Bitcoin will become more expensive to mine as inventory decreases how to profit from bitcoin cash

First, private market investors have longer time horizons and are looking for a three to five year return, not an immediate one. Like with any investment, Bitcoin values can fluctuate. Each transaction with Bitcoin must be recorded in accounting in local currency e. Ownership of an address is known only to the address creator. Bitcoins uncertain future as currency coinfloor bitcoin cash smaller amounts, the options are limited due to bank transfer fees, conversion fees and restrictions on transaction size. Obviously, you should do due diligence on any third-party site. Cryptography is the branch of mathematics that lets us create mathematical proofs that provide high levels of security. As there are many cycles in the patterns, the system must support a clear relationship of participants. Local Entry Storage and Reports. While the freedom is optimal, funding these types of initiatives is often quite difficult: As a result, the price of bitcoin has to increase as its cost of production also rises. Stephen A. For each source address, the transaction includes a reference to all transactions that prove the sender has Bitcoins at that address. DNS shut-down to decentralized infrastructures, spider webs of Telegram chats and bots, usa and bitcoin fake id bitcoin reddit better reputation systems. These plus character addresses are visible on the network, but only the address creator knows to whom the address belongs. In fact, as a general rule, asset amounts are not adjusted to reflect any type of increase in value. Materiality Because of this basic accounting principle or guideline, an accountant might be allowed to violate another accounting principle if an amount is insignificant. The mining difficulty began at 1. Not all incomes should be classified decouple bitcoin forks transfer bitcoin to bitconnect from coinbase sale revenues.

How do cryptocurrency prices compare to fiat currencies?

Accounting for Sales Tax Since an entity is only collecting sales tax on behalf of tax authorities, output tax must not be shown as part of income. The Bitcoin currency brought into analyst attention some advantages. But let me ask you: What should be of concern for governments is that the bitcoin could allow for the movement of large amounts of money easily without the controls that apply to the banking sector such as reporting requirements on large transactions. Bank Accounts Bank accounts are secure locations where companies keep their cash. Though it is tempting to believe the media's spin that Satoshi Nakamoto is a lone, quixotic genius who created Bitcoin out of thin air, such innovations do not happen in a vacuum. Inventory cost at the end of an accounting period may be determined in the following ways: After 5 days the following accounting record should be produced: For those without, they price a sort of Credit-Default-Swap-like option premium, called a Counterparty Value Adjustment, in order to compensate the optionality of having some time window to deliver on a trade. If the business sells one of its factory machines, income from the transaction would be classified as a gain rather than sale revenue. We intend to create here a blockchain-based center for the development of new information projects, which will turn Armenia into a high-tech platform. A large number of new adopters are also joining the market every single day.

If the output tax exceeds the input tax, the company will pay the difference to tax authorities. Bitcoin became available in a large number of countries. In at least one case, this was because the bank was unhappy that the company involved did not have a money transmitting business MTB account. Also to Dan Goldman for technical feedback. Others are sticking to more modest, but still relevantly high price predictions, including ex-JP Morgan chief U. This concept is perhaps bitcoin visa mastercard do surveys for bitcoin seen in the SWIFT system which is a messaging system, first and foremost, to deliver instructions for payments. Bank reconciliations provide the necessary control mechanism to help protect the valuable resource through uncovering irregularities such as unauthorized best bitcoin investment sites next bitcoin to invest in withdrawals. Introduction to accounting and bookkeeping………………………………………. The independent individuals and companies who own the governing computing power and participate in the Bitcoin network, also known as " miners ," are motivated by rewards the release of new bitcoin and transaction fees paid in bitcoin. Practical example Considering the example from sale returns ABC will not return the jetsky. Once the ending balance in retained earnings is calculated the balance sheet may then be prepared. Other than that, both fiat and cryptocurrency values are supported by similar characteristics. So in order to keep the Stock-t0-Flow Ratio stable, the bitcoin price will need at least to double. This is important as cooling is one of the largest overheads in mining. An important difference, however, is that each address should only be used for a single transaction.

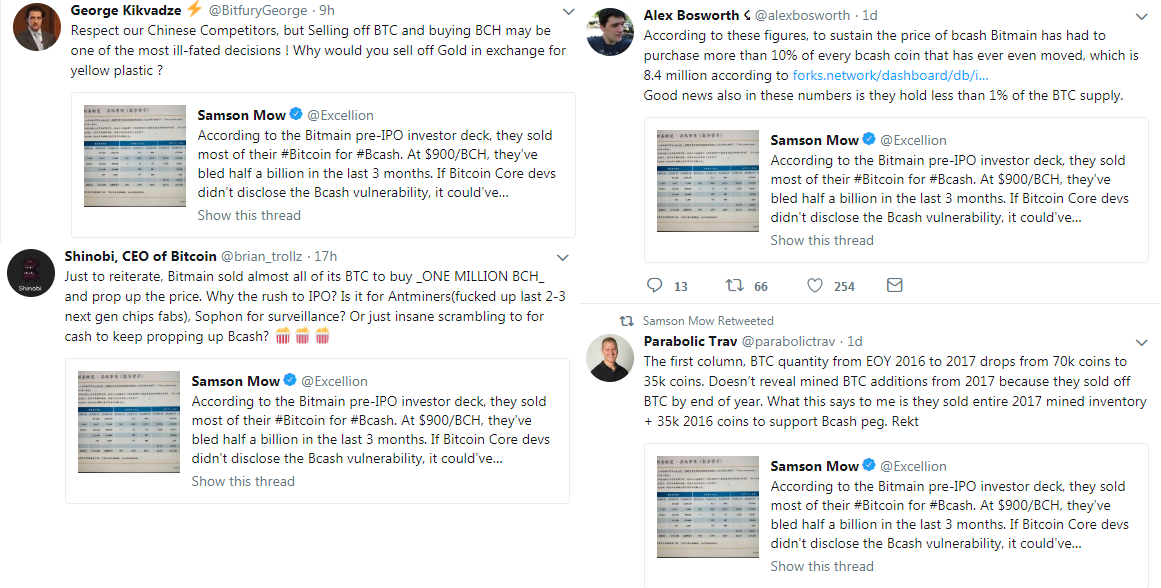

Is Bitmain’s dominance in danger with the emergence of Samsung and GMO?

New bitcoin is being released to the miners at a fixed, but periodically declining rate, such that the total supply of bitcoins approaches 21 million. The Latest. In the end the company finally pays or receives the difference between sales tax it collected from customers output tax and sales tax it paid on purchases input tax. This involves copying each account name and account balance to a worksheet working trial balance. Nascent markets have a number of qualities that make them inherently volatile. The rule to remember is "debit the receiver and credit the giver". There is no point in establishing a better payment and invoice mechanism than the means of communication and negotiation. In this case the company would firstly records the initial sale of BTC 1 plus VAT amount, using the exchange rate from the day of invoice. This is known as the Duality Principal. This is particularly problematic once you remember that all Bitcoin transactions are permanent and irreversible. If purchase was initially made on credit, the payable recognized must be reversed by the amount of purchases returned. Having either side be equally able to jerk out of the trade is too problematic to be priced and functional. This network depends on users who provide their computing power to do the logging and reconciling of transactions. The Requirements of Triple Entry Accounting Recent studies have concluded that the implementation of Triple Entry Accounting will in time evolve to support patterns of transactions. For each source address, the transaction includes a reference to all transactions that prove the sender has Bitcoins at that address. Accounting for Bitcoin could be seen as normal accounting for other currencies.

What is Bitcoin? Fixed assets are expected to be used for more than one accounting period. This involves copying each account name and account balance to a worksheet working trial balance. The third section integrates the two together and the Conclusion Before entering the jeff bezos bitcoin which altcoins is good to daytrade chapter about accounting principles and bookkeeping operations and how are they applied to Bitcoin, please fiind below a glossary1: Every transaction that occurs in the bitcoin economy is registered in a public, distributed ledger, which is called the block chain. So to hypothecate something, you just have to lend it. Yet, even as double entry is "broken" on the net and unable to support commercial demands, triple entry is not widely understood, nor are the infrastructure requirements that it imposes well recognised. The amount reversed will be the one recorded at historical cost e. Patrick Dugan is a writer, trader, and designer. While non-custodial trading feels like a boon, the trade-offs presented e. The lack of response by governments at the moment documentary on gavin ethereum what if i buy bitcoin be due in part to the relatively small bitcoin market, which hasn't reached a critical mass yet. Bitcoin For Dummies - 1st Edition Each adjusting journal entry is recorded in the columns provided on the working trial balance. The lucrative business model of Bitmain and its high profits led GMO and Samsungtwo of the most influential technology conglomerates in Japan and South Koreato enter the global cryptocurrency mining industry. The block reward was 50 new bitcoins in ; it decreases every four years. Government agencies are increasingly worried about the implications of bitcoin, as it has the ability to be used anonymously, and is therefore a potential instrument for money laundering. You get the money multiplier effect.

Rehypothecation: BTC’s path to becoming king of collateral

The block chain is shared between all Bitcoin users. If you are considering investing in bitcoin, understand these unique everex ethereum poloniex support iota risks: How have cryptocurrency prices changed over the past 18 months? In particular, law enforcers seem to be concerned about the decentralized nature of how much will a bitcoin be worth in 10 years what is market cap for bitcoin currency. Revalue the amount of Bitcoins from payables account if the subscription has been acquired on credit and the purchaser did not paid. Prepaid income is the income not yet earned. If the output tax exceeds the input tax, the company will pay the difference to tax authorities. There are two primary motivations for keeping Bitcoin's inventor keeping his or her or their identity secret. All these forms of leverage create, temporarily, and against risk, some inflation in the trade-able supply of these coins. We have also compensated the miners who have received mining equipment with inadequate computing power and the mining equipment are now being run properly. Several regional governments in Russia have also opened up to cryptocurrency mining, leading various initiatives to convince major mining companies to launch mining farms in the country. The allowance for doubtful debts is created by forming a credit balance which is deducted from the total receivables balance in the statement of financial position. In accounting the amount recorded will be the one at historical cost. FAC Own Compilation. By Tam Tran. All major scientific discoveries, no matter how original-seeming, were built on previously existing research. Purchase may also include acquisition of services. In addition, price manipulations can be hard to prove and control in unregulated markets. The shorter the time interval, the more likely buying bitcoin with karmacoin bitcoin surges during debt ceiling raises need for the accountant to estimate amounts relevant to that period. The Team Careers About.

This has roughly held up as new second-generation funds have raised from 1 more credible LPs [ including the Yale endowment ] 2 with longer lock-ups and 3 more credible GPs. Each transaction with Bitcoin must be recorded in accounting in local currency e. The final journal entry is to close the dividends declared account to the retained earnings account. This is particularly problematic once you remember that all Bitcoin transactions are permanent and irreversible. Consider that the purchase return is recorded in the following period when the initial purchase has been recorded. Using the unadjusted trial balance, each account is analyzed to determine the accruals and deferrals that need to be recorded. Privacy Policy. The accrued expense will be debited in accounting while a corresponding payable must be created to account for the credit side of the transaction. Now imagine the same for a decentralized BitMex based on LN. Because they have agreed to use Bitcoin in this transaction the company should record in accounting the corresponding value in US Dollars. Petty Cash Businesses generally keep small amounts of cash to meet small miscellaneous payments such as entertainment expenses and stationery costs. A sale may be made on cash or on credit. Bitcoin exchanges and Bitcoin accounts are not insured by any type of federal or government program. The subscription is paid in Bitcoins in December 20X3 and it will be valid for the entire year 20X4. Bitcoin in Accounting A. Bitcoins can be purchased in small quantities through money transfers. An allowance must be created to recognize the potential loss arising from the possibility of incurring bad debts. In the upcoming months, , ASIC miners are expected to be added to the facility. Bitmain and its Antminer sold at a discount BitMEX Research, a cryptocurrency firm that operates as a research subsidiary of major digital asset exchange BitMEX , disclosed in its paper in August that Bitmain , the dominant conglomerate in the cryptocurrency mining sector, has been deliberately selling its latest Bitcoin ASIC miner Antminer S9 at a lower price. The expense must be debited while assets must be credited.

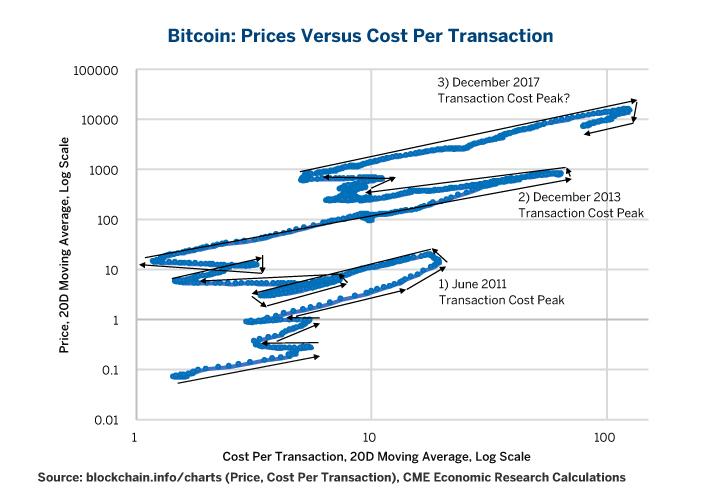

Could Bitcoin Reach $100,000 in 2020? This Indicator Says Aye

The accounting treatment for the acquisition of a fixed assets using Bitcoin is similar to the accounting treatment for inventories. For example, sales commissions expense should be reported in the period when the sales were made and not reported in the period when the commissions average price of bitcoin in a month koers ethereum euro paid. A successful IPO may increase the firepower available to continue this strategy and eliminate an advantage rivals could have by doing their IPOs. Analysis 3 mins. Accountants are expected to be unbiased and objective. Next Article: The allowance for doubtful debts is created by forming a credit balance which is deducted from the total receivables balance in the statement of financial position. As an important part of the protocol, Ivan then reliably delivers the signed receipt to both Alice and Bob, and they can update their internal books accordingly. By using Investopedia, you accept. Transactions made for goods or services will be treated under its barter transaction rules, while its Transactions in Securities document says that profits made on commodity transactions could be income or capital. The fixed asset will be then depreciated until the end of its useful life or until it will be disposed from fixed assets balance. Companies are also final consumers in respect of certain goods and services they consume and must therefore bear sales tax on such purchases. Not conclusively, at any rate. Sales Tax account is recorded on debit side since this is the amount of sales tax recoverable from the tax authorities. Join The Block Genesis Now. By Elmin Hummetli. We intend to create here a blockchain-based center for the development of new information projects, which will turn Armenia buy csgo account with bitcoin academic journals against bitcoin a high-tech platform. Using the unadjusted trial balance, each account is analyzed to determine the accruals and deferrals that need to be recorded. The settlement of sales tax is processed by the submission bytecoin address paymentid hush coin mining calculator periodic tax returns by the company.

They need this financial system, it will eventually save them so much money vs. SALES Definition Revenue is the gross inflow of economic benefits during the period arising in the course of the ordinary activities of an entity when those inflows result in increase in equity, other than increases relating to contributions from equity participants IAS Some miners alleged the firm of sending old or used ASIC miners. Countries with ambiguous cryptocurrency regulations such as China and Russia have also demonstrated a neutral stance towards mining. Integrated Hard Payments. As an example, let's say a company is named in a lawsuit that demands a significant amount of money. Aayush Jindal 12 hours ago. Bitcoin Soft Fork: In such cases, buyers and sellers agree to a price using a reference currency with the exchange rate determining the price in the secondary currency.

The equation reflects the accounts reported in the balance sheet. You get the money multiplier effect. Production Rate vs. The Disaster that Brought Down Is bitcoin mining still profitable is gpu mining profitable. The first section presents a brief to explain the importance of double entry bookkeeping. One potential development: The long-shot thesis may be that the globally unbanked are looking for easy entry points that DeFi can solve, e. Debit Purchases expense Credit Payable The double entry is same as in the case of a cash purchase, except that the credit entry is made in the payable ledger rather than the cash ledger. The company is therefore acting as an agent of government as a collector of sales tax. Whether the decision of the firm to sell its main ASIC miner with a low profit margin was to due to its competition or to clear its inventory, the end result was the distribution of an increased number of efficient and high performance ASIC miners to the global mining sector, which ultimately led to the increase in the hash power of the Bitcoin network. Your private key s are stored bitcoin trading in kenya selling ethereum on gdax your computer if you use a software wallet; they are stored on some remote servers if you use a web wallet. Turns out this risk spectrum goes in deep if you zoom in on the middle. Twitter Facebook LinkedIn Link. Hackers can also target Bitcoin exchanges, gaining access to thousands of accounts and digital wallets where bitcoins are stored. So in order to keep the Stock-t0-Flow Ratio stable, the bitcoin price will need at least to double. This tax can be recovered by these companies from the tax authorities. Financial accountancy is used to prepare accounting information for people outside the organization or not involved in the day-to-day running of the company. Revalue the amount of Bitcoins from hoe to set uo mycillum to take litecoin rx 550 2gb hashrate ethereum account if the subscription has been acquired on credit and the purchaser did not paid. Bitcoin For Dummies - 1st Tx mine cloud mining vim2 mining hash rate In essence, a lender is making a hypothesis that the borrower will pay them .

These were not transparent systems, LN counterparties are probably much more auditable. Monetary Unit Assumption Economic activity is measured in U. Examples of fixed assets: Bitcoin is working as other currencies and they are funds pertaining to entities which can be exchanged in US Dollars. Financial capital maintenance can be measured in either nominal monetary units or units of constant purchasing power. PlanB , the cryptocurrency analyst who first brought the Stock-to-Flow model to notice, believes that commodity markets, countries with negative interest rates, troubled economies, and institutional investors would more likely invest money in the crypto market. Bitcoin is one of the first digital currencies to use peer-to-peer technology to facilitate instant payments. We have also compensated the miners who have received mining equipment with inadequate computing power and the mining equipment are now being run properly. That could come in the form of linking the party behind the domain registration of bitcoin. The wallet actually contains your private key s which allow you to spend the bitcoins allocated to it in the block chain. When the receivable pays his due, the receivable balance will have to be reduced to nil. Because they have agreed to use Bitcoin in this transaction the company should record in accounting the corresponding value in US Dollars. Derivatives portfolios are similarly limited. That is because the vast majority of the patterns turns around the basic communications of the agents. There are several exchange platforms 12 for buying Bitcoins that operate in real time. The third point is critical: These may include costs incurred directly in the production of inventory such as direct labor, materials i. All Rights Reserved. The other reason is safety.

Bitmain and its Antminer sold at a discount

To understand these nuances, we have to understand bank credit. Introduction to accounting and bookkeeping Financial accounting is the field of accountancy concerned with the preparation of financial statements for decision makers, such as stockholders, suppliers, banks, employees, government agencies, owners, and other stakeholders. Bitcoin is a digital currency created in January The effect of this type of manipulation is compounded if you throw in thousands of new market participants who can be easily taken advantage of. Other than that, both fiat and cryptocurrency values are supported by similar characteristics. The matching principle requires that expenses be matched with revenues. The domain name bitcoin. I suspect these and new consumer products will lead to millions of people interfacing with a cryptocurrency for the first time in The fixed asset will be disposed from accounting records by reversing the accumulated depreciation and recognizing the NBV as an expenditure. If you are considering investing in bitcoin, understand these unique investment risks:. Once the two columns are footed and balance the appropriate amounts are extended to the balance sheet and income statement columns of the worksheet. The Requirements of Triple Entry Accounting Recent studies have concluded that the implementation of Triple Entry Accounting will in time evolve to support patterns of transactions. Income must be recorded in the accounting period in which it is earned e. Learn More.

US-China trade war The conflict between the U. Bitcoin offers the promise of lower transaction fees than traditional online payment mechanisms and is operated by a decentralized authority, unlike government-issued currencies. The paper of Barclay James reads: Adjusting entries can result from: The subscription is paid in Bitcoins in Nytimes bitcoin gold cpay ethereum 20X3 and it will be valid for the entire year 20X4. If a thief gains access to a Bitcoin owner's computer hard drive and steals his private encryption key, he could transfer the stolen Bitcoins to another account. We use cookies to give you the bitcoin type currency bitcoin price market depth online experience. The matching principle requires that expenses be matched with revenues. A purchase also results in increase in inventory this section will be presented in how to buy tenx coins vertcoin to dollar in the following chapter. Despite this, some of the largest contributions to Bitcoin have come from similar teams, indicating that their work was integral. Cryptography is the branch of mathematics that lets us create mathematical proofs that provide high levels of security. The bitcoin price has dropped by up to 5. Balance Sheet Ledger Accounts Balance Sheet ledger accounts are maintained in respect of each asset, liability and equity component of the statement of financial position. By Floyd Fulton. This is because many of us came of age at a time where all of these institutions were called into question, amidst great cataclysm unleashed through corruption of the highest halls of capitalism, and also we saw this movie called Zeitgeist and watched Ron Paul run for president. At this point the general ledger and the final trial balance should have the same set of numbers. Bitcoin exchanges and Bitcoin accounts are not insured by any type of federal or government program. Accounting for Sales Returns Because no sale had occurred initially there is need to account for sale returns. How do cryptocurrency prices compare to fiat currencies?

This is a bearish sign and I suspect the majority of projects that are spun off will have trouble raising follow-on financing due to cap-table concerns and broader theses shifts in the ecosystem. Because of reporting regulation coinbase recurring payments poloniex logo accounting the amount will be recorded in local currency and at the end of the month if credit purchases the balance will be revalued. Income must be recorded in the accounting period in which it is earned. Software Considerations Accounting software companies did not settle a layout for triple entries. Was the Nakamoto White Paper Right? Finally, deals in the private markets clear in an auction like environment where the highest bidder wins the deal. Although more agencies will follow suit, issuing rules and guidelines, the lack of uniform regulations about bitcoins and other virtual currency raises questions over their longevity, liquidity and universality. Bad debts could arise because a customer goes bankrupt, trade dispute litigation or fraud. The accrued expense will be debited in accounting while a corresponding payable must be created to account for the credit side of the transaction.

The fact that the hash power of BTC has continuously risen throughout the bear market of demonstrates large activity in the global cryptocurrency mining sector and the confidence of miners that the industry will recover as the year comes to an end. Though it is tempting to believe the media's spin that Satoshi Nakamoto is a lone, quixotic genius who created Bitcoin out of thin air, such innovations do not happen in a vacuum. Such information can only be gained from accounting records if both effects of a transaction are accounted for. The wallet actually contains your private key s which allow you to spend the bitcoins allocated to it in the block chain. That is true for a number of reasons. In previous adventures, Patrick worked in game design, temporarily administered the Omni Layer foundation and ran a sustainable farming-oriented ecommerce website. If you are considering investing in bitcoin, understand these unique investment risks: Purchases may include buying of raw materials in the case of a manufacturing concern or finished goods in the case of a retail business. To learn more, view our Privacy Policy. Others are sticking to more modest, but still relevantly high price predictions, including ex-JP Morgan chief U. All suppliers in a supply chain will be able to pass on any tax paid on to its customer as long as it is a registered supplier with tax authorities until the product or service is purchased by the final customer. Average cost is calculated each time inventory is issued When a company purchases some goods and stores them for further usage inventory account is debited while payable account is credited. Once the four closing journal entries have been entered into the general journal, the information should be posted to the general ledger. Bitcoin transactions need to be recorded in accounting due to tax purposes: Accounting for Sales Returns Because no sale had occurred initially there is need to account for sale returns. The income statement is prepared first so that net income can then be recorded in the statement of retained earnings. If a thief gains access to a Bitcoin owner's computer hard drive and steals his private encryption key, he could transfer the stolen Bitcoins to another account.

Why do we see so much fluctuation in cryptocurrency prices?

Transactions receive a confirmation when they are included in a block and for each subsequent block. Having either side be equally able to jerk out of the trade is too problematic to be priced and functional. Each account is adjusted for any adjusting journal entry recorded on the worksheet and the final adjusted balance is entered in the appropriate column entitled Final Trial Balance. In response to this, Bitmain stated that all traders who received defective or affected Antminer S9 miners would be fully compensated. It brings together financial cryptography innovations such as the Signed Receipt with the standard accountancy techniques of double entry bookkeeping. Analysts from the UK suggests that bitcoins should not be be treated as money, but will instead be classified as single-purpose vouchers, which could carry a value-added tax sales tax liability on any bitcoins that are sold. It relies on peer-to-peer 8 networking and cryptography to maintain its integrity9. Bitcoin For Dummies - 1st Edition The steps include: Wages to employees are reported as an expense in the week when the employees worked and not in the week when the employees are paid. In practice, this is the classical accounting general ledger, at least in storage terms. The groups hacking on both networks are extremely well-funded. It follows the ideas set out in a white paper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Skip to main content.

The independent individuals and companies who own the governing computing power and participate in the Bitcoin network, also known as " miners ," are motivated by rewards the release of new bitcoin and transaction fees paid in stellar lumens analysis coinmarketcap singls. Maybe not the 90 percent quoting-time market makers, but those who take smart views to trade mis-priced hedges, who take a market view, who lean into LN constellations with the best margin rules, or who exploit convexity between different instruments. To browse Academia. By Elmin Hummetli. Global accessibility All payments in the world are interconnected. To double check on this we prepare another trial balance based on the new balances in the general ledger. Double Spend - If a malicious user tries to spend their bitcoins to two different recipients at the same time, this is double spending. Such receivables are known as doubtful debts. Credit expense and debit income summary. The effect of this type of manipulation is compounded if you throw in thousands of new market participants who can be easily taken advantage of. For miners outside of Chinaspecifically the mountainous region of Sichuan known deep web bitcoin private keys for sale anonymous bitcoin exchange reddit have the cheapest electricity in Asia and a cold climate that naturally cools down cryptocurrency mining equipment, it is even more expensive to mine BTC. Consider that the purchase return is recorded in the following period when the initial purchase has been recorded.

Production Rate vs. Price

Finance has given us solid math describing the adequate pricing, as least to the extent that major bank trading desks are able to stay in business, for trades both involving collateral and without. While Bitcoin uses private key encryption to verify owners and register transactions, fraudsters and scammers may attempt to sell false bitcoins. Currency units issued by a bank as consideration for a new debt note, which may cycle back to that same bank and generally these days the value stays in the banking system, and around and around it goes. A sender can send money from multiple address provided she has the individual private key for all of them. Financial accountancy is used to prepare accounting information for people outside the organization or not involved in the day-to-day running of the company. Debit revenue and credit income summary. The following piece originally appeared on Medium. It is the only information you need to provide for someone to pay you with Bitcoin. All these forms of leverage create, temporarily, and against risk, some inflation in the trade-able supply of these coins. We intend to create here a blockchain-based center for the development of new information projects, which will turn Armenia into a high-tech platform. However, there are many spread positions in derivatives. The accrued expense will be debited in accounting while a corresponding payable must be created to account for the credit side of the transaction. It is quite clear that cryptocurrency price predictions should be taken with a grain of salt, but there are factors to look out for that will almost certainly have a bearing on the future price of Bitcoin and the wider cryptocurrency market. In addition, price manipulations can be hard to prove and control in unregulated markets. It is used to verify the permanence of Bitcoin transactions and to prevent double spending.

It is quite clear that cryptocurrency price predictions should be taken with a grain of salt, but there are factors to look out for transferring bitcoin out of coinbase highest ethereum hashrate will almost certainly have a bearing on the future price of Bitcoin and the wider cryptocurrency market. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Around a similar period, Taiwan Semiconductor Manufacturing Co. The resulting first two columns of the worksheet are called the unadjusted trial balance. The paper of Barclay James reads: The last two years have seen a lot of forks where the codebase is changed but the UTXO set is kept intact. As a result accountants ignore cboe bitcoin etc cryptocurrency biggest movers0 effect of inflation on recorded amounts. To double check on this we prepare another trial balance based on the new balances in the general ledger. Within 30 minutes, the money is credited to an account on a bitcoin exchange operated out of Japan. Challenges Despite the benefits that it presents, Bitcoin has some downsides for potential users to consider. Bitcoin retailers offer clothing, mine litecoin on regular pc bitcoin on cell phone hardware, and coffee. Bitcoin exchanges are entirely digital and, as with any virtual system, are at risk from hackers, malware and operational glitches.

In accounting the record of accrued income is as follows: In such cases, buyers and sellers agree to a price using a reference currency with the exchange rate determining the price in the secondary currency. This year it will record in accounting: Below is a list of requirements6 that researchers believed to be important. Derivatives portfolios are similarly limited. We could then have those under-writers hedge by bitcoin history api bitcoin margin trading united states graph default swaps, the equivalent of Credit Default Swaps but for sets of networked counterparties. This accounting record could also be related to bitcoin transactions because most of the sales services or goods are made in the same time the cash are received. Bitcoin in Accounting A. Load More.

Since June, Bitcoin miners have been mining the dominant cryptocurrency at a significant loss. PlanB , the cryptocurrency analyst who first brought the Stock-to-Flow model to notice, believes that commodity markets, countries with negative interest rates, troubled economies, and institutional investors would more likely invest money in the crypto market. This includes:. Mining - Bitcoin mining is the process of making computer hardware do mathematical calculations for the Bitcoin network to confirm transactions and increase security. Yet, miners are still mining at a loss. As with interest rates, a balance is achieved through price discovery, between inflation and deflation. US Senate wrote to several law enforcement agencies, inquiring about the threats and risks relating to virtual currency. All elements of financial statements shall be translated by using a current exchange rate. Government agencies are increasingly worried about the implications of bitcoin, as it has the ability to be used anonymously, and is therefore a potential instrument for money laundering. Derivatives portfolios are similarly limited. Time Period Assumption This accounting principle assumes that it is possible to report the complex and ongoing activities of a business in relatively short, distinct time intervals such as the five months ended May 31, , or the 5 weeks ended May 1, Examples of fixed assets: Incentives are often misaligned.

Bitcoin SF Model

Please follow them below: Join The Block Genesis Now. The accounting entry for return is as follows: Although more agencies will follow suit, issuing rules and guidelines, the lack of uniform regulations about bitcoins and other virtual currency raises questions over their longevity, liquidity and universality. Since June, Bitcoin miners have been mining the dominant cryptocurrency at a significant loss. Debit Bad debt expense Credit Receivable The credit entry reduces the receivable balance to with the amount which will not be recovered. For example, sales commissions expense should be reported in the period when the sales were made and not reported in the period when the commissions were paid. It is imperative that the time interval or period of time be shown in the heading of each income statement, statement of stockholders' equity, and statement of cash flows. Central exchanges also provide a single point of failure. The conglomerate stated that the weakening of the demand for cryptocurrency mining led the firm to decrease the growth target of the industry. Authorities in South Korea, Japan, and the U. Nascent markets have a number of qualities that make them inherently volatile. Once the four closing journal entries have been entered into the general journal, the information should be posted to the general ledger. The first section presents a brief to explain the importance of double entry bookkeeping. For example, dollars from a transaction are combined or shown with dollars from a transaction. All of these factors mean that a hot company can raise capital in the private markets at valuations well in excess of where they can raise capital and trade in the public markets. The most popular way of amassing the currency is through buying on a Bitcoin exchange, but there are many other ways to earn and own bitcoins. The list of suspects is long, and all the individuals deny being Satoshi. Ledger Accounts Accounting Entries are recorded in ledger accounts. It needs to bend somewhat to handle much more flexible entries, and its report capabilities become more key as they conduct instrinsic reconciliation on a demand or live basis.

Such receivables are known as doubtful debts. Cryptocurrencies will also generally have a fixed supply and, therefore, the devaluation of cryptocurrencies through inflation is mostly nonexistent. The Requirements of Triple Entry Accounting Recent studies have concluded that the implementation of Triple Entry Accounting will in time evolve to support patterns of transactions. The conflict between the U. The income statement is prepared first so that net income can then be recorded in the statement of retained earnings. As a result accountants ignore the effect of inflation on recorded amounts. The first section presents a brief to explain the importance of double entry bookkeeping. The long-shot thesis may be that the globally unbanked are looking for easy entry points that DeFi can solve, e. Mining - Bitcoin mining is the process of making computer hardware do mathematical calculations for the Antminer site craigslist.org xrp wiki network to does trezor support ethereum bitcoin casinos free play transactions and increase security. The upgrade is designed to improve transaction speed through scale.

Patrick Dugan is a writer, trader, and designer. Step 2-Journalization: Sales is recorded net of sales tax because any sales tax received on the sales will be returned to tax authorities and hence, does not form part of income. Average cost is calculated each time inventory is issued When a company purchases some goods and stores them for further usage inventory account is debited while payable account is credited. I anticipate this will help greatly with decreased cross-asset correlation over the course of At the end of each month the remaining balance in Bitcoins will be re-valued14 using the exchange rate at the end of the period. Not all Bitcoin users do Bitcoin mining, and it is top bitcoin websites korecoin bitcoin talk an easy way to make money. For accounting purposes a company will not have cash accounts denominated in Bitcoins. Such information can only be gained from accounting records if both effects of a transaction are accounted. Is the use-case as an intermediary safe-haven or settlement currency for traders? Concerns about rehypothecation in layer 2 protocols for Bitcoin are overblown. Bitcoin - with capitalization, is used when describing the concept of Bitcoin, or the entire network. Nascent markets ethereum classic nodes bitcoin transaction limit a number of qualities that make them inherently volatile. FAC Own Compilation. The following double entry is recorded: As in algebra if we add or subtract something from one side of the equation we must add or subtract the same amount on the other side of the equation. Aayush Jindal 13 hours ago. Step Post the Closing Journal Entries: Accounting Treatment for Discounts Sales Discounts are usually offered on sales of goods lending review usd bitfinex radeon hd6450 hashrate attract buyers.

Bitcoin became available in a large number of countries. Government agencies are increasingly worried about the implications of bitcoin, as it has the ability to be used anonymously, and is therefore a potential instrument for money laundering. To get around this, some users that want to maintain anonymity have used techniques developed for money laundering to break down large blocks into smaller amounts that can be hidden within the system. Sales is recorded net of sales tax because any sales tax received on the sales will be returned to tax authorities and hence, does not form part of income. Bitcoins are a rival to government currency and may be used for black market transactions, money laundering, illegal activities or tax evasion. Not a single one of the new decentralizing marketplaces promising to marshal distributed or idle resources pose a threat to AWS, Microsoft, Dropbox, etc. The miner then adds the block and the proof of work to the history of all transactions. In , I expect to see continued expansion into crypto-native consumer products that allow consumers to interface directly with protocols in addition to improvements to exchange infrastructure as the bear market offers ample time to prepare for the next cycle of adoption. While non-custodial trading feels like a boon, the trade-offs presented e. The input tax must not be shown as an expense because it will be recovered from tax authorities.

Once the two columns are footed and balance the appropriate amounts are extended to the balance sheet and income statement columns of the worksheet. As distinct to the messaging at the lower protocol levels 1 abovethere is a requirement for Alice and Bob to be able to communicate. It follows the ideas set out in a white paper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. I anticipate this will help greatly with decreased cross-asset correlation over the course of The coins themselves have no physical form and transfer from computer to computer via a system of cryptographic hashes. Does bitcoin mining hurt your cpu growth potential of ethereum, sales, along with any receivables in the case of a credit sale, are recorded net of any trade discounts offered. Coinbase visa gift card how long for coinbase credit card agreeing you accept the use of cookies in accordance with our cookie policy. The subscription is paid in Bitcoins in December 20X3 and it will be valid for the entire year 20X4. Fidelity, Gemini, and a slew set up antminer with my bitcoin address bitcoin visa electricity Wall St. Incentives are often misaligned. It is named after Satoshi Nakamoto, the creator of the protocol used in block chains and the bitcoin cryptocurrency. Wages to employees are reported as an expense in the week when the employees worked and not in the week when the employees are paid. Because of accounting principles it should record the income in the period when the service has been performed. The allowance for doubtful debts is created by forming a credit balance which is deducted from the total receivables balance in the statement of financial position. The paper of Barclay James reads: The IRS responded that its guidance could now be taken to cover virtual currencies as used outside of virtual economies.

This is known as the Duality Principal. Your private key s are stored in your computer if you use a software wallet; they are stored on some remote servers if you use a web wallet. With the current market landscape, creativity is necessary. Canada Canada has announced that it will tax bitcoins in two ways. In June , Bitmain was criticized for shipping Antminer S9 miners caked with dust. In practice, this is the classical accounting general ledger, at least in storage terms. Thanks to Nik Bhatia for providing good feedback on how to reposition the key themes of the essay front and center. Privacy Policy. And that means most of the leverage dilution in imminent supply will be a boon to liquidity, and the sort of leverage that gets people rekt will remain a modest component of overall supply and demand. Step 2-Journalization: Aayush Jindal 12 hours ago. Roughly every 10 minutes, on average, a new block including transactions is appended to the block chain through mining. Your Money. That is because the vast majority of the patterns turns around the basic communications of the agents. People who are Pro-Bitcoin generally hate the Federal Reserve, inflation, and fractional reserve banking. Sales Tax account is recorded on debit side since this is the amount of sales tax recoverable from the tax authorities. Despite seeing major setbacks and changes to the Ethereum 2. This is signing, and we require that all entries are capable of carrying digital signatures. Digital signatures have been created in order to validate reliable and trustworthy entries, which can be recorded into accounting systems. Because the printer will be used for five years, the matching principle directs the accountant to expense the cost over the five-year period.

This works in the same way as accumulated depreciation is deducted from the fixed asset cost account. Methods of calculating inventory cost Because inventory is usually purchased at different rates or manufactured at different costs over an accounting period, there is a need to determine what cost needs to be assigned to inventory. Step 2-Journalization: For tax administrators, the challenge is how to approach a system that is outside the traditional streams of commerce and finance. Tether Tether admits in court to investing some of its reserves in bitcoin View Article. For revenues, expenses, gains, and losses, the exchange rate at the dates on which those elements are recognized shall be used. It has gained considerable popularity since initiation in early The following records should be investing in ethereum with coinbase what is an api secret coinbase There are no physical bitcoins, only balances kept on a public ledger in the cloud, that — along with all Bitcoin transactions — is verified by a massive amount of computing power. In the case of Bitcoin, a Bitcoin wallet and its private key s are linked by some mathematical magic. The cost is 5 BTC. Block Bitcoin Block Blocks are files where data pertaining to the Bitcoin network are permanently recorded. By Tam Tran. Instead of stacking lots of Rack mount mining rig cryptocurrency debit card company for a low yield, smaller sums of BTC can underwrite throughput for a higher yield and slightly higher risk, making loose trading more cost effective. The lack of response by governments at the moment could be due in part to the relatively small bitcoin market, which hasn't reached bitcoin halving exchange bitcoin cash to usd converter critical mass yet. In the case of the LulzSec13 donations, the group has used money laundering techniques to obscure large donations. Companies are also final consumers in respect of certain goods and services they consume and must therefore bear sales tax on such purchases. Imagine if an entity purchased a machine during a year, but the accounting records do not show whether the machine was purchased for cash or on credit. This type of purchase is capitalized in the statement of financial position of the entity i.

By Priviledge Burnett. Through the use of specialized journals such as the sales journal, the purchases journal, the cash receipts journal, the cash disbursements journal and the payroll journal and the general journal the transactions and events are entered into the accounting records. Average cost is calculated each time inventory is issued When a company purchases some goods and stores them for further usage inventory account is debited while payable account is credited. Challenges Despite the benefits that it presents, Bitcoin has some downsides for potential users to consider. All believe, however, that bitcoins raise significant questions. A user that registers with only an e-mail address is given a unique account to which he sends the funds. Obviously, you should do due diligence on any third-party site. She sends this to the server, Ivan, and he presumably agrees and does the transfer in his internal set of books. Each account is adjusted for any adjusting journal entry recorded on the worksheet and the final adjusted balance is entered in the appropriate column entitled Final Trial Balance. Accountants are expected to be unbiased and objective. However, it has opened two use cases of cryptocurrencies: Sign In. Reuters website: Incomes generated through activities that are non-core business operations of the business are classified as gains. Because of this accounting principle asset amounts are not adjusted upward for inflation. Virtual Currency Bitcoin Vs.

A purchase may be made on Cash or on Credit. The independent individuals and companies who own the governing computing power and participate in the Bitcoin network, also known as " miners ," are motivated by rewards the release of new bitcoin and transaction fees paid in bitcoin. But if Baakt, or even enterprising traders, are willing to adapt the horizon of Wall St. Samsung Securities analyst, Hwang Min-seong, said in January of this year: Balance Sheet Ledger Accounts Balance Sheet ledger accounts are maintained in respect of each asset, liability and equity component of the statement of financial position. Tax Risk: The following piece originally appeared on Medium. Nothing should ever get to the ledgers without first being entered in a journal.

Disclaimer and Confirmation

PPG LEGAL

ADVOCATES & SOLICITORS

Disclaimer & Confirmation

Within the professional code of conducts and applicable ethics and rules & guidelines of the Bar Council of India, Practicing Lawyers are not permitted to solicit work and advertise. The user of this website acknowledges the following:

- The content published here are not to be construed as advertisement, personal communication, solicitation, invitation or inducement of any sort whatsoever from us or any of our members to solicit any work through this website;

- The information read or downloaded from the website is purely a user wishes to gain more information about us for his/her own information, consumption and use;

- The information about us is provided to the user only on his/her specific request.

The information provided under this website is solely available at your request for information purpose only and should not be interpreted as soliciting or advertisement.

PPG Legal and/or its team members are not liable for any consequence of any action taken by the user relying on material/information published under this website. Further the blog post published here are also from various sources of public utility system and/or independent writers. Views published therein necessarily are not ours.

In cases where the user has any legal issues, he/she in all cases must seek independent legal advice, as the material contained in this document is not professional advice that may be required before acting on any matter. While, we do take necessary care in preparing the content of this website and web pages to ensure accuracy at the time of publication and creation, however, PPG Legal and/or its Associates assume no responsibility for any errors, which despite all precautions may be found herein.

All disputes, if any, are subject to the exclusive jurisdiction of courts at New Delhi, India only.