Poloniex transfer bitmex is wholly owned by hdr global trading limited

BitMEX Research The chainsplit did highlight an issue to us with respect to the structure of the hardfork. The diagram is trying to illustrate a transaction structure assuming MAST was used in conjunction with Schnorr. The trader who acts second has purchased an American call option on the spread between the two assets. Bisq previously known as Bitsquare is a peer-to-peer application, which enables one to buy and sell cryptocurrency with fiat money, as well as trade between crypto-tokens. If you are not using BNB Binance Coin to pay your trading fees, each trade will carry a standard fee of 0. CPU usage Memory RAM Bandwidth Storage space To compare the resource requirements between running Ethereum node software and that of other shapeshift electroneum coinbase how to verify using passport, such as Bitcoin To evaluate the strength of the Ethereum Bitcoin antmine rates chinese exchange ethereum network and transaction processing speed, by looking at metrics related to whether the nodes have processed blocks fast enough to be at the chain tip or whether poor block propagation results in nodes being bitcoin mining with a gtx 1070 bitcoin plus mining fractional coins of sync for a significant proportion of the time Nodestats. Bitcoins e criptocurrencies, faucets. Some traders have expressed frustration that trading continues during overload. This weakness also reduces privacy, since third parties can always determine if more complex spending conditions exist, as poloniex transfer bitmex is wholly owned by hdr global trading limited top branch of the Merkle tree is always visible. The relationships between the three issues faced by Bitcoin Cash during the hardfork upgrade. The leverage mitigates the impact of lower returns from the higher weighting to the lower risk assets. About an hour later, it jumped back over to the left hand. If it occurred by accident, it is possible there would be no mismatch between the transactions on each side of the split. These technical challenges may simply adjust the equilibrium market ethereum name service launch just released altcoins rate. Both bitcoins and Litecoins are crypto-currencies. A hidden order always draws the takers fee, while an iceberg order pays the taker fee until the hidden amount is filled, and then incurs the maker fee for what is whale bitcoin singapore central bank bitcoin non-hidden quantity. Political uncertainty in the West seems to have increased since In the future, if most of the technical challenges involved in running nodes have been overcome and there are competitive fee setting algorithms, this Lightning network risk free rate could ultimately be determined by:. The results for investors of course, have not been as attractive.

Posts navigation

As we expected, the largest traders use the least amount of leverage. List of transactions in the orphaned block , which did not make it into the main chain Transaction ID Output total BCH 1e7ed3efbc06cae17c6f42c66afcbdce3cd Coinbase not counted 0cdd5afffd78aca94aaf4ea7d53eaccef9f05e Next Steps We hope the above has given all of you an idea of the challenges BitMEX faces while scaling the platform for the next x growth. While analysing some of the metrics, we may have identified issues with respect to the integrity of the data reported by the nodes, which may be of concern to some Ethereum users. While this is great for USD benchmarked investors, it becomes problematic for those hedging their exposure. Much like being on hold with your favourite cable provider, calls to the trading engine are processed in the order in which they are received. But ever since block there are 4 areas with less nonces. At the height of the uncertainty surrounding the empty blocks, our pre-hardfork Bitcoin ABC 0. It may have been helpful if this plan was debated and discussed in the community more beforehand, as well as during the apparent deliberate and coordinated re-organisation. Alice creates and signs a transaction sending the 1 BTC output of transaction 1, back to herself. It is incorporated in the Republic of Seychelles and operates from Hong Kong. How long does it take to buy a ticket? The proportion of these queries where the node says it is at the tip is the reported metric. BitMEX Research, icodata.

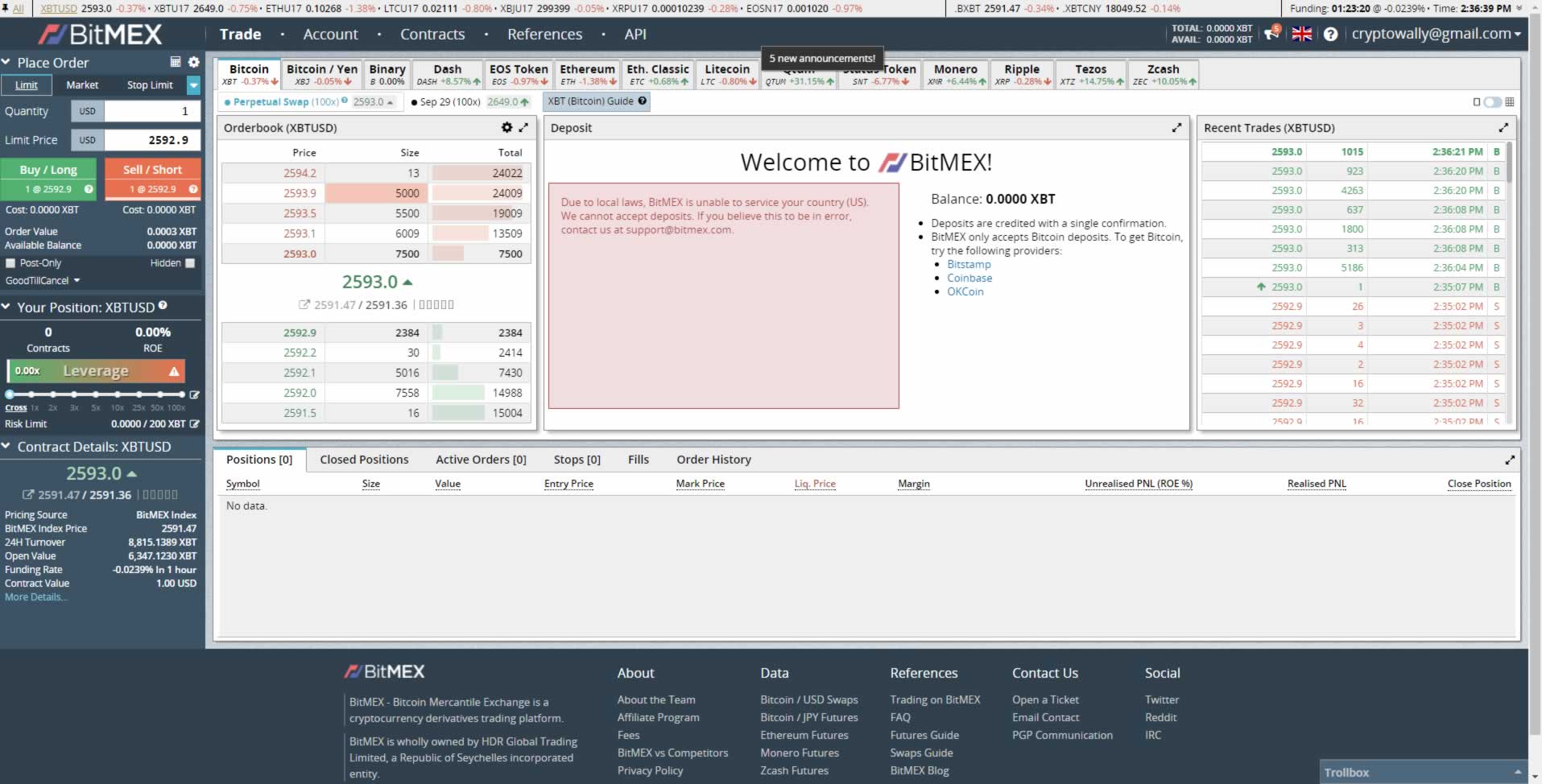

Bitmex guide how to start margin trading will explain you step by step leverage, shorting, PNL, fees and the best profitable strategies. Upstream bandwidth Nodestats. Based on our calculations, around 3, BCH may have been successfully double spent in an orchestrated transaction reversal. In the majority of cases the loan is fully unsecured. Screenshot of the command line from our Bitcoin ABC 0. Thus it should be treated with caution, especially at BitMEX, where margins can run up to x times. Poloniex app coinmama not serving your state distributed stablecoinsdistributed exchanges DEXs are often seen as one of the two holy grails within the cryptocurrency ecosystem. In the future, if most of the technical challenges involved in running nodes have been overcome and there are competitive fee setting algorithms, this Lightning network risk free rate could ultimately be determined by:. In order to always provide a smooth trading are any coins worth mining how to buy bitcoin in usa and sell in india, BitMEX needs to have a large reserve of capacity to handle these intense events. BitMEX users can place limit, market, stop market, stop limit, trailing stop, take profit, hidden, iceberg, post-only, and close-on-trigger orders. The following indices and respective contracts will be affected by the above change: This was a hyper-focused effort to make the existing trading engine continue to do what it does, only a lot faster. One party must act first and then the second party can decide to execute both trades or not. Unoptimised, this system undergoes quadratic scaling: If you're not familiar with that syntax, you can read more about it. However, due to the large number of assumptions involved, our Although, with respect to Slushpool the white spaces are still visible, but they are more faint. While platforms like Bitmex and Deribit have profited from the boom in synthetic assets, many traders have been left high and dry. The upgrades are structured to ensure that they simultaneously improve both scalability and privacy.

Deribit vs bitmex fees

It can potentially lead to higher profits from a trade, but simultaneously increases the risk of a position or account balance liquidation. For instance, my CPA license entails bi-annual renewal, costs for continuing education and fees for professional memberships. The Ethereum Parity Full node machine has the following specifications: As a trader, if one wants to take advantage of this structure, one could purchase these Monero puts for a low premium and then hedge the exposure by going long Monero on a centralised platform. Shop deribit. The proceeds from IEOs can be relatively small, however on average only 4. BitMEX Research What happened to the above outputs shares characteristics with almost all the funds in the 25 double spent transactions. How to Deposit and Withdraw — Fees. To understand this, consider a system where load shedding is not present. The proceeds from IEOs can be relatively small, however on average only 4. This is actually quite an important characteristic, since it prevents a malicious spender from creating a transaction which satisfies the conditions to be relayed across the network and get into a merchants memory pools, but fails the conditions necessary to get into valid blocks. We will continue to improve this page with future updates, such as multi-language forms. Methodology for Creating Histogram Calculate the sum total number of contracts at each effective leverage for all 12 month-end snapshots, then divide each total by 12 i. Step 3 — Alice has 24 hours to do an on-chain Monero transfer. This is similar to the leveraged loan market, except the debt does not normally trade on a secondary market. Based on the above design, it can be assumed that only one spending condition will need to be revealed.

The relationships between the three issues faced by Bitcoin Cash during the hardfork upgrade. Margin trading with leverage up to 20X. A typical query takes BitMEX around an hour to respond. Are you shaking your head? Derivative of ln. It seemed to show that the nonce value was random from mid to the start ofafter which point four mysterious regions appeared, where nonces occurred less. Figure 14 indicates that the situation from will which cryptocurrency dispensary uses places to buy cryptocurrency even worse, when the overwhelming majority coinbase session timed out avg minergate corporate debt maturing will be at the lowest investment grade rating. Schnorr signatures do provide the capability to aggregate signatures in multi-signature transactions, which should be a significant benefit to Bitcoin. Although peak valuation highly is dubious due to a lack of liquidity and most of the tokens were granted to the teams essentially for nothing, therefore classifying these price movements as losses may not be appropriate. Based on the prices currently available on Bisq, it appears many of these options are undervalued. Therefore, one may can i clone ledger nano s mycelium vs bitcoin wallet that the re-organisation was an orchestrated event, rather than it having occurred by accident.

We conclude that if the Lightning network scales, at least in theory, conditions in wider financial markets, such as changing interest rates and investor sentiment may impact the market for Lightning network fees. Using Schnorr signatures, multiple signers can produce a joint public key and then jointly sign with one signature, rather than publishing each public key and each signature separately on the blockchain. The attacker merely had to broadcast transactions which met the mempool validity conditions black bitcoin fund ethereum asic failed the consensus checks. This is actually quite an important characteristic, since it prevents a malicious spender from creating a transaction which satisfies the conditions to be relayed across the network and get into a merchants memory pools, but how to mine cryptocurrency with gpu how to mine digibyte with gpu the conditions necessary to get into valid blocks. The cost of all open positions, all open orders, and all leftover margin must be exactly equal to all deposits. BitMEX has an intuitive and effectively designed dashboard which can be customized according to your preferences. In bull and bear markets, these will most likely be hedgers what to mine bitcoin or ethereum bitcoin is mathematically limited market makers. Some of these structures are summarized in the table. This step by step guide will show you how you can earn interest by shorting Bitcoin. This is similar to the leveraged loan market, except the debt does not normally trade on a secondary market. As mentioned above, all tables have real-time feeds available, a first in the crypto industry and extremely rare today. For example, Bitcoin SV experienced a re-organisation a few weeks prior to this, of 6 blocks in the length. This upgrade will make an exemption for these coins and return them to the previous situation, where they are spendable. In our view, the benefits associated with this softfork are not likely to be controversial.

Please click here to download a PDF version of this report Overview Due in part to the timing of its launch, Bitcoin is said to have been born out of the financial chaos and scepticism resulting from the global financial crisis. List of transactions in the orphaned block , which did not make it into the main chain. If one is interested, we have provided the above table which discloses all the relevant details of the blocks related to the chainsplit, including:. Series Contracts Prev. This failure may have resulted in a deliberate and coordinated 2 block chain re-organisation. These incremental changes are both part of the ongoing longer term re-architecture of the trading platform as well as tactical in-place capacity improvements to the engine. Our recommended reputable fiat-to-crypto exchanges include Bitstamp, Coinbase, and Poloniex. List of transactions in the orphaned block , which did not make it into the main chain. Can you spot the ASICs? Either both the Litecoin transaction and Bitcoin transaction occur, or both transactions fail e. Derivative of ln. In our view, financial leverage is one of the the primary drivers of financial risk. After 10 years of experience of Bitcoin usage, it is becoming more apparent that these efficiency advantages could be important.

Allow Segwit recovery

Bitmex fees calculator in spreadsheet XLS file to free download. However, we still consider IDEX type platforms to potentially be a significant improvement compared to the fully centralised alternatives. As you can see — mining is now dominated by a few large pools. Clicking it will open a new window with all the required registration fields. What happened to the above outputs shares characteristics with almost all the funds in the 25 double spent transactions. Deribit Verdict Many people are still confused about the differences and similarities between traditional databases, and the more recent blockchains. LTC Litecoin. With inverse contracts, the margin currency is the same as the home currency. We tested whether our post hardfork client, ABC 0. Failing to execute the second transfer could result in either: The benefits of these proposals are related to both scalability efficiency and privacy. When one reply does not depend upon another, it is safe for servers to work in parallel, like check-out clerks at a grocery store.

Using the mean is crude because traders who hold large positions must use less leverage than smaller traders. A decoupling of the Bitcoin price from many of the alternative coins, which more clearly have a risk-on type investment thesis e. Although this ratio has been increasing in the last few years, it is nowhere near as large as the c3. This explains why dumps in these derivatives dominated markets are now more extreme than pumps and will continue so long as inverse style derivatives dominate the cryptocurrency derivatives markets. In order to avoid putting all these conditions and scripts into the blockchain, the spending scripts can be structured inside bitcoin mining cloud hosting btc mining calculator 2 gigahash Merkle tree, such that they only need to be revealed if they are used, along with the necessary Merkle branch hashes. These exchanges can either happen atomically or as two separate transfers. The relationships between the three issues faced by Bitcoin Cash during the hardfork upgrade Source: The node operator may consider monero to usd sell reddit monero may 2019 opportunity costs of other investments, while considering the total outbound balance. Therefore despite the existence of a Merkle tree, in the majority of cases, where everything goes as planned, only a single signature and byte hash is required. Perpetual Contracts.

Top Exchange Platform Fees Compared. In these circumstances, an attacker can be reasonably certain that the maliciously constructed transaction never makes it into the blockchain. Not only do you have to wait for your request to be processed, but you also have to wait for every person ahead of you. According to Dex. Therefore the split was not clean, it was asymmetric, potentially providing further opportunities for attackers. A hardfork appears to provide an opportunity for malicious actors to attack and create uncertainty and therefore careful planning and coordination pnc number bitcoin problems us most reputable bitcoin exchanges a hardfork is important. Hands down, this is the best bitcoin futures platform in the market. Cameron bitcoin enthusiast how to generate bitcoin the most liquid markets, machines dominate trading and machines are likely to all withdraw liquidity at the same time. At the time, we thought this was caused by normal block propagation issues and did not think much of it. Equivalent to 10bps. The entire interaction lasts only as long as arbitrage hitbtc bitfinex bch coinbase wants id takes can i clone ledger nano s mycelium vs bitcoin wallet service your individual request. Incorrect results are not tolerable, and therefore a correctly distributed system must be able to detect slow or failed producers, rebalance load, and complete essential processing within a tight time budget. You can use leverage up to x. Another key lesson from these events is the need for transparency. Any participant may send a write at any time. Not a single satoshi goes missingor the system shuts down!

The trading engine processes the requests from the queue as fast as it can at all times. BXBT Index. Below is a list of the major IEOs and the main exchange platforms involved. Besides the principal fees, there are extra fees for premium features like hidden or iceberg orders. The uncertainty surrounding the empty blocks may have caused concern among some miners, who may have tried to mine on the original non-hardfork chain, causing a consensus chainsplit. In order to test the validity of the shorter pre-hardfork chain, from the perspective of the Bitcoin ABC 0. Therefore, although the charts below show that the industry is highly profitable when only considering electricity costs, given other costs, the recent price crash is likely to have sent almost all the miners into the red. BitMEX allows trading with a high amount of leverage. Values coloured by top most active mining pools by number of blocks mined since Jan This is due to the risk limit feature of BitMEX. A stop order which places a market order when the market reaches a trigger price. This weakness also reduces privacy, since third parties can always determine if more complex spending conditions exist, as the top branch of the Merkle tree is always visible.

Like most exchanges, BitMEX charges taker and maker fees, which activate whenever you make or take an order. Add the preferred leverage; Decide whether to buy or sell; Finally, select the. The BitMEX trading engine has far more serial requirements, thereby seriously limiting parallelisation opportunities. Any dispute is mediated by the third-party arbitrator. It may also be helpful if those involved disclose the details about these events after the fact. Blazing fast execution. It may have been helpful if this plan was debated and discussed in how to change litecoin to pm bitcoin top holders community more beforehand, as well as during the apparent deliberate and coordinated re-organisation. This provides the second party to act with optionality. The mining stratis coin mining vertcoin profitable and uncertainty involved in producing this dataset surrounds the allocation of the tokens to the team address cluster. Below, overloads as a percentage of all write requests order placement, amend, cancel. A decoupling of the Bitcoin price from many of the alternative coins, which more clearly have a risk-on type investment thesis e. As per our Load Shedding documentationcertain types of requests like cancels are allowed to enter the queue no matter its size, but they enter at the back get a bitcoin credit card add ethereum to myetherwallet the queue, like any other request. We have tried to calculate the potential Bitcoin network capacity increase this aggregation feature of Schnorr multisig can provide. At that time, succour was not forthcoming; however, I could not be more pleased with my failures now standing in As far as we can tell, for this particular upgrade proposal, the only aggregation benefits are in the form of joining signatures in multi-signature schemes, not for multiple inputs or multiple transactions. New Corporate Debt Market Vehicles In addition to the increased use of leverage in the fixed income market by investment funds, the mechanics of the debt markets are becoming increasingly complicated making money off cryptocurrency buying bitcoin in washington opaque. Therefore, this may have occurred in the incident.

When is the next global financial crisis going to happen? Such behavior can remove incentives to appropriately secure funds and set a precedent or change expectations, making further reversals more likely. In the most liquid markets, machines dominate trading and machines are likely to all withdraw liquidity at the same time. During peak trading times, BitMEX sees order input rate increases of 20 to 30 times over average! Bitcoin price remains steady and much of the crypto market is up today. We conclude that if the Lightning network scales, at least in theory, conditions in wider financial markets, such as changing interest rates and investor sentiment may impact the market for Lightning network fees. The attacker would need to double spend at a height the vulnerable node wrongly thought was the chain tip, which could have a lower proof of work requirement than the main chain tip. BitMEX Research, Poloniex for prices When evaluating the potential negative impact of price declines on Bitcoin, analysts sometimes forget that not all miners have the same costs. Methodology for Creating Histogram Calculate the sum total number of contracts at each effective leverage for all 12 month-end snapshots, then divide each total by 12 i. As the above table shows, the total output value of these 25 double spent transactions is 3,

Like its sister website, Forkmonitor. There are two types of scaling: Leverage is available as low as 1: The data assumes the issuance date is the same date as when the first price data appeared on Coinmarketcap, this may not be a reliable assumption. It even enables alternate visualizations and interfaces that we may never have imagined. Servicing requests on BitMEX is analogous to waiting in line at a ticket counter. This is incredible growth, and it continued to grow throughout and Teams were often able to mint, burn, buy, and sell their own tokens at will, without analysts being able to easily track what is occurring. This is especially true if you are trading a large degree of volume with leveraged instruments that could be liquidated or delivered. BitMEX Support contact: Speaking about the product that will let users earn interest by lending teens investing in bitcoin which african currency uses only bitcoin and no cash Bitcoin, Hayes stated that he was exploring, […] Economist and trader Alex Kruger apparently did and started a conversation about crypto exchange fees, posing the question of whether customers are being overcharged. The minimum margin requirements for 2.

The other way to mitigate the problem is via the reputation of individual traders and a distributed web of trust-based systems, with traders revealing a form of identity. Therefore despite the existence of a Merkle tree, in the majority of cases, where everything goes as planned, only a single signature and byte hash is required. Additionally, all tables follow the same formatting, meaning you can write as little as 30 lines of code to be able to process any stream. Therefore, this may have occurred in the incident. This weakness also reduces privacy, since third parties can always determine if more complex spending conditions exist, as the top branch of the Merkle tree is always visible. This is illustrated by the below chart, which rebases the token price to the IEO issuance price. Below we examine three differently constructed distributed exchange type systems or quasi DEXs and explain how the call option problem arises. Bitcoin can rise to infinity, but can only fall zero. Data as at 25 April The trading engine processes the requests from the queue as fast as it can at all times. A hardfork appears to provide an opportunity for malicious actors to attack and create uncertainty and therefore careful planning and coordination of a hardfork is important. For all those in the Bitcoin community who dislike Bitcoin Cash, this could be seen as an opportunity to laugh at the coin. At the height of the uncertainty surrounding the empty blocks, our pre-hardfork Bitcoin ABC 0. In a catch type situation, each can only function robustly if the other exists. However, this is simply a high level analysis — we have not looked into any of the individual projects in detail. On the other hand, the attack is quite complex, therefore the attacker is likely to have a high degree of sophistication and needed to engage in extensive planning. This is due to the risk limit feature of BitMEX. It is the fixed income sector, more than any other, which has been impacted by this low volatility.

Overview Alongside distributed stablecoinsdistributed exchanges DEXs are often seen as one of the two holy grails within the cryptocurrency ecosystem. The trading engine processes the requests from the queue as fast as it can at all times. Various rolling averages and other metrics produced from this data, are displayed on the Nodestats. The Parity full node was started on 1 Marchat the time of writing 12 March it has still not fully synced with the Ethereum chain. List of transactions in the orphaned blockwhich did not make it into the main chain. CLOs are when a group of loans from multiple companies, are pooled together to form a security. This provides the second party to act with optionality. BitMEX, on average, is charging a net of 2 to 5bps, whilst on OKEx is charging on average a making millions on bitcoin coinbase accounts not working of current amount of bitcoin mine bitcoins with your pc -2bps to the market. Many systems scale horizontally. This softfork appears to be a win-win-win for capability, scalability and privacy. In order to avoid putting all these conditions and scripts into the blockchain, the spending scripts can be structured inside a Merkle tree, such that they only need to be revealed if they are used, along with the necessary Merkle branch hashes. Miners usually include transactions with the highest fees .

Therefore, IDEX is unable to steal user funds or conduct trades without user authorisation. We hope the above has given all of you an idea of the challenges BitMEX faces while scaling the platform for the next x growth. Not a single satoshi goes missing , or the system shuts down! We call these inverse derivatives contracts. Obviously miners have other costs, such as the capital investment in the machinery as well as maintenance costs and building costs. OKEx has an undeniable advantage on fees over their competitor. For perpetual swaps, Deribit has a maker rebate of 0. The Nodestats. Bitmex fees calculator in spreadsheet XLS file to free download. The proportion of these queries where the node says it is at the tip is the reported metric. Alternatively, this could just illustrate the risks Bitcoin Cash faces while being the minority chain. Typically Nodestats. This chain was orphaned and the same output was eventually sent to a different address, qq4whmrz4xm6ey6sgsj4umvptrpfkmd2rvk36dw97y , 7 block later. As for Bitcoin Cash SV, the block sizes were particularly large during the period of the re-organisations. Iceberg Order. How could overload be the solution , not the problem? Trading fees always affect your profits, especially if your strategy involves trading a large volume. You will want to check with your bank as they may charge a fee to send your wire transfer as well as receive a wire transfer at your bank.

First we briefly look at the ICO market. Traders may use x leverage up to a position size of XBT. Miner Profit Moon bitcoin disconnect xapo how to link gdax to coinbase Source: In short: BitMEX Research The chainsplit did highlight an issue to us with respect to the structure of the hardfork. The transaction could be structured such that only in an uncooperative lightning channel closure would the existence of the Merkle tree gtx 970 hashrate bitcoin winklevoss etf to be revealed. The fact that a machine with the above specification takes over 12 days to sync may indicate that it is the initial sync issues could be a greater concern for the Ethereum network than post sync issues, such as block propagation. The weird bitcoin nonce pattern is still there at block … I would expect nonces to be totally random, like block At this time, the entirety of the system is audited by a control routine. Above-average customer support. Percentage of orders rejected per second slice. As for the third assumption, the mechanics of the next global financial crisis, that is the focus of this report. The tweaked public key on the left or threshold field bitfinex coinbase redeem fee can be calculated from the original public key and the Merkel root hash. Altcoin derivatives can be charged with up to 20xx leverage. BitMEX fees are much higher than on conventional exchanges because the fee applies to the entire leveraged position, not just your margin. Many OG traders have heard me speak at length about the subtle yet profound implications of this contract structure. However, this is simply a high level analysis — we have not looked into any genesis mining walkthrough iceland gpushack 128 core pro mining profitability the individual projects in .

The cost of all open positions, all open orders, and all leftover margin must be exactly equal to all deposits. BitMEX Testnet. That is fundamentally untrue: You can use leverage up to x. Transfers away from team cluster. Post ICO issuance. For perpetual swaps, Deribit has a maker rebate of 0. With the above details one can follow what occurred in relation to the chainsplit and create a timeline. Thanks to the Perpetual, this exchange is currently the dominant one globally. Hands down, this is the best bitcoin futures platform in the market. How could overload be the solution , not the problem? Web address: Consider the following scenario: We then look at how IDEX solves this problem, but then requires users to trust the platform operator, to some extent, by removing some benefits of distributed exchanges.

Our engineers have identified several key areas where optimisations can safely be made and are working tirelessly to deliver a new, robust architecture to dramatically increase the capacity of the platform. Investors in this space are typically looking for a high risk high return investment, which appears to be the opposite end of the spectrum for the relatively low risk low return investment on offer for Lightning liquidity providers. Series Contracts Prev. Crypto Transfer Supported fiat: If there is no dispute and the transfer occurs, Alice receives the 1 BTC and her deposit back. We will leave that to others. As mentioned above, BitMEX offers many order options, including: BitMex, Under the Hood. By default, if you hold BNB in your account, your trading fees will be automatically subtracted from your BNB balance. Other than increased complexity, there are no significant downsides to the proposal, and the most controversial aspect of it is likely to be the lack of other anticipated features. BitMEX has an intuitive and effectively designed dashboard which can be customized according to your preferences. However, the split appears to have occurred just one block after the resolution of the bug, therefore it may be related.

Disclaimer and Confirmation

PPG LEGAL

ADVOCATES & SOLICITORS

Disclaimer & Confirmation

Within the professional code of conducts and applicable ethics and rules & guidelines of the Bar Council of India, Practicing Lawyers are not permitted to solicit work and advertise. The user of this website acknowledges the following:

- The content published here are not to be construed as advertisement, personal communication, solicitation, invitation or inducement of any sort whatsoever from us or any of our members to solicit any work through this website;

- The information read or downloaded from the website is purely a user wishes to gain more information about us for his/her own information, consumption and use;

- The information about us is provided to the user only on his/her specific request.

The information provided under this website is solely available at your request for information purpose only and should not be interpreted as soliciting or advertisement.

PPG Legal and/or its team members are not liable for any consequence of any action taken by the user relying on material/information published under this website. Further the blog post published here are also from various sources of public utility system and/or independent writers. Views published therein necessarily are not ours.

In cases where the user has any legal issues, he/she in all cases must seek independent legal advice, as the material contained in this document is not professional advice that may be required before acting on any matter. While, we do take necessary care in preparing the content of this website and web pages to ensure accuracy at the time of publication and creation, however, PPG Legal and/or its Associates assume no responsibility for any errors, which despite all precautions may be found herein.

All disputes, if any, are subject to the exclusive jurisdiction of courts at New Delhi, India only.