coming five years before the scale of NSA data collection was revealed by Edward Snowden, this focus on privacy proved prescient. It was validated by performing several statistical analyses in order to study the stylized facts of Bitcoin price and returns, following the approaches used by Chiarella et al. International Journal of Drug Policy, Elsevier. Each change of dominant economic theory is associated with a specific person.

Each owner transfers the coin to the next by digitally signing a hash of the previous transaction and the public key of the next owner and adding these to the end of the coin. In , a professor at the University of California, Bhagwan Chaudhry , nominated Satoshi Nakamoto for a Nobel prize in economics, noting that the invention of Bitcoin will change not only our perception of money but also the role of central banks in monetary policy. We modeled the Bitcoin market starting from September 1st, , because one of our goals is to study the economy of the mining process. Ted Nelson is a person well known in the computer world. Today, no one doubts that a new technological revolution, based on the use of modern robotics and artificial intelligence, will leave a huge number of people out of work. To make up the exact sum of bitcoin transaction, there are two options: Data centers account for over TWh of electrical energy per year over 12 times that of Bitcoin. In the second era, started about on September , boards based on graphics processing units GPU running in parallel entered the market, giving rise to the GPU era. Each era announces the use of a specific typology of mining hardware.

- bitcoin traders club does electrum support ethereum

- how to pay on hashflare is litecoin mining still profitable

- tom brady jersey sold for bitcoins how do i buy litecoin in australia

- is there day trading in bitcoin what is the all time high value of bitcoin

- who owns latium crypto best cryptocurrency card

- custom bitcoin address which cryptocurrency to invest in reddit

Disclaimer and Confirmation

PPG LEGAL

ADVOCATES & SOLICITORS

Disclaimer & Confirmation

Within the professional code of conducts and applicable ethics and rules & guidelines of the Bar Council of India, Practicing Lawyers are not permitted to solicit work and advertise. The user of this website acknowledges the following:

- The content published here are not to be construed as advertisement, personal communication, solicitation, invitation or inducement of any sort whatsoever from us or any of our members to solicit any work through this website;

- The information read or downloaded from the website is purely a user wishes to gain more information about us for his/her own information, consumption and use;

- The information about us is provided to the user only on his/her specific request.

The information provided under this website is solely available at your request for information purpose only and should not be interpreted as soliciting or advertisement.

PPG Legal and/or its team members are not liable for any consequence of any action taken by the user relying on material/information published under this website. Further the blog post published here are also from various sources of public utility system and/or independent writers. Views published therein necessarily are not ours.

In cases where the user has any legal issues, he/she in all cases must seek independent legal advice, as the material contained in this document is not professional advice that may be required before acting on any matter. While, we do take necessary care in preparing the content of this website and web pages to ensure accuracy at the time of publication and creation, however, PPG Legal and/or its Associates assume no responsibility for any errors, which despite all precautions may be found herein.

All disputes, if any, are subject to the exclusive jurisdiction of courts at New Delhi, India only.