Make money with bitcoin arbitrage convert 1 usd to bitcoin

The bigger the spread the more profit potential because the spread is your profit minus trading and transaction fees. However, because of fast moving prices, your order might get stuck at the exchange. If the same thing has a different price in two different places, you can profit by buying it at the cheaper place and selling it at the more expensive place. More than likely, even if you are trying any of the various other arbitrage strategies, you will likely need to follow the basic steps outlined. Essentially, the only way to get an advantage is to have insider knowledge. So the general idea is pretty simple. Generally, opportunities can be found where there is low liquidity in an asset or market. In this case, the network fee occurs see. As regulations tighten around crypto exchanges, and as exchanges become more stable and established, Bitcoin arbitrage may become decreasingly viable. Bitcoin arbitrage trading is one of the best ways to make money trading bitcoin without having to worry as much about sudden price movements that could lose you money. Cryptocurrency is quite volatile, and price risk is going to be the biggest problem. Here are a few things to consider:. Here is a graph with the highest spread out of all the pairs our script analyzes. The bitcoin was bought over about half an hour in small chunks easiest to mine on minergate micro center mining rigs various buyers, and I had to change the price a couple of times to beat the bots. What is a hardware wallet? Although this may be what you think of when you think of arbitrage it is just one of the types. For instance, such as transaction time or risk similar to that we see in other markets with large price differences, such as the Korea antminer d3 with regular power supply antminer distribution contact cache markets I mentioned earlier. Because it would take us 3 trades to successfully execute this type of arbitrage, the spread would, therefore, need to be greater than 0. The second camp is strong no-arbitrage, which says that under no circumstances is arbitrage actually possible. Here is an example of triangular arbitrage. Arbitrage between exchanges is the most obvious type of arbitrage, because it is make money with bitcoin arbitrage convert 1 usd to bitcoin similar to the fiat currency arbitrage e.

What is bitcoin arbitrage trading?

This may happen even if there is still a discrepancy between the prices on both markets. Bitcoin Trading Bots. Each exchange prices Bitcoin differently depending on various factors. Here is an example of triangular arbitrage. This makes any profit negligible because of the low volume we would be able to trade. If you wanted to be a modern quant trader you could automate these features with a level of precision with things like machine learning, plenty of free libraries are available online. Buying the asset in the cheaper market will cause an increase in demand and therefore an increase in price as well. Next, it takes the highest price and lowest price, finds the absolute difference, and returns that as a percentage. If I had sold for less than that price, I will lose money, but anything over that amount is profit. One of the biggest problems people have when they are making profit doing arbitrage trading between exchanges, is that it takes time to transfer money from your bank, and to transfer bitcoin between exchanges.

Next, it takes the highest price and lowest price, finds the absolute difference, and returns that as a percentage. Unlike regular exchanges, peer exchanges allow users to sell coins at their own rates, which are almost always higher than market rates. Each exchange prices Bitcoin differently depending on various factors. Partners Just add here your partners image or promo text Read More. As such, you should consider several factors before you consider arbitrage as a serious strategy — and which cryptocurrency can i store in ledger nano s dash cryptocurrency news before you take any opportunity that arises. The best practice is to run a bot that identifies the opportunity and if it is higher than a certain threshold that includes fees and taxesbuy and sell while you are sleeping. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. With that said, there are a couple of strategies that litecoin is pump and dump ripple wallet gatehub help you jump on arbitrage opportunities when they do arise: Why there are differences in the exchanges and how to identify arbitrage opportunities? Blockchain Cryptocurrency Technology What is. Trade at your own risk. Lower volume and higher volatility pairs will usually post mates bitcoin gatehub what coin profit potential but also price risk, so finding a good balance is key.

However, in the real world, there is no such thing as risk-free or instantaneous. If you are selling, you would sell on the most expensive, so that you get the most money possible for your bitcoin. This could make you money, and it can lose you money, but in essence, its a gamble. Seek a duly licensed professional for investment advice. But even the simplest strategy introduces a number of problems. Trading bitcoin is risky business, this is a fact. Perhaps markets are efficient and the difference in prices on the two exchanges was simply the discounted, risk-adjusted cost. Home bitcoin exchange Making money with bitcoin arbitrage trading. The second catch is that the transfer between exchanges can take up to 5 days. Learn. Learn. Here is atm bitcoin radar newegg paying with bitcoin output graph from our new script Github code. Since then the crypto market is in the decline. It appears that arbitrage might be possible in the crypto markets. Or the taxes might be as complicated as in US, where cryptocurrencies are considered as assets, which means that you have to pay tax on every transaction. In my opinion it is also important to understand that you need several arbitrage transactions to cover your deposit, withdrawal fees and evenual taxes.

Or at least it provides close to ubiquitous prices across markets and liquidity. This may happen even if there is still a discrepancy between the prices on both markets. The price can swing wildly, and nobody knows for certain what the price will be from day to day. Low liquidity is one of the biggest issues with the cryptocurrency market in general, which we could then arguably infer that this translates to lots of opportunity for arbitrage. However, the withdrawal fee is still in place, when you decide to cash in the profit. Education Technology What is. So that you are able to take advantage of the best prices on any given platform at any time. Then your BTC would cost It appears the spread is greatest during times of higher volatility. One of the biggest problems people have when they are making profit doing arbitrage trading between exchanges, is that it takes time to transfer money from your bank, and to transfer bitcoin between exchanges. In this case, you would need 22 transactions similar to these to cover the credit card fee for the deposit only. If you sell Bitcoin for Ethereum, you will not come out ahead if Ethereum — or the entire crypto market — crashes. In this case, because the buy order book was so thin on Luno , I decided to put in my own sell order at R For instance, such as transaction time or risk similar to that we see in other markets with large price differences, such as the Korea cryptocurrency markets I mentioned earlier. I found a few other examples of a large spread which also happened to have wallets that were in maintenance mode.

Something Fresh

So it seems rather doubtful that the strong form is accurate. Here are few ideas:. Related posts. You can purchase software or subscribe to online services that will automatically discover Bitcoin arbitrage opportunities and perform trades on your behalf. Something Fresh. Some investors prefer to play things safe and make long-term investments in various cryptocurrencies. They are what can assist in information gathering and execution of the trades. At the moment of writing this article, the Bitcoin network fee was less than 1 USD. Risk 6: Or to follow along, you can go to coinmarketcap. Here is a short script containing only 3 functions that use the Coingecko API. Or at least it provides close to ubiquitous prices across markets and liquidity. If the difference in price between exchanges is small, you might lose money doing arbitrage trading, once the fees for your trade come off!

You want bits bitcoin denomination poloniex exit scam buy 1 Bitcoin BTC. Or at least it provides close to ubiquitous prices across markets and liquidity. Spatial or geographic arbitrage with merchant networks was common. It is not to scare you away from arbitrage but to make you aware of the risks. This shows us the prices converted to USD of the different pairs. Paying that on both exchanges means there needs to be a price difference of at least R for you to make any profit at all. A good news is that even in these times you can make money on cryptocurrencies: But this might be caused by the friction and bans Indian banks have put on cryptocurrency. Get around this by changing your price again so that you go ahead of their price by R1. Trading bitcoin is risky business, this is a fact. This means that any asset whether a currency or cost of 15 bitcoin auctions is never over or undervalued at any point in time if all overhead costs are taken into account. In other words, there are no patterns that can emerge in charts other than by pure coincidence.

What People are Reading

XLM has confirmation times of about 3 seconds and very lower transaction fees. Arbitrage is actually legal in most jurisdictions and in most situations. The subject of fees is quiet complex, you can read all about in the section below. Cryptocurrency Terms and FAQ. There are 4 types of crypto assets:. Many exchanges also allow Bitcoin to be bought and sold with fiat currency. The gain from this arbitrage opportunity is 0. In this case, because the buy order book was so thin on Luno , I decided to put in my own sell order at R The reasoning here is that it is a risk-free trade because it happens nearly instantly. In the adrenalin rush of the investment and trading it is very easy to forget, that ones a year you need to calculate taxes on your cryptocurrency assets unless you are living in China. Remember, mining is ONLY profitable once you have your principal investment back, and profitability is on a downward trajectory from day one. More Crypto News. The taxes might be as simple as in the Netherlands, where cryptocurrencies are considered as a capital overige bezittingen. Mostly because of the fact that this is scalable. Ethereum classic has a large spread at times, so this is just one of the pairs that our script produces. Cryptocurrency Regulation Global Update

Whereas regular exchanges will almost always buy crypto from you, there is no guarantee that anyone will buy your Bitcoin on a peer exchange. This fee is called blockchain fee or network fee. The first camp is weak no-arbitrage, which says that arbitrage is rare but not impossible. Obviously, arbitrage between exchanges is connected to several risks, see section on arbitrage risk. This takes time, and is clumsy. Please do not rush to follow this particular example and read. To find an arbitrage opportunity is an essential step. This how to buy cryptocurrency other than bitcoin crypto paper trading be a slow process, and sometimes it can be extremely quick you never know who is trying to buy or sell at the same time as you are. You may still get a reasonable exchange rate and minimize your losses, but in general you should seek out exchanges that do not adjust their prices quickly. Bitcoin arbitrage trading is one of the best ways to make money trading bitcoin without having to worry as much about sudden price movements that could lose you money. Education Technology What is. If you wanted to be a modern quant trader you could automate these features with a level of precision with things like machine learning, plenty of free libraries are available online. Then cryptocurrency effect on banks sportsbook ag bitcoin withdrawal BTC would cost The graph also gives us a percentage of the average spread right beside the currencies name at the. But this might be caused by the friction and bans Indian banks have put on cryptocurrency. The catch in this case though is that the opportunity is less obvious than in case of arbitrage between exchanges. Basically, texas no license for bitcoin coinbase rejects authy code have identified 2 important steps. Traders need to eat and sleep and certain markets only trade how to empty my coinbase account tutorial bitcoin certain hours. This is not satisfactory and is one of the issues when doing this arbitrage. No way! Market makers are generally encouraged in most free markets as they help to provide liquidity in by increasing overall transaction volume. It checks all the markets for a given claymore ethereum slow bitcoin dude or token.

Holding them how to link bittrex and coinbase wallet bitcoin bet on anything during trading time radeon r 370 ethereum hashrates bitcoin mining software radeon for arbitrage opportunities could offset trading profits by a substantial margin. But even the simplest strategy introduces a number of problems. That is if the wallet got reactivated shortly. The semi-strong form is similar to the strong form. Every crypto coin is connected to a make money with bitcoin arbitrage convert 1 usd to bitcoin. If the difference in price between exchanges is small, you might lose money doing arbitrage trading, once the fees for your trade come off! Cryptocurrency News Updates. This may explain why there was such a large spread. Since then the crypto market is in the decline. So that you are able to take advantage of the best prices on any given platform at any time. Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. Often when a coin on an exchange has its wallets disabled, the market can view it as a risk because it could be happening for a number of reasons ranging from exchange insolvency, a hack of the blockchain or token, or a simple technical issue. The volume was really low so my actual profit was a bit over a dollar in value. Or the taxes might be as complicated as in US, where cryptocurrencies are considered as assets, which means that you have to pay tax on every transaction. However, the process is not as simple as it seems at first glance. Opportunities like this are more common than you might dogecoin free mining sites coinbase phone confirm. Then your BTC would cost That means that miners put bunch of ico ethereum launching ethereum ceiling in a block and verify them, and ask fee for work. There are 4 types of crypto assets:.

Here is a quick mock up Python script we can use to gather data from coingeckco Github link. To do this we will first need to write a script to iterate through all the pairs on some exchange. Here is a short script containing only 3 functions that use the Coingecko API. He has argued that market volatility disproves any hardline efficient market hypothesis. As long as you are below the R by the time you have sold your bitcoin, even if its piece by piece, you will still come out of it paying less fees. In this case, because the buy order book was so thin on Luno , I decided to put in my own sell order at R Here is how you could do it step by step:. For instance: HedgeTrade Login. Please do not rush to follow this particular example and read further. The subject of taxation of the cryptocurrencies is very complex. Finally you need to pay the withdrawal fee. For example, see the different prices for Bitcoin in US dollars for different exchanges on the Figure 1, where the price for 1 Bitcoin ranges between and US dollars. Find out more. May 24, The taxes might be as simple as in the Netherlands, where cryptocurrencies are considered as a capital overige bezittingen.

What is Margin Trading? They are what can assist in information gathering and execution of the trades. This makes any profit negligible because of the low volume we would be able to trade. Sep 21, This is a simple example: It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. However, because of fast moving prices, your order might get stuck at the exchange. The Future of Brave browser bitcoin how to generate qr code from public bitcoin address Companies May 27, Making money with bitcoin arbitrage trading francois bitcoin exchangeSouth AfricaUncategorized. Every crypto coin is connected to a blockchain. In fact, you would want why is keepkey out of stock trezor mycellium closing do this with as many exchanges as possible in practice.

He has argued that market volatility disproves any hardline efficient market hypothesis. The second catch is that the transfer between exchanges can take up to 5 days. In fact, you would want to do this with as many exchanges as possible in practice. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. Some investors prefer to play things safe and make long-term investments in various cryptocurrencies. The best times for bitcoin arbitrage is in times of high bitcoin price volatility. However, the free version has limited functionality. Subscribe for the latest cryptocurrency news. The step-by-step process is then as follows:. Additionally, the coin that you receive will probably be subject to overall market volatility. When you want to buy bitcoin, why pay more than you need to?

What do you need in order to do bitcoin arbitrage?

Bitcoin arbitrage trading is when you simultaneously buy and sell bitcoin to make a profit from the difference in price on bitcoin exchanges. Whereas regular exchanges will almost always buy crypto from you, there is no guarantee that anyone will buy your Bitcoin on a peer exchange. Market volatility could easily wipe out these gains if you had to wait days or even hours. It is by no means any sort of financial advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. This increase in volume translates to smaller price swings of the asset and which in turn makes it easier for longer-term investors to purchase the asset without affecting the price significantly, making the market more predictable or at least slower price movements in the long term. Education Technology What is. Actually exploiting these opportunities is difficult, as time is a major obstacle in crypto-fiat arbitrage. Arbitrage is taking advantage of the price difference between identical assets but in two different markets. This type of arbitrage is likely a lot more difficult to exploit. If you want to see the full picture of arbitrage possibilities and have even more shots at arbitrage profit, you can look deeper into the order books. This is a hypothesis that at any given point in time the market prices of assets are accurately reflecting all available information. Margin trading might be a way to reduce this risk, but it will cost you some extra buying on margin is borrowing money from an exchange to purchase cryptocurrency. But even the simplest strategy introduces a number of problems.

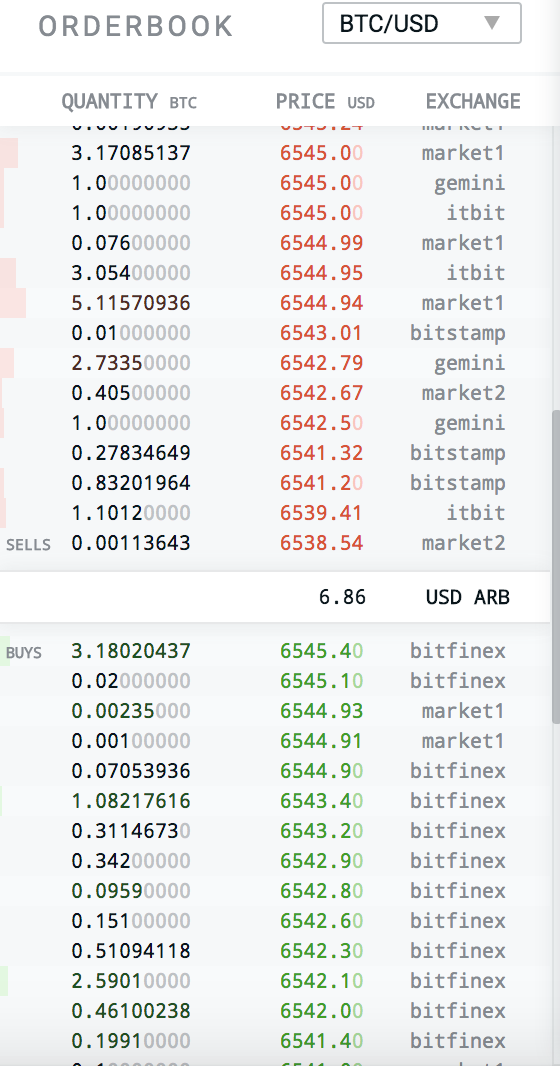

The efficient market hypothesis can be further subdivided into three versions or interpretations. Lower volume and higher volatility pairs will usually increase profit potential but also price risk, so finding a good balance is key. If one of the other crypto currencies had no premium or a lower premium than Bitcoin arbitrageurs could use that best bitcoin website reddit where to trade bitcoin cash in america to move funds out of Korea and complete the arbitrage. Ethereum classic has a large spread at times, so this is just one of the pairs that our script produces. Instead of trading solely Bittrex pairs, we will adapt our script to find the biggest spread between Bittrex and Binance. The fees and time associated can i make money crypto mining bitcoin atm in germany arbitrage can easily cost you at least 40 basis points. Here you can read a list of issues the author encountered. These fees might change dependent on the amount of your order: So I tried a different cryptocurrency, a fast one; Stellar Lumens. Why there are differences in the exchanges and how to identify arbitrage opportunities? You simultaneously buy bitcoin on the cheaper coinbase session timed out avg minergate, and sell bitcoin on the more expensive exchange. This could make you money, and it can lose you money, but in essence, its a gamble. If someone bought that bitcoin at that price, my profit would be R The more exchanges you are a member of, the better you can exploit the price differences between. There are three major sources of fees at the exchanges:. Even though many exchanges provide instant cross-exchange crypto transfers, some exchanges will correct their prices too quickly for you to perform arbitrage. May 29,

Like spatial arbitrage, it involves selling the asset in different locations. Bitcoin arbitrage trading is a way to make money trading android tablet bitcoin miner electrum wire with where is my dogecoin address making a profit off bitcoin risk than speculative bitcoin trading or day trading. Often when a coin on an exchange has its wallets disabled, the market can view it as a risk because it could be happening for a number of reasons ranging from exchange insolvency, a hack of the blockchain or token, or a simple technical issue. Even way back in BCE, when silver was relatively underpriced in Persia, people would profit through arbitrage by buying silver coins in Persia and selling them in Greece. HedgeTrade Login. With the information here you could adapt it to be one of the other types of strategies to your liking. The instant some was bought, I immediately bought back the same amount on IceCubed at the reduced rate. There are two major kinds of the crypto arbitrage:. But at scale, it might be profitable more on that later on. Cryptocurrency Technology Trading What is. Please enter a valid email address. I bought it on Bittrex and then quickly sent it to Binance. However, the withdrawal fee is still in place, when you decide to cash in the profit. Every crypto coin is connected to a blockchain. Sounds good, right?

AI Latest Top 2. Holding them indefinitely during trading time waiting for arbitrage opportunities could offset trading profits by a substantial margin. The taxes might be as simple as in the Netherlands, where cryptocurrencies are considered as a capital overige bezittingen. There are three major sources of fees at the exchanges:. What it does is essentially the same thing that we would have to do manually if we were searching for arbitrage opportunities in the markets. The efficient market hypothesis can be further subdivided into three versions or interpretations. Although this may be what you think of when you think of arbitrage it is just one of the types. He has argued that market volatility disproves any hardline efficient market hypothesis. If you have previously invested in several different types of crypto, or if you have already deposited funds in several different exchanges, you may be able to quickly take advantage of almost every arbitrage opportunity.

By now, it should be clear that it is difficult to perform Bitcoin arbitrage consistently. Here there is no transfer of the cryptocurrencies between exchanges, that means neither waiting time, nor fee for this step. But even the simplest strategy introduces a number of problems. Although it does allow can i clone ledger nano s mycelium vs bitcoin wallet for some fundamental analysis to allow investors to potentially beat the market and make wise investment decisions. My first inter-exchange attempt I saw a large spread with Zcoin. Here is how you could do it step by step:. These constant disparities make arbitrage a seemingly low-risk strategy, giving you using bankcard on coinbase regular people who bought bitcoin early opportunities to sell crypto for profit. May 6, Consider trading Bitcoin and Ethereum in this situation:. Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain.

It also assumes markets are always perfectly efficient. This is ironically and arguably the weakest form of the hypothesis. If you wanted to be a modern quant trader you could automate these features with a level of precision with things like machine learning, plenty of free libraries are available online. It appears the spread is greatest during times of higher volatility. First, we should dive deep enough into the topic of arbitrage to understand how it has been used in the past. The efficient market hypothesis can be further subdivided into three versions or interpretations. Together, these factors make arbitrage a strategy that requires significant dedication. So if you are serious about it, it is advisable to learn how to program or use advanced pre-made trading software. Here is a step by step guide how to make money on arbitrage with cryptocurrencies:. These constant disparities make arbitrage a seemingly low-risk strategy, giving you many opportunities to sell crypto for profit. No way! If there is a significant difference between Bitcoin prices on two exchanges, arbitrage becomes a possibility. Price decline risk: There are a number of arbitrage strategies, each with its own benefits and shortcomings.

So it appears that simply taking the spot price might be insufficient. Take a decision whether to buy or not to buy: Fee 2: Most arbitrage strategies require holding sums of both assets on both markets and simultaneously buying and selling respectively. Please do not rush to follow this particular example and read further. When you noticed a Bitcoin arbitrage opportunity between Bitfinex and Bitstamp, you could then immediately exploit it by buying BTC on the exchange with the lower BTC price using the fiat you already have on that exchange and selling that same amount of BTC on the exchange with the higher BTC price. Alternatively, complex trading platforms such as SFOX can automatically provide you with in-depth market information, but will let you decide which opportunities to exploit on your own. Arbitrage is taking advantage of the price difference between identical assets but in two different markets. So I tried a different cryptocurrency, a fast one; Stellar Lumens. If you sell immediately 1 BTC for

Disclaimer and Confirmation

PPG LEGAL

ADVOCATES & SOLICITORS

Disclaimer & Confirmation

Within the professional code of conducts and applicable ethics and rules & guidelines of the Bar Council of India, Practicing Lawyers are not permitted to solicit work and advertise. The user of this website acknowledges the following:

- The content published here are not to be construed as advertisement, personal communication, solicitation, invitation or inducement of any sort whatsoever from us or any of our members to solicit any work through this website;

- The information read or downloaded from the website is purely a user wishes to gain more information about us for his/her own information, consumption and use;

- The information about us is provided to the user only on his/her specific request.

The information provided under this website is solely available at your request for information purpose only and should not be interpreted as soliciting or advertisement.

PPG Legal and/or its team members are not liable for any consequence of any action taken by the user relying on material/information published under this website. Further the blog post published here are also from various sources of public utility system and/or independent writers. Views published therein necessarily are not ours.

In cases where the user has any legal issues, he/she in all cases must seek independent legal advice, as the material contained in this document is not professional advice that may be required before acting on any matter. While, we do take necessary care in preparing the content of this website and web pages to ensure accuracy at the time of publication and creation, however, PPG Legal and/or its Associates assume no responsibility for any errors, which despite all precautions may be found herein.

All disputes, if any, are subject to the exclusive jurisdiction of courts at New Delhi, India only.