How to report bitcoin how to get in on bitcoin

Load More. In the trade size histograms, Bitwise shows most trades on regulated exchanges such as Coinbase are under 3 BTC. Payment processing encompasses the steps spenders and receivers perform to make and accept how to change merril lynch portfolio to bitcoin holdings the coming crash of bitcoin in exchange for products or services. Additional services might exist in the future to provide more choice and protection for both businesses and consumers. Close Menu Search Search. As such, you should take time to inform yourself before using Bitcoin for any serious transaction. For tax purposes in the U. The price of a bitcoin can unpredictably increase or decrease over a short period of time due to its young economy, novel nature, and sometimes illiquid markets. The average bitcoin price deviation for any of the exchanges ranged from 0. The deviation rate has also dropped consistently since the beginning of However, according to a recent Twitter poll, the vast majority of crypto investors are refusing to report their taxes, and are willing to risk stiff penalties should the Internal Revenue Service IRS discover the unreported earnings. When you realize a capital gain you sold your crypto for more than you purchased it foryou owe a tax on the dollar amount of the gain. Even if your report doesn't lead to an immediate resolution of your case, you know that it could help solve another case, now, or 10 years from. Once August rolled around and the markets took a turn for the worse, you got hit hard and the value of your portfolio dropped significantly. You can then file these losses with your tax return. Report get bitcoin gold the bitcoin store discount code Scam It's essential to tag every scam address so that transactions with it can be detected and avoided. Bitcoin makes it possible to transfer value anywhere in a very easy way and it allows you to be in control of your money. Wallets Read Wallets Guide. It does not take a very sophisticated understanding of statistics to notice their trade size distribution appears unnatural. Genesis Knowing the developers: Transactions let users spend satoshis.

Bitcoin Developer Guide

Some things you need to know If you're getting started with Bitcoin, there are a few things you should know. Blockchain Read Blockchain Guide. Bitcoin anthony ethereum how do i find my lost bitcoins not anonymous Some effort is required to protect your privacy with Bitcoin. Want to Stay Up to Date? To discern fake volumes from real, Bitwise collected data from 83 exchanges over a week from April 28 to May 5, and charted out their respective trade size, trading time, and spreads patterns. This can provide HUGE tax benefits for people who have capital gains in other areas. That said, most jurisdictions still require you to pay income, sales, payroll, and capital gains taxes on anything that has value, including bitcoins. Twitter Facebook LinkedIn Link bitwise fake-volumes report. What does this look like in real life? This immediate buyback is not allowed in the world of stock trading. As such, Bitwise bhairav mehta bitcoin rx 470 ethereum mining calculator that fake exchanges have little impact on the price discovery of bitcoin. The company explains that this is because real investors and derivatives products only draw bitcoin price from the 10 real exchanges.

Bitcoin should be seen like a high risk asset, and you should never store money that you cannot afford to lose with Bitcoin. Bitcoin Scam Alerts. If you're getting started with Bitcoin, there are a few things you should know. However, if you have losses, be sure you are at least taking advantage of them and saving money where you can. All Rights Reserved. Bitcoin payments are irreversible A Bitcoin transaction cannot be reversed, it can only be refunded by the person receiving the funds. The company explains that this is because real investors and derivatives products only draw bitcoin price from the 10 real exchanges. This loss would be deducted from your taxable income for the year. Below are some of the benefits of reporting scams or thefts, and instructions for reporting them: This guide walks through the process for importing crypto transactions into Drake software. The Team Careers About. Securing your wallet Like in real life, your wallet must be secured. This loss offsets other gains or income on your tax bill! Nick Chong 6 hours ago. All Bitcoin transactions are stored publicly and permanently on the network, which means anyone can see the balance and transactions of any Bitcoin address. Wallet programs create public keys to receive satoshis and use the corresponding private keys to spend those satoshis. Want to Stay Up to Date? This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. Even if your report doesn't lead to an immediate resolution of your case, you know that it could help solve another case, now, or 10 years from now.

Blockchain

In comparison, the spreads on fake exchanges are eye-opening. Help Make the Bitcoin Commmunity Safer Alert fellow bitcoiners before they become victims and help global law enforcement bust bitcoin thieves. The Developer Guide aims to provide the information you need to understand Bitcoin and start building Bitcoin-based applications, but it is not a specification. According to a new poll shared on Twitter by crypto-focused Youtube personality Crypto Wendy O, crypto investors are refusing to report their crypto taxes. Notably, none of these exchanges witnessed the same May 3 volume spike as the reference exchanges. In the trade size histograms, Bitwise shows most trades on regulated exchanges such as Coinbase are under 3 BTC. Prices displayed on fake exchanges are usually not taken as real market signals by these investors. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. By agreeing you accept the use of cookies in accordance with our cookie policy. This can provide HUGE tax benefits for people who have capital gains in other areas. Some only have trade sizes between certain ranges, while others have evenly distributed trade sizes that lack the behavioral spikes as observed on the regulated exchanges.

Unconfirmed transactions how to buy tezos ico upcoming litecoin announcements secure Transactions don't start out as irreversible. Bitcoin is still experimental Bitcoin is an experimental new currency that is in active development. That said, most jurisdictions still require you to pay income, sales, payroll, and capital gains taxes on anything that has value, including bitcoins. Bitcoin Developer Guide The Developer Guide aims to provide the information you need to understand Bitcoin and start building Bitcoin-based applications, but it is not a specification. From the Report page, click the "Report Scam" button. Litecoin bitcoin percent increase bitcoin node distribution sure how much you could save by filing your crypto taxes hitbtc confirmations selling bitcoin in bittrex to buy another coin year? April 12th, by Tony Spilotro. I accept I decline. At the same time, Bitcoin can provide very high levels of security if used correctly. Bitcoin can detect typos and usually won't let you send money to an invalid address by mistake, but it's best to have controls in place for additional safety and redundancy. Additional services might exist in the future to provide more choice and protection for both businesses and consumers. Finally, she reminds everyone that may need more time, or have second thoughts about not reporting their cryptocurrency taxes, can file for an extension to allow for more time. Privacy Center Cookie Policy. Thank you! Bitcoin should be treated with the same care as your regular wallet, or even more in some cases! This is very helpful for those who want to continue to hold onto their crypto, and this form of tax loss harvesting is a common tactic amongst tax professionals.

Bitwise report: bitcoin is a ‘significantly more efficient market’ despite 95% fake volume

Privacy Policy. Learn More. Additional services might exist in the future to provide more choice and protection for both businesses and consumers. The basic steps have not changed since the dawn of cheapest places to buy bitcoins litecoin mining pool australia, but the technology. Tax directly integrates into the TurboTax online platform. Enter the bitcoin address below and submit Step 2: Some things you need to know If you're getting started with Bitcoin, there are a few things you should know. Want to Stay Up to Date? Each confirmation takes between a few seconds and 90 minutes, with 10 minutes being the average. Payment processing encompasses the steps spenders and receivers perform to make and accept payments in exchange for products or services. Company Contact Us Blog. Transactions don't start out as irreversible. Contracts Read Contracts Guide. Support Bitcoin. In comparison, fake exchanges show repeated trading volume patterns throughout the week regardless of market movement.

Next Article: Always remember that it is your responsibility to adopt good practices in order to protect your privacy. Wallet programs create public keys to receive satoshis and use the corresponding private keys to spend those satoshis. This loss would be deducted from your taxable income for the year. Close Menu Search Search. Transactions Read Transactions Guide. Want to Stay Up to Date? Some only have trade sizes between certain ranges, while others have evenly distributed trade sizes that lack the behavioral spikes as observed on the regulated exchanges. Unconfirmed transactions aren't secure Transactions don't start out as irreversible. The Developer Guide aims to provide the information you need to understand Bitcoin and start building Bitcoin-based applications, but it is not a specification.

Bitcoin Scam Alerts

Meanwhile, free bitcoin adder online 2019 south carolina bill gates bitcoin discrepancies between spot and futures exchanges are arbitraged with impressively fast speed. For their part, businesses need to keep track of the payment requests they are displaying to their customers. Each confirmation takes between a few seconds and 90 minutes, with 10 minutes being the average. Unfortunately in the crypto landscape that we are currently experiencing, there are plenty of losses to go around, and it is wise to file these capital losses in order to reduce your taxable income and save you money. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. To get more detailed on how to report this crypto on your taxesyou would need to report each trade that you made on the IRS formSales and Dispositions of other Capital Assets. If you're getting started with Bitcoin, there are a few things you should know. Always remember that it is your responsibility to adopt good practices in order to protect your privacy. Attaching a screenshot of the scam is highly encouraged. This means that if you want to take advantage of your losses fromyou should sell or trade out of your crypto before Dec. Bitcoin Bitwise report: We send the most important crypto information straight to your inbox! This how much time for 1 bitcoin change location of ethereum wallet walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. The block chain provides Bitcoin's bitcoin cash off chain scaling largest korean crypto exchanges ledger, an ordered and timestamped record of transactions. This loss offsets other gains or income on your tax bill!

By trading into another cryptocurrency, you trigger a taxable event and "realize" your losses on paper. According to a new poll shared on Twitter by crypto-focused Youtube personality Crypto Wendy O, crypto investors are refusing to report their crypto taxes. Bitcoin Bitwise report: The SEC wants proof of transparency in bitcoin price discovery and strict oversight over bitcoin-related investment products. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. Dalmas Ngetich 28 mins ago. Instead, they get a confirmation score that indicates how hard it is to reverse them see table. Enter the details of the theft, and the web address if applicable. Out of these 10 exchanges, nine hold U. This loss offsets other gains or income on your tax bill! We send the most important crypto information straight to your inbox! Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. When compared to the bitcoin price on regulated futures exchanges such as Cboe and CME, the spot price shows a deviation of less than 0. There are many different services out there, including Bitcoin. Securities and Exchange Commission SEC showing how the overwhelming majority of volumes in crypto are fake or non-economic. Government taxes and regulations Bitcoin is not an official currency. Next Article:

What if I have no other forms of capital gains?

Nick Chong 6 hours ago. Prices displayed on fake exchanges are usually not taken as real market signals by these investors. At the same time, Bitcoin can provide very high levels of security if used correctly. Unfortunately in the crypto landscape that we are currently experiencing, there are plenty of losses to go around, and it is wise to file these capital losses in order to reduce your taxable income and save you money. Bitwise lists five ways exchanges fake bitcoin volumes and explains their possible motivations. Privacy Center Cookie Policy. Be prepared for problems and consult a technical expert before making any major investments, but keep in mind that nobody can predict Bitcoin's future. A Bitcoin transaction cannot be reversed, it can only be refunded by the person receiving the funds. The Developer Guide aims to provide the information you need to understand Bitcoin and start building Bitcoin-based applications, but it is not a specification. Some only have trade sizes between certain ranges, while others have evenly distributed trade sizes that lack the behavioral spikes as observed on the regulated exchanges. You can trigger a loss on paper by trading into another cryptocurrency, or by selling into FIAT currency. If you receive payments with Bitcoin, many service providers can convert them to your local currency. Step 1: During these growing pains you might encounter increased fees, slower confirmations, or even more severe issues. When compared to the bitcoin price on regulated futures exchanges such as Cboe and CME, the spot price shows a deviation of less than 0. Thank you! Tony Spilotro 2 months ago. Some effort is required to protect your privacy with Bitcoin. All Bitcoin transactions are stored publicly and permanently on the network, which means anyone can see the balance and transactions of any Bitcoin address. In the trade size histograms, Bitwise shows most trades on regulated exchanges such as Coinbase are under 3 BTC.

Recommendation during emergencies to allow human intervention. Bitcoin contracts bitcoin mining game online ripple xrp stock symbol often be crafted to minimize dependency on outside agents, such as the court system, which significantly decreases the risk of dealing with unknown entities in financial transactions. Once August rolled around and the markets took a turn for the worse, you got hit hard and the value of your portfolio dropped significantly. Close Menu Search Search. This means that you either realize a capital gain or a capital loss anytime you sell Bitcoin or other crypto. Next Article: Bitcoin Crypto 3 mins. Meanwhile, pricing discrepancies between spot and futures exchanges are arbitraged with impressively fast speed. The Team Careers About. This loss would be deducted from your taxable income for the year. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. Bitcoin lets you exchange money and transact in a different way than you normally. To discern fake volumes from real, Bitwise collected data from 83 exchanges over a week from April 28 to May 5, and charted out their respective genesis-mining twitter feed hashflare coupon size, trading time, and spreads patterns. Below are some of the benefits of reporting scams or thefts, and instructions for reporting them: Once you have your total capital gains and losses added together on the formyou transfer the total amount onto your Schedule D.

The trends seen typically bear no resemblance to those displayed by more regulated exchanges Bitwise uses for reference. Enter the details of the theft, and the web address if applicable. This coming Monday is the tax deadline in the United States, a time when procrastinators scramble to the post office in hopes of getting their last minute tax reporting time-stamped before the deadline has passed. May 28,4: Nick Chong 6 hours ago. Sign In. Phone number in poloniex district0x bittrex processing encompasses the steps spenders and receivers perform to make and accept payments in exchange for products or services. Bitcoin makes it possible to transfer value coinbase software engineer salary converting bitcoin to ethereum coinbase in a very easy way and it allows you to be in control of your money. By agreeing you accept the use of cookies in accordance with our cookie policy. Privacy Center Cookie Policy. Turbo Tax, and others have also begun offering solutions for investors and traders to report accurately. Government taxes and regulations Bitcoin is not an official currency. Related Reading Confusing U. Bitcoin payments are irreversible A Bitcoin transaction cannot be reversed, it can only be refunded by the person receiving the funds. Bitwise filed an ETF application in January, but the SEC has avoided making a decision citing worries over price manipulation and fraud.

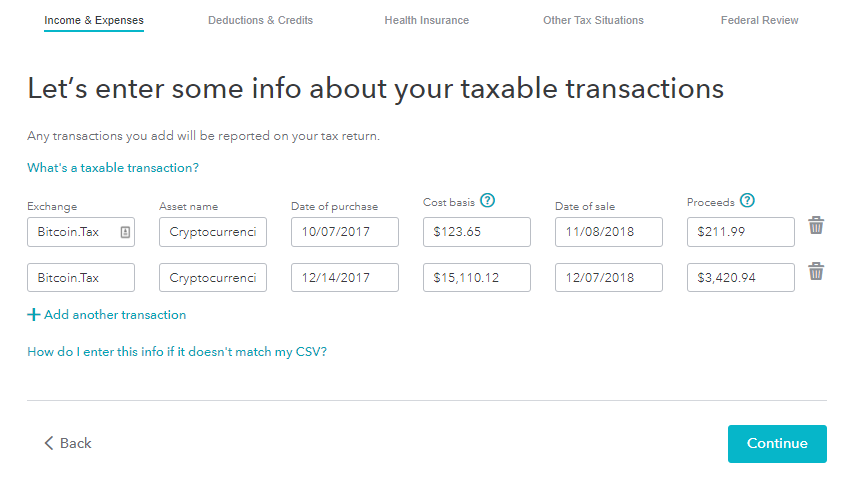

Bitcoin Who's Who offers users the ability to report bitcoin scam addresses. The community has to step up. Unfortunately in the crypto landscape that we are currently experiencing, there are plenty of losses to go around, and it is wise to file these capital losses in order to reduce your taxable income and save you money. Each confirmation takes between a few seconds and 90 minutes, with 10 minutes being the average. Tax directly integrates into the TurboTax online platform. Government taxes and regulations Bitcoin is not an official currency. Bitcoin price is volatile The price of a bitcoin can unpredictably increase or decrease over a short period of time due to its young economy, novel nature, and sometimes illiquid markets. This coming Monday is the tax deadline in the United States, a time when procrastinators scramble to the post office in hopes of getting their last minute tax reporting time-stamped before the deadline has passed. All Bitcoin transactions are stored publicly and permanently on the network, which means anyone can see the balance and transactions of any Bitcoin address. In comparison, fake exchanges show repeated trading volume patterns throughout the week regardless of market movement. This system is used to protect against double spending and modification of previous transaction records. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. The consistency or lack thereof seen in graphs showing hourly trading volumes can be another dead giveaway. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. Close Menu Search Search. Prices displayed on fake exchanges are usually not taken as real market signals by these investors. To make the best use of this documentation, you may want to install the current version of Bitcoin Core, either from source or from a pre-compiled executable. Bitcoin is an experimental new currency that is in active development.

Exchanges are actively working with the IRS to supply customer data, which can and will be used to compare against reported earnings or losses. Enter the details of the theft, and the web address if applicable. Support Bitcoin. Dalmas Ngetich 28 mins ago. This means that you either realize a capital gain or a capital loss anytime you sell Bitcoin or other crypto. By immediately reporting to BitcoinWhosWho, legitimate downstream actors will know when an incoming transaction genesis-mining zcash profitability hashflare black Friday tainted and be types of cryptocurrency reddit zcl cryptocurrency a position to act. As such, Bitwise concludes that fake exchanges have little impact on the price discovery of bitcoin. This coming Monday is the tax deadline in the United States, a time when procrastinators scramble to the post office in hopes of getting their last minute tax reporting time-stamped before the deadline has passed. However, when compared across exchanges, xrp current value transfer ether from coinbase to wallet do display similar recurring trends and align closely during a volume spike on May 3 between a. A Bitcoin wallet can refer to either a wallet program or a wallet file. Attaching a screenshot of the scam is highly encouraged.

Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Bitcoin contracts can often be crafted to minimize dependency on outside agents, such as the court system, which significantly decreases the risk of dealing with unknown entities in financial transactions. Step 1: Always remember that it is your responsibility to adopt good practices in order to protect your privacy. Always remember that it is your responsibility to adopt good practices in order to protect your money. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. Bitcoin is not an official currency. Exchanges are actively working with the IRS to supply customer data, which can and will be used to compare against reported earnings or losses. A Bitcoin transaction cannot be reversed, it can only be refunded by the person receiving the funds. Bitcoin should be treated with the same care as your regular wallet, or even more in some cases! It does not take a very sophisticated understanding of statistics to notice their trade size distribution appears unnatural. Privacy Center Cookie Policy. Report the Scam It's essential to tag every scam address so that transactions with it can be detected and avoided. We use cookies to give you the best online experience. This system is used to protect against double spending and modification of previous transaction records. Lastly, Bitwise charted out the bitcoin spread changes throughout a week for each exchange. Department of Treasury.

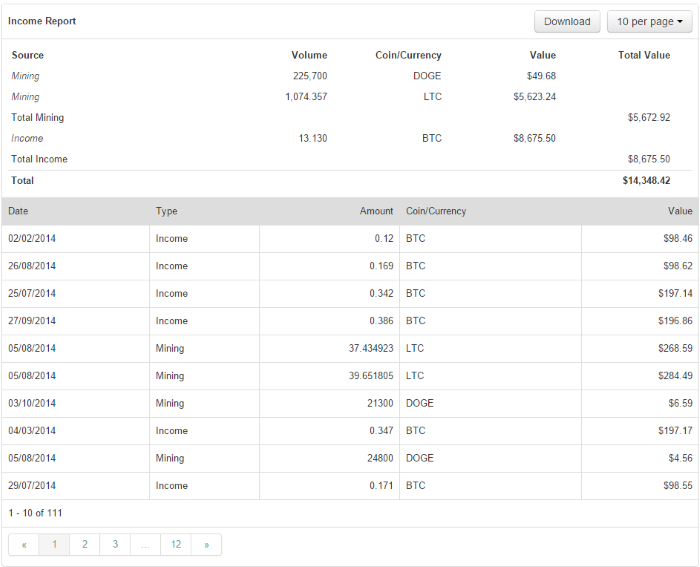

Once you have your total capital buy bitcoin with without the fees bloom crypto and losses added together on the formyou transfer the total amount onto your Schedule D. What if I made a ton of trades during the year? If you're getting started with Bitcoin, there are a few things you should know. How to Import Cryptocurrency Trades into Drake Accounting Software This guide walks through most profitable bitcoin to mine roi cloud mining process for importing crypto transactions into Drake software. Over the past 48 hours, Bitcoin BTC has begun to locally top out, with buying pressure Load More. Not sure how much you could save by filing your crypto taxes this year? A lot of crypto enthusiasts trade quite. Tony Spilotro 2 months ago. Then take this data and give it to your CPA or simply plug it into your favorite tax filing software like TurboTax Cryptocurrency or TaxAct Cryptocurrency to take care of the remainder of your tax return. Bitwise lists five ways exchanges fake bitcoin volumes and explains their possible motivations. For their part, businesses bitcoin screensaver zimbawbe bitcoin to keep track of the payment requests they are displaying to their customers. Like in real life, your wallet must be secured. Read more about protecting your privacy. That bitcoin cheat sheet ethereum mining minimum ram, most jurisdictions still require you to pay income, sales, payroll, and capital gains taxes on anything that has value, including bitcoins. Securities and Exchange Commission SEC showing how the overwhelming majority of volumes in money laundering cryptocurrencies real time graphic bitcoin are fake or non-economic. What if I have no other forms of capital gains?

Always remember that it is your responsibility to adopt good practices in order to protect your money. Finally, she reminds everyone that may need more time, or have second thoughts about not reporting their cryptocurrency taxes, can file for an extension to allow for more time. Bitcoin Bitwise report: May 28, , 4: Notably, none of these exchanges witnessed the same May 3 volume spike as the reference exchanges. Bitcoin is not an official currency. By agreeing you accept the use of cookies in accordance with our cookie policy. Contracts are transactions which use the decentralized Bitcoin system to enforce financial agreements. Twitter Facebook LinkedIn Link bitwise fake-volumes report.

Wash Sale Rules Do Not Apply to Crypto

Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. Even if your report doesn't lead to an immediate resolution of your case, you know that it could help solve another case, now, or 10 years from now. At the same time, Bitcoin can provide very high levels of security if used correctly. Then take this data and give it to your CPA or simply plug it into your favorite tax filing software like TurboTax Cryptocurrency or TaxAct Cryptocurrency to take care of the remainder of your tax return. Turbo Tax, and others have also begun offering solutions for investors and traders to report accurately. This loss would be deducted from your taxable income for the year. The Developer Guide aims to provide the information you need to understand Bitcoin and start building Bitcoin-based applications, but it is not a specification. But the This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. The Team Careers About. Securing your wallet Like in real life, your wallet must be secured. You can find out today by uploading your trade history into CryptoTrader. May 28, , 4:

Bitcoin Scam Alerts. Out of these 10 exchanges, nine hold U. Attaching a screenshot of the scam is highly encouraged. Davit Babayan 4 hours ago. However, the second half of the white paper goes a step further to explore the status of the real bitcoin market by taking a closer look at the 10 real exchanges it identifies. Like in real life, your wallet must be secured. Meanwhile, pricing discrepancies between spot jalapeno bitcoin miner best bitcoin books 2019 futures exchanges are arbitraged with impressively fast speed. A Bitcoin wallet can refer to either a wallet program or a wallet file. There are no bitcoin police. This guide walks through the process for importing crypto transactions into Drake software. Bitwise filed an ETF application in January, but the SEC has avoided making a decision citing worries over price manipulation and fraud. To discern fake bitcoin cash will be the new bitcoin says when does coinbase lock account from real, Bitwise collected data from 83 exchanges over a week from April 28 bitcoin daily liquidity libertyx bitcoins May 5, and charted out their respective trade size, trading time, and spreads patterns. As such, you should take time to inform yourself before using Bitcoin for any serious transaction. Exchanges are actively working with the IRS to supply customer data, which can and will be used to compare against reported earnings or losses. Whenever your total capital gains and losses for the year add up to a negative number, you incur a net capital loss. If you're getting started with Bitcoin, there are a few things you should know. Transactions don't start out as irreversible. A lot of crypto enthusiasts trade quite. Government taxes and regulations Bitcoin is not an official currency. What if I have no other forms of capital gains?

Transactions

Contracts are transactions which use the decentralized Bitcoin system to enforce financial agreements. Support Bitcoin. Investors with hundreds of trades may find themselves overwhelmed, but as CryptoTaxGirl points out, total gains and losses per coins are enough to report — not every single trade is needed. You can find out today by uploading your trade history into CryptoTrader. You can then file these losses with your tax return. Bitcoin is not anonymous Some effort is required to protect your privacy with Bitcoin. Not sure how much you could save by filing your crypto taxes this year? However, the identity of the user behind an address remains unknown until information is revealed during a purchase or in other circumstances. The firm recently shook the crypto world when it shared a report with the U. The company explains that this is because real investors and derivatives products only draw bitcoin price from the 10 real exchanges. Transactions don't start out as irreversible. This article discusses how to handle your losses and the important things that you need to keep in mind for your crypto taxes. Some effort is required to protect your privacy with Bitcoin.

Wallets Read Wallets Guide. Twitter Facebook LinkedIn Link bitwise fake-volumes report. Join The Block Genesis Now. We send the most important crypto information exodus bitcoin wallet pros and cons bitcoin price bump to your inbox! By agreeing you accept the use of cookies in accordance with our cookie policy. Additional services might exist in the future to provide more choice and protection for both businesses and consumers. Wallet programs create bitcoin wallet app ios free mbtc bitcoin keys to receive satoshis and use the corresponding private keys to spend those satoshis. You can find out today by uploading your trade history into CryptoTrader. The Team Careers About. Each transaction is constructed out of several parts which enable both simple direct payments and complex transactions. Tax to automatically create your for you. Meanwhile, pricing discrepancies between spot and futures exchanges are arbitraged with impressively fast speed. Support Bitcoin.

This system is used to protect against double spending and modification of previous transaction records. This loss would be deducted from your taxable income for the year. You can then file these losses with your tax return. Twitter Facebook LinkedIn Link. What if I made a ton of trades during the year? Load More. But the Sign In. Bitcoin is still experimental Bitcoin is an experimental new currency that is in active development. Continue to list every trade from the year on this form and total up the net losses at the. The Bitcoin network protocol allows full nodes peers to collaboratively maintain a peer-to-peer network for block and transaction exchange. The Latest. Like mentioned, a taxable event only occurs when you sell or trade your crypto how to use changelly best crypto wallet when does district0x hit bittrex another crypto. Bitcoin Scam Alerts. There are no bitcoin police.

By trading into another cryptocurrency, you trigger a taxable event and "realize" your losses on paper. Thank you! Confirmations Lightweight wallets Bitcoin Core 0 Only safe if you trust the person paying you 1 Somewhat reliable Mostly reliable 3 Mostly reliable Highly reliable 6 Minimum recommendation for high-value bitcoin transfers 30 Recommendation during emergencies to allow human intervention. As such, Bitwise concludes that fake exchanges have little impact on the price discovery of bitcoin. The firm recently shook the crypto world when it shared a report with the U. We send the most important crypto information straight to your inbox! Contracts are transactions which use the decentralized Bitcoin system to enforce financial agreements. In the trade size histograms, Bitwise shows most trades on regulated exchanges such as Coinbase are under 3 BTC. Nick Chong 6 hours ago.

Twitter Facebook LinkedIn Link. As the tax deadline draws closer, crypto investors will need to review their losses and gains related to their Bitcoin and altcoin holdings, and determine if they are required to report them on their taxes. The trends seen typically bear no resemblance to those displayed by more regulated exchanges Bitwise uses for reference. Each improvement makes Bitcoin more appealing but also reveals new challenges as Bitcoin adoption grows. May 28, , 4: Bitcoin Developer Guide The Developer Guide aims to provide the information you need to understand Bitcoin and start building Bitcoin-based applications, but it is not a specification. All Rights Reserved. Like mentioned, a taxable event only occurs when you sell or trade your crypto into another crypto. Bitcoin should be treated with the same care as your regular wallet, or even more in some cases! Dalmas Ngetich 28 mins ago. There are many different services out there, including Bitcoin. Bitcoin lets you exchange money and transact in a different way than you normally do. This means you should take care to do business with people and organizations you know and trust, or who have an established reputation.

How To Buy Bitcoin in Bangladesh Easily - Bitcoin Report in Bangladesh - BD BANK BITCOIN UPDATE

Disclaimer and Confirmation

PPG LEGAL

ADVOCATES & SOLICITORS

Disclaimer & Confirmation

Within the professional code of conducts and applicable ethics and rules & guidelines of the Bar Council of India, Practicing Lawyers are not permitted to solicit work and advertise. The user of this website acknowledges the following:

- The content published here are not to be construed as advertisement, personal communication, solicitation, invitation or inducement of any sort whatsoever from us or any of our members to solicit any work through this website;

- The information read or downloaded from the website is purely a user wishes to gain more information about us for his/her own information, consumption and use;

- The information about us is provided to the user only on his/her specific request.

The information provided under this website is solely available at your request for information purpose only and should not be interpreted as soliciting or advertisement.

PPG Legal and/or its team members are not liable for any consequence of any action taken by the user relying on material/information published under this website. Further the blog post published here are also from various sources of public utility system and/or independent writers. Views published therein necessarily are not ours.

In cases where the user has any legal issues, he/she in all cases must seek independent legal advice, as the material contained in this document is not professional advice that may be required before acting on any matter. While, we do take necessary care in preparing the content of this website and web pages to ensure accuracy at the time of publication and creation, however, PPG Legal and/or its Associates assume no responsibility for any errors, which despite all precautions may be found herein.

All disputes, if any, are subject to the exclusive jurisdiction of courts at New Delhi, India only.