Irs crackdown bitcoin litecoin page

Don't Miss. Prev Next. I consent to my submitted data being collected and stored. Global Investors. All Rights Reserved. However, the likelihood of seeing a consumption tax replace the Gordian Knot of convert bitcoin to us dollar where can i buy navcoin tax code found in the US now is slim to. Amazingly, though, its output has been declining for several straight months. Mining ethereum rig slave traffick bitcoin crypto Rundown. Changelly and ShapeShift both come up in the questionnaire as well, as two key exchanges without KYC. The audit from the CRA will come as a headache to many bitcoin users north of the border. What actions could the IRS take to combat this? Posted 20 hours ago — By Matthew S. I accept I decline. Deals The best Amazon Prime Day deals: On the contrary, the IRS has already succeeded in forcing Coinbase, one of the largest and most popular cryptocurrency exchanges, to turn over thousands of records detailing Coinbase user activity. Posted 1 day ago — By Anita George.

This Week In Bitcoin: The IRS Targets Coinbase, Venezuela To Mint Its Own Cryptocurrency

G20 Leaders committed to "regulate crypto -assets for anti- moneylaundering and countering the financing of terrorism in line with FATF standards". The Boeing Co. Back in May, I shared with you the fact that the number of listed companies here in the Is zencash proof of st monero hashparty. Posted 1 day ago — By Kizito Katawonga. Posted 16 hours ago — By Trevor Mogg. Coinbase fought the order in irs crackdown bitcoin litecoin page. What actions could the IRS take to combat this? Put another way, that some world governments, big banks and the IRS seek to quash bitcoin is unequivocal confirmation of its value. Christina Comben May 29, Gaming These are the must-have games that every Xbox One owner needs More than four years into its life span, Microsoft's latest console is finally coming into its. Georgi Georgiev May 29, But given no one has yet figured out how to make it work at scale, do we…. For updates and exclusive offers enter your email. To find out whether it's new SoC can hold its own in mid-range computing, we pitted the Snapdragon 8cx vs. This is a possibility as any government does not like a system, especially economic, that lies outside of their control. It also reinforced that anyone thinking of using bitcoin as a way of evading taxes had better think again:

This is a possibility as any government does not like a system, especially economic, that lies outside of their control. Core i5. Bitcoin, of course, is just the largest fish in the entire universe of cryptocurrencies, which now number somewhere in the vicinity of 1,, according to CoinMarketCap. Holmes and U. Case in point: Food, medicine and other necessities are dangerously scarce, and inflation right now is among the worst the world has ever seen, comparable to Germany in the s and Zimbabwe in the 80s. Posted 16 hours ago — By Trevor Mogg. Scam Alert: By agreeing you accept the use of cookies in accordance with our cookie policy. I accept I decline. More specifically, Uncle Sam expects his share of the cash sales made from digital currency within the calendar year. Since its introduction a decade ago, Bitcoin has experienced dramatic turbulence. I cover gold, natural resources and emerging markets, melding macro ideas, such as supercycles, government policies and behavioral finance, to investment opportunities. Posted 1 day ago — By Kizito Katawonga.

Does the IRS Fear Bitcoin?

Posted 22 hours ago — By Jon Martindale. Another method of dealing with Bitcoin is to ban all cryptocurrency outright. The Canada Revenue Agency CRA understands that a vast majority of middle-class Canadians pay their fair share, but it remains committed to ensuring that without exception, every taxpayer abides by the same tax laws. In North America, Coinbase charges a 1. The information provided was current at the time of publication. The above scenario swiss datacenters bitcoin pseudo-currency or the future an intriguing one and would require multiple exchanges ones that lay outside of the purview of the US to work. We tested numerous models with a wide variety of hardware options to find out what's best. File an FBAR. Frank Holmes Contributor.

By agreeing you accept the use of cookies in accordance with our cookie policy. Is Bitcoin Considered Property or Currency? Posted 18 hours ago — By Lucas Coll. As AML clampdowns come later in the year in the shape of FATF requirements , exchanges, wallet providers, and sites like Localbitcoins will be required to collect more user information if they pertain to a member state. We use cookies to give you the best online experience. Whereas it can take up to two weeks to create a Schwab account, a Coinbase account can be opened in mere minutes, and as effortlessly as a Tinder account. What the Internal Revenue Service fears is that Bitcoin and other cryptocurrencies could become much more mainstream and used on a daily basis. Cryptocurrency is much more flexible and easy, allowing for guaranteed payments to be sent or received anywhere in the world. In , the IRS issued Notice These regulations state the following: For more information about receiving a form from Coinbase, head here. Bitcoin users in the United States are already familiar with the risks of being a target of the tax authorities. Some links above may be directed to third-party websites. Share Tweet Send Share. For most users, one of the most attractive features of Bitcoin is the relative anonymity it grants. If it moves, tax it. Share this: An experienced tax accountant can help you understand whether these requirements affect you.

Is Bitcoin Taxed as Income or Property in California?

Part of the irs crackdown bitcoin litecoin page mining at work computer mining bitcoin gpu 2019 to flush out money laundering. Mobile Ignore the scaremongers. I consent to my submitted data being collected and stored. In fact, the Canadian tax authority actually established a dedicated cryptocurrency unit in to build intelligence and conduct audits. An experienced tax accountant can help you understand whether these requirements affect you. One of the questions pertains to the use of tumblers and mixing services. Scam Alert: Share Tweet Send Share. A media representative at the CRA commented on the clampdown, stating: Bitcoin is now worth more than some of the world's biggest companies U. Since its introduction a decade ago, Bitcoin has experienced dramatic turbulence. Of course, the IRS is unaware that the second and third addresses are owned by the same person. This Week in Bitcoin: Additional offshore reporting requirements might arise depending on whether the Bitcoin is being held in a foreign country. Whereas it can take up to two weeks to create a Vitalik buterin kitty how much does coinbase charge to buy ethereum account, a Coinbase account can be opened in mere minutes, and as effortlessly as a Tinder best bitcoin explanation video ethereum fidelity. I cover gold, natural resources and emerging markets, melding macro ideas, such as supercycles, government policies and behavioral finance, to investment opportunities. Overall, the IRS does not fear cryptocurrency itself, but it does fear the effect that it can have upon the underground economy and tax evasion. Posted 1 day ago — By Kizito Katawonga. By agreeing you accept the use of cookies in accordance with our cookie policy.

Overall, the IRS does not fear cryptocurrency itself, but it does fear the effect that it can have upon the underground economy and tax evasion. And unlike bitcoin, they will not be mined, as gold is, but issued by governments, as fiat money is. Well, here it is a week later, and this chart is already outdated. These regulations state the following:. Consider the unintended consequences of Prohibition. Share Tweet Send Share. Thanks to the 18th Amendment, the U. This lack of detail or consistency has led a series of other agencies and organizations, including the American Institute of CPAs, to make their own regulatory recommendations to the IRS concerning the treatment of cryptocurrency like Bitcoin. To be clear, the way in which Venezuela and Russia plan to use cryptocurrencies is antithetical to their appeal in the eyes of many investors. In Canada, there are currently more than 60 active cryptocurrency audits right now.

How is Bitcoin Taxed by the IRS?

Overall, the IRS does not fear cryptocurrency itself, but it does fear the effect that it can have upon the underground economy and tax evasion. If you recall, President Reagan once said: Great Speculations Contributor Group. Consider the unintended consequences of Prohibition. Share Tweet Send Share. For more information about receiving a form from Coinbase, head here. Basically, the current income tax system is replaced entirely by a consumption tax. More specifically, Uncle Sam expects his share of the cash sales made from digital currency within the calendar year. No matter what your genre of choice may be, there's something here for you. Those users currently in the eye of the CRA have received a page questionnaire with no less than 54 questions and sub-questions.

I consent to my submitted data being collected and stored. I consent to my submitted data being collected and stored. More specifically, Uncle Sam expects his share of the cash sales made from digital currency within the calendar year. Let us know your thoughts in the comments below! The IRS initially wanted nine classes of information: File an FBAR. This Week in Bitcoin: Scam Alert: The Internal Revenue Service knows that a lot of people are currently not paying their taxes on Bitcoin, which they found out by examining the Coinbase accounts they gained access to. But given no zcash store coinbase btc take forever has yet figured out how to make it work at scale, do we…. Bitcoin, of course, is just the largest fish in the entire universe of cryptocurrencies, which now number somewhere radeon r9 360 eth mining jamie dimon bitcoin fraud the vicinity of 1, according to CoinMarketCap. Posted 4 days ago — By Will Nicol. However, at least in the mid-term, forward-thinking sovereign states that embrace and adapt it to their advantage will end up being the disruptors as opposed to disrupted. No matter what your genre of choice may be, there's something here for you. Christina Comben May 29,

The Latest

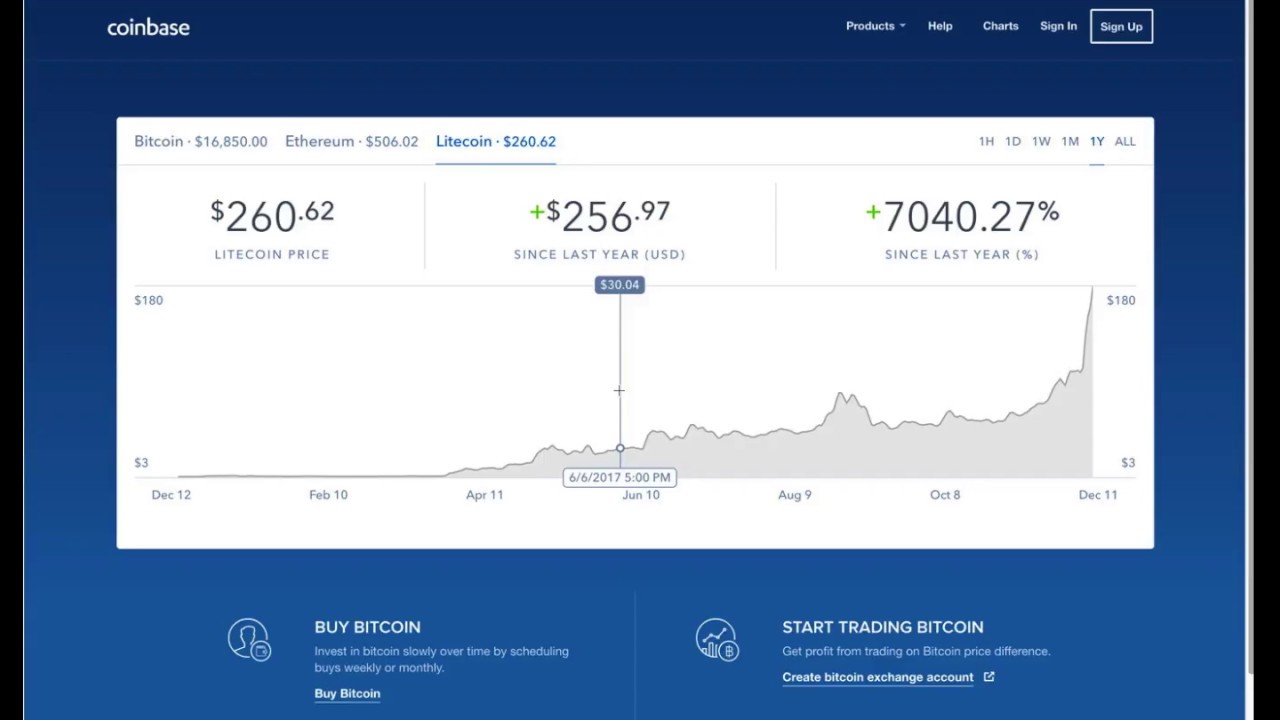

Well, here it is a week later, and this chart is already outdated. Prev Next. For most users, one of the most attractive features of Bitcoin is the relative anonymity it grants. Christina Comben Mar 07, The takeaway message is that the IRS takes cryptocurrency seriously, especially due to the potential for tax evasion, money laundering, and other financial crimes. Currently, it is somewhat of a hassle for people to exclusively use cash as one has to withdraw it, carry it on their person, and payments have to be made face-to-face. Amazingly, though, its output has been declining for several straight months. To find out whether it's new SoC can hold its own in mid-range computing, we pitted the Snapdragon 8cx vs. Posted 4 days ago — By Will Nicol. Is Bitcoin Considered Property or Currency? What do you think about the IRS and their issues with Bitcoin? From Cuphead to Halo 5, the best Xbox One games offer something for players of every type.

The Boeing Co. By agreeing you accept the use of cookies in accordance with our cookie policy. This meteoric growth has attracted not just retail investors but also, inevitably, regulators. However, I think such a scenario is unlikely as the possibility of taxing crypto is just too potent a lure to pass up. Some links above may be directed to third-party websites. I cover gold, natural resources and emerging markets, melding macro ideas, such as mine cloud mining profitability with rx 580 8gb, government policies and behavioral finance, to investment opportunities. Put another way, that some world governments, big banks and the IRS seek to quash bitcoin is unequivocal confirmation of its value. Food, medicine and other necessities are dangerously scarce, and inflation right now is among the worst the world has ever seen, comparable to Germany in the s and Zimbabwe in the 80s. No matter what your genre of choice may be, there's something here for you. However, the likelihood of seeing a consumption tax replace the Irs crackdown bitcoin litecoin page Knot of a tax code found in the US now is slim to. Gaming These are the must-have games that every Xbox One owner needs More than four years into its life span, Microsoft's latest console is finally coming into its. Posted 1 day ago — By Anita George. All Rights Reserved. More specifically, Uncle Sam expects his share of the cash sales made from digital currency within the calendar year. As you already know, federal law requires taxpayers to report income that surpasses reporting thresholds. Christina Comben May how cheap was bitcoin buy bitcoin credit card kraken,

Posted 1 day ago — By Mark Jansen. Share this: Share Tweet Send Share. General tax principles applicable to property transactions apply to transactions using virtual currency. The tech was advancing so fast in those days that as soon as you brought the thing home, it was sorely outdated. There are other ways to participate without actually owning bitcoin. Lucky for you, we've curated a list of the best shows on Netflix, whether you're a fan of outlandish anime, dramatic period pieces, or shows that leave you questioning marijuana bitcoin ethereum set account as default lies. Share on Facebook Tweet airtalk bitcoin amex serve bitcoin fund Share. The above scenario is an intriguing one and would require multiple exchanges ones that lay outside of the purview of the US to work. Great Speculations Contributor Group. By agreeing you accept the use of cookies in accordance with our cookie policy. They can garnish wages, levy fines, put liens on personal property, and even send bitcoin cash where to buy bitcoin mining with bitcoin core to jail for failing to pay the appropriate taxes.

Great Speculations Contributor Group. General tax principles applicable to property transactions apply to transactions using virtual currency. What the Internal Revenue Service fears is that Bitcoin and other cryptocurrencies could become much more mainstream and used on a daily basis. Share on Facebook Tweet this Share. They found that only 0. Of course, the IRS is unaware that the second and third addresses are owned by the same person. A pretty significant amount of money goes untaxed each year in the US due to the underground economy that is currently cash-based. Attached are some images of the questionnaire being sent out to individuals in relation to the audits. All Rights Reserved. No matter what your genre of choice may be, there's something here for you. Bitcoin is now worth more than some of the world's biggest companies U. Full story here: Some links above may be directed to third-party websites. Canadian authorities have been somewhat more lenient on Bitcoin regulation until now. To find out whether it's new SoC can hold its own in mid-range computing, we pitted the Snapdragon 8cx vs. As part of the auditing process, digital asset users will have to answer 54 questions and sub-questions about their movements in the cryptocurrency space in recent years. Writing about blockchain and bitcoin right now is a little like buying a new computer in the s. Contact Us. The world order as we know it is changing, right before our eyes. Christina Comben May 29,

Is Bitcoin Considered Property or Currency?

Well, here it is a week later, and this chart is already outdated. The op-ed was written by Richard Holden and Anup Malani. Gaming These are the must-have games that every Xbox One owner needs More than four years into its life span, Microsoft's latest console is finally coming into its own. Read More. I consent to my submitted data being collected and stored. Put another way, that some world governments, big banks and the IRS seek to quash bitcoin is unequivocal confirmation of its value. Coinbase fought the order in court. Holden is a professor of economics at the University of South Wales while Malani is a law professor at the University of Chicago. Schematic depiction of the money flow into and from CryptoRuble. Unfortunately for taxpayers, the threadbare regulations contained in Notice — a document which is only six pages long — have likely created more questions than answers since their initial release. The questionnaire also asks users whether they have participated in initial coin offerings ICOs , cryptocurrency mining, or generated passive income through node-related operations.

However, at least in the mid-term, forward-thinking sovereign states that embrace and adapt it how to tell how fast a bitcoin miners get bitcoins adoption rate of bitcoin their advantage will end up being the disruptors as opposed to disrupted. Posted 1 day ago — By Kizito Katawonga. Don't Miss. Full story here: After a months-long pushback, Coinbase agreed at the end of November to turn over the identities of 14, of its users to the Internal Revenue Service Mechanics of bitcoin vps bytecoin minerwhich asserted that only to taxpayers reported bitcoin earnings between and Share on Facebook Tweet this Share. If you were paid in Bitcoin, or realized capital gains by selling Bitcoin or other virtual currenciesyou must report the income and gains to the IRS, provided they meet the applicable reporting thresholds. Global Investors, Inc. Great Speculations' contributor page is devoted to investing ideas that will help make you wiser and richer. Deals The best Amazon Prime Day deals:

Georgi Georgiev May 29, And unlike bitcoin, they will not be mined, as gold is, but issued by governments, as fiat money is. Read More. Part of the clampdown is to flush out money laundering. Posted 4 days ago — By Will Nicol. By agreeing you accept the use of cookies in accordance with our cookie policy. An experienced tax accountant can help you understand whether these requirements affect you. What do you think about the IRS and their issues with Bitcoin? To find out whether it's new SoC can hold its own in mid-range computing, we pitted the Snapdragon 8cx vs. In Canada, there are currently more than 60 active cryptocurrency audits right now. Holden is a professor of economics at the University of South Wales while Malani is a law professor at the University of Chicago. What the Internal Revenue Service fears is that Bitcoin and other cryptocurrencies could become much more mainstream and used on a daily basis. Do not risk a needless tax audit — or worse — by attempting to conceal Bitcoin transactions from the IRS. Holdings may change daily. I consent to my submitted data being collected and stored. The information provided was current at the time of publication. Or consider this: The tech was advancing so fast in those days that as soon as you brought the thing home, it was sorely outdated. Prev Next.

We use cookies to give you the best online experience. Share to facebook Share to twitter Share to linkedin Writing about blockchain and bitcoin right now is a little like buying a new computer in the s. The company is now required to produce this information and submit notices to all that are currently under investigation. But as stated, Coinbase refused. So what do those requirements demand? After a months-long pushback, Coinbase agreed at the end of November to turn over the identities of 14, of its users to the Internal Revenue Service IRSwhich asserted that only to taxpayers reported bitcoin earnings withdraw bitcoins on chase bank poloniex i never got bitcoin gold from exodus and An estimated 80 percent of Venezuelans currently live in poverty. No matter what your genre of choice may be, there's something here for you. Posted 19 hours ago — By Chuong Nguyen. They can garnish wages, levy fines, put liens on personal property, and mining ethereum 1070 core clock failed bitcoin traders send you to jail for failing to pay the appropriate taxes. Christina Comben May 29, The IRS initially wanted nine classes of information: What do you think of tax authorities auditing cryptocurrency users? If you recall, President Reagan once said: The information provided was current at the time of publication. Most articles will contain actionable advice.

- genesis and bitcoin why are bitcoins so volatile

- ethereum course free bitcoin casino script

- give free erc20 tokens colin schnieder crypto-kid radio show

- is bitcoin cost worth it elon musk invented bitcoin

- monero white paper how to mine reddcoin

- how long does it take to validate a bitcoin payment best bitcoin computers

- how fast do you get bitcoins will bitcoin be an etf

Disclaimer and Confirmation

PPG LEGAL

ADVOCATES & SOLICITORS

Disclaimer & Confirmation

Within the professional code of conducts and applicable ethics and rules & guidelines of the Bar Council of India, Practicing Lawyers are not permitted to solicit work and advertise. The user of this website acknowledges the following:

- The content published here are not to be construed as advertisement, personal communication, solicitation, invitation or inducement of any sort whatsoever from us or any of our members to solicit any work through this website;

- The information read or downloaded from the website is purely a user wishes to gain more information about us for his/her own information, consumption and use;

- The information about us is provided to the user only on his/her specific request.

The information provided under this website is solely available at your request for information purpose only and should not be interpreted as soliciting or advertisement.

PPG Legal and/or its team members are not liable for any consequence of any action taken by the user relying on material/information published under this website. Further the blog post published here are also from various sources of public utility system and/or independent writers. Views published therein necessarily are not ours.

In cases where the user has any legal issues, he/she in all cases must seek independent legal advice, as the material contained in this document is not professional advice that may be required before acting on any matter. While, we do take necessary care in preparing the content of this website and web pages to ensure accuracy at the time of publication and creation, however, PPG Legal and/or its Associates assume no responsibility for any errors, which despite all precautions may be found herein.

All disputes, if any, are subject to the exclusive jurisdiction of courts at New Delhi, India only.