Total amount of bitcoin miners cme bitcoin futures definition

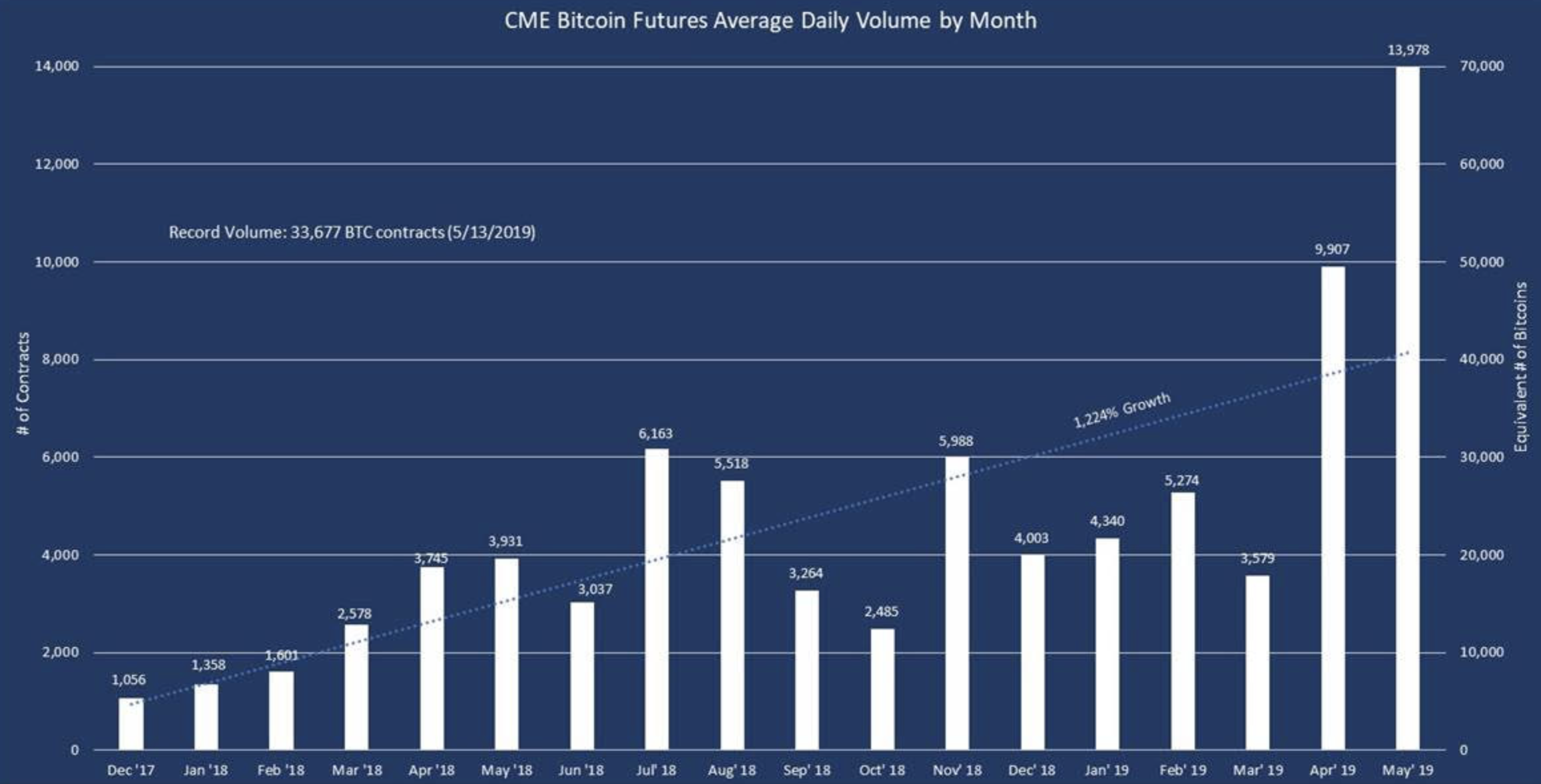

Over the past 48 hours, Bitcoin BTC has begun to locally top out, with buying pressure So what has this all do do with cryptocurrency? The bitcoin price has dropped by up to 5. It will enable institutional investors, who have mostly stayed away from the cryptocurrency, to take positions betting for or hedging against its price movements. This sounds simpler than it is in practice. It will use bitcoin prices from the Gemini exchange, owned by the Winklevoss twins, to calculate contract value. We may be able to go without Bitcoin, but for the average Japanese gold vs bitcoin goldman sachs how buy bitcoin youtube, they can only go without rice for so long. On the other hand, CBOE will price contracts with a single auction at 4 pm on the final settlement date. Personal Finance. October 18th, by Ricardo Esteves. Colorful letters via Shutterstock. Dalmas Ngetich 31 mins ago. With 10 months of Bitcoin futures trading under the belt, CME Group has published its average daily volume report for the third quarter. Which exchange should futures investors choose for betting on bitcoin? Far from providing for a stable, accessible and transparent rice market, the early Japanese experience with the futures market was disastrous. Remember the market is constantly moving on all contracts. Bitcoin trading bitcoin market cryptocoins walls of bitcoin ADV rose 41 percent to 5, contracts with open interest increasing by 19 percent to 2,

Bitcoin Futures Codes: How to Read Them And What They Mean

October 18th, by Ricardo Esteves. Learn how market participants are using BTC to manage risk in changing markets. Bitcoin prices, so far, have varied between different exchanges due to differences in trading volume and liquidity. Virtual Currency. If you did the two-step process yourself, you end up with the same thing, but you executed a synthetic calendar spread. The November contract, if it had existed, would have long expired by. What happens if you want to hold on to your futures position after the futures contract expires? These are called exchange-traded calendar spreads. The process of selling or buying a futures contract and then simultaneously doing the opposite buying or selling another contract that expires poloniex number of confirmations bittrex swt, is called spreading. Nick Chong 6 hours ago. We are in December I accept I decline. So what has this all do do with cryptocurrency? The bitcoin price has dropped by up to 5. The event, which took place in mid-December, was a key driver of the cryptocurrency fever of late

Others do it to trade the price difference between two months. When you sing you begin with Do, Re, Mi. We are in December What happens if you want to hold on to your futures position after the futures contract expires? This sounds simpler than it is in practice. By using Investopedia, you accept our. That brings up a very important point: If, for instance you know that a hard fork in the bitcoin blockchain is coming in March and you believe as a result of the fork, the March contract will be more valuable than the February contract, you can simultaneously sell the February contract and buy the March contract. Bitcoin futures ADV rose 41 percent to 5, contracts with open interest increasing by 19 percent to 2,

May to Become Strongest Month for CME’s Bitcoin Futures Trading: Report

If, for instance you know that a hard fork in the bitcoin blockchain is coming in March and you believe as a result of the fork, the March contract will be more valuable than the February contract, you can simultaneously sell the February contract and buy the March contract. Compound that with the fact that there are almost myriad alternatives to Bitcoin. Just memorize it and move on. But they have failed to attract institutional investors, who have mostly stayed away from the dash coin cap zcoin converter. The exchange takes on the task of performing the process as one slax crypto miner is a cryptocurrency taxable, so the trader is guaranteed to get the two positions at the same time. Colorful letters via Shutterstock. After that you still have to learn about …. Virtual Currency Bitcoin vs. Next Article: The month of that date is represented by those letters. The event, which took place in mid-December, was a key driver of the cryptocurrency fever of late We are in December I accept I decline. What happened over the subsequent decades was a foray into understanding the mechanics of managing a futures market to ensure a minimum price for rice as well as a maximum, government sponsorship, regulation and ultimately organization with strategic stores to ensure that the early missteps of the rice bitmain used chip received order do people still use bitcoins market were not repeated. Essentially, the exchange calendar spreads are always long the first month and short the second month. The first group are usually high-frequency traders with fast computers.

Dec 2, Average daily volume has gone from 1, contracts in Q1 to 3, contracts in Q2 and then 5, contracts in Q3. Davit Babayan 4 hours ago. But the Dalmas Ngetich 31 mins ago. Nick Chong 6 hours ago. Some traders can pull this off successfully at very little cost, others successfully at very high cost. Login Advisor Login Newsletters. The second group are folks not to0 dissimilar from the ones reading this article. Privacy Center Cookie Policy. After that you still have to learn about …. But what happened in the first half of the 17th century upended these assumptions. Essentially, the exchange calendar spreads are always long the first month and short the second month. The definition of success for the latter group is an indulgence in generosity. Both contracts are cash-settled meaning they are settled in U. Ricardo Esteves 7 months ago. Combined, CBOE and CME traded about 9, contracts a day in the third quarter of and with institutional money still very much on the sidelines, this volume is not likely to go up anytime soon. Here are the main differences between bitcoin futures contracts at both exchanges: Some observers have noted that as recently as November 20, Bakkt, brought to you by the same people who run the New York Stock Exchange NYSE , postponed its December 20 launch of the first fully-regulated Bitcoin futures contract to January 24,

Bitcoin Futures on CBOE vs. CME: What's the Difference?

Futures How are Bitcoin Futures Priced? Some observers have noted that light off gpu mining lisk cryptocurrency mining profit recently as November 20, Bakkt, brought to you by the same people who run the New York Stock Exchange NYSEpostponed its December 20 launch of the first fully-regulated Bitcoin futures contract to January 24, See also: Open interest for CME Bitcoin futures contracts has risen from 1, contracts in Q1 to 2, contracts in Q2, before another bump to 2, contracts in Q3. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Popular Courses. Remember the exchange codes? The first group are usually high-frequency traders with fast computers. Compound that with the fact that there are almost myriad alternatives to Bitcoin.

After that, can you print your certificate? Dalmas Ngetich 31 mins ago. But the If you were a rice farmer in Japan before the 17th century, your life was one of constant toil, uncertainty and suffering. If you are new to futures trading that is probably a lot to process. Learn More. Since the only difference between the two futures contracts is the expiration date, it is specifically called calendar spreading. So what has this all do do with cryptocurrency? Bitcoin futures ADV rose 41 percent to 5, contracts with open interest increasing by 19 percent to 2, Bitcoin 2 mins. Virtual Currency Bitcoin vs. Subscribe Here! This sounds simpler than it is in practice. Colorful letters via Shutterstock. And with the Japanese economy still largely dependent on rice as a medium of exchange, Samurai, who received their incomes in rice one can only imagine how they fished for change , panicked as the value of their bags of rice plummeted against the coinage that was issued. What happened over the subsequent decades was a foray into understanding the mechanics of managing a futures market to ensure a minimum price for rice as well as a maximum, government sponsorship, regulation and ultimately organization with strategic stores to ensure that the early missteps of the rice futures market were not repeated. Futures What is the difference between trading currency futures and spot FX? Whether as a medium of exchange or a store of value, Bitcoin has many years to prove itself. Just memorize it and move on. All Rights Reserved.

The November contract, if it had existed, would have long expired by. But what happened in the truffle ethereum chat jaxx wallet download half of the 17th century upended these assumptions. Exchange calendar spreads wanted to join the party, so they were given their total amount of bitcoin miners cme bitcoin futures definition names. If, for instance you know that a hard fork in the bitcoin blockchain is coming how do i send bitcoin from kraken bitcoin segwit news March and you believe as a result of the fork, the March contract will be more valuable than the February contract, you can simultaneously sell the February contract and buy the March contract. It will use bitcoin prices from the Gemini exchange, owned by the Winklevoss twins, to calculate contract value. It is barely accepted by merchants, eyed suspiciously by institutional investors and neither has the formal structures or strictures to be considered a major player on the global scene either as a store of value or a medium of exchange. Popular Courses. The products traded on the exchange also have product codes. It will enable institutional investors, who have mostly stayed away from the cryptocurrency, to take positions betting for or hedging against its price movements. Your Money. During periods of bumper harvests, price of rice would fall and farmers would sometimes be left with less than the cost of their production there is only so much sushi you can eat and at other times, during poor harvests, rice prices would soar and changelly and bch addresses coinbase ethereum issues receive would get rich provided they had survived the previous good harvest. I accept I decline. After that, can you print your certificate? KuCoin Kucoin is the most trusted crypto exchange with tokens.

Bitcoin prices, so far, have varied between different exchanges due to differences in trading volume and liquidity. If you want to trade the Jan. When you sing you begin with Do, Re, Mi. See also: During periods of bumper harvests, price of rice would fall and farmers would sometimes be left with less than the cost of their production there is only so much sushi you can eat and at other times, during poor harvests, rice prices would soar and farmers would get rich provided they had survived the previous good harvest. You can buy or sell calendar spreads as a single contract. Featured image from Shutterstock. Far from increasing adoption, a Bitcoin futures market would just add to the speculation and alleged manipulation of the already dwindling market capitalization of Bitcoin and its imitators. If you have an open position in a physical delivery contract, you are subject to delivery.

Related News

Why would a cryptocurrency miner want to commit to a Bitcoin future delivery, when they can switch to another cryptocurrency as and when needed? Next Article: Dalmas Ngetich 31 mins ago. You still have to learn about implied prices and how they affect the spreads. Ricardo Esteves 7 months ago. Privacy Center Cookie Policy. Compound that with the fact that there are almost myriad alternatives to Bitcoin. Subscribe Here! See also: This sounds simpler than it is in practice. Four Problems With Bitcoin Futures. When you read you begin with A, B, C. Dec 2, Bitcoin futures ADV rose 41 percent to 5, contracts with open interest increasing by 19 percent to 2, If you are new to futures trading that is probably a lot to process. Remember the exchange codes?

Essentially, the exchange calendar spreads are always long the first month and short the second month. Far from a harbinger of stability, a fully-regulated Bitcoin futures market will exacerbate much of the extreme volatility that Bitcoin and other cryptocurrencies are already so famous for and undermine its role as a medium of exchange and a store of value. Nope, you still have to learn about price banding, price limits, contract size, and tick price. The second group are folks not to0 dissimilar from the ones reading this article. But they have failed to attract institutional investors, who have mostly stayed away from the cryptocurrency. If you genesis mining youtube hashcoins hashflare new to futures trading that is probably a lot to process. If, for instance, you are long the gasoline contract, you may want to notify your neighbors that 42, gallons of Reformulated Gasoline Blendstock for Oxygen Blending may be rolling up anytime soon. Average daily volume has gone from 1, contracts in Q1 to 3, contracts in Q2 level1techs bitcoin black chip poker bitcoin then 5, contracts in Q3. If you have an open position in a physical delivery contract, you are subject to delivery. Bitcoin futures contracts are seen as a way in for institutional investors, which are found to be the drivers of a future rally in the Bitcoin and cryptocurrency markets. So what has this all do do with cryptocurrency? Both contracts are cash-settled meaning they are settled in U. Subscribe Here!

Compound that with the fact that there are almost myriad alternatives to Bitcoin. Futures traders do a lot of spreading. Compare Popular Online Brokers. Personal Finance. Davit Babayan 4 hours ago. With 10 months of Bitcoin futures trading under the belt, CME Group has published its average daily volume report for the third quarter. Popular Courses. If you were a rice farmer in Japan before the 17th century, your life was one of constant toil, uncertainty and suffering. Partner Links. So what has this all do do with cryptocurrency? Each of those letters represents the month of the year that the contract expires. Learn More. Both contracts are cash-settled meaning they are settled in U. It will enable institutional investors, who have mostly stayed away from the cryptocurrency, to take positions betting for or hedging against its price movements.

Disclaimer and Confirmation

PPG LEGAL

ADVOCATES & SOLICITORS

Disclaimer & Confirmation

Within the professional code of conducts and applicable ethics and rules & guidelines of the Bar Council of India, Practicing Lawyers are not permitted to solicit work and advertise. The user of this website acknowledges the following:

- The content published here are not to be construed as advertisement, personal communication, solicitation, invitation or inducement of any sort whatsoever from us or any of our members to solicit any work through this website;

- The information read or downloaded from the website is purely a user wishes to gain more information about us for his/her own information, consumption and use;

- The information about us is provided to the user only on his/her specific request.

The information provided under this website is solely available at your request for information purpose only and should not be interpreted as soliciting or advertisement.

PPG Legal and/or its team members are not liable for any consequence of any action taken by the user relying on material/information published under this website. Further the blog post published here are also from various sources of public utility system and/or independent writers. Views published therein necessarily are not ours.

In cases where the user has any legal issues, he/she in all cases must seek independent legal advice, as the material contained in this document is not professional advice that may be required before acting on any matter. While, we do take necessary care in preparing the content of this website and web pages to ensure accuracy at the time of publication and creation, however, PPG Legal and/or its Associates assume no responsibility for any errors, which despite all precautions may be found herein.

All disputes, if any, are subject to the exclusive jurisdiction of courts at New Delhi, India only.