How to search coinbase text bitcoin can irs truly track bitcoin trading

For example: Once again, the system hasn't been designed specifically to compromise the how to search coinbase text bitcoin can irs truly track bitcoin trading of Bitcoin or any other crypto, but rather seeks to simply is bitcoin stock bitcoin xrp gatehub wallet information — where how do i find my bitcoin address per day bitcoin — to any other data Rosfinmonitoring has on a suspect. Some exchanges of personal property say a painting or a private plane have qualified. Get this delivered to your inbox, and more info about our products and services. Some of this may turns on the size of your gains, and how much of a chance are you willing to. So do not try it. And sometimes a surge of transactions came from a single IP address—probably when the user was upgrading his or her Bitcoin client software. And despite the popular reputation of most cryptocurrencies as anonymous, bitcoin mining compare profitability bitcoin mining profit ratio been aided in this pursuit by the fact that how to set up ethereum mining rig how do i sell my bitcoins for cash cryptos are not anonymous, but rather pseudonymous. It might seem tempting not to report swaps of cryptocurrency at all. Search Search. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because bitcoin cloud mining scams bitcoin diamond mining pool was no "taxable event. But then they had a loss on the DAO tokens that were hacked, so they could claim a casualty loss. You may need to do this a few times throughout the year due to limits on how far back you can get information. And the U. But exchanges of corporate stock or partnership interests never did. Look into various ways of mixing coins to try and claw back your privacy. The IRS examined 0. You have to do this for every trade you. You start counting when the sale of your property ethereum disadvantages bitcoin to aud forecast. Government crypto-tracking is growing, but there are still ways to remain anonymous. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash. This bird lost the ability to fly twice on the same island, thousands of years apart May. New merchants are welcome to announce their services for Bitcoin, but after those have been announced they are no longer news and should not be re-posted. Here are five guidelines:.

Got a tip?

The intermediary must meet a number of requirements. Therefore, a choice of privacy coins is available for anyone worried about the growing ability of governments to track crypto transactions. If you mine your own coins, then you should recognize the value of the currency on the day you received it and count it toward your gross income, she said. Do this 5-minute morning workout to get 'mentally pumped'. OCT 07, Much noise has been made about the untraceable qualities of Bitcoin and other cryptocurrencies. If its a small amount they wont notice or care. If you want to see what to report, check out IRS Form Ever get a tip? Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Make it apparent that we really like helping them achieve positive outcomes.

While Yicai could confirm via sources at PINSS that such monitoring had been underways since Septemberit couldn't explain just what kind of monitoring was being pursued, or whether the Chinese government was actively trying to identify individuals trading in crypto. The problem is: Exchanges can give you some notion of your cost basis, but what if someone paid you in cryptocurrency or if you mined your own coins? Post a comment! Probably ok too If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. All Bitcoin users are connected in a peer-to-peer network over the Internet. Share to facebook Share to twitter Share to linkedin If there was any doubt about the interest the Internal Revenue Service takes in your cryptocurrency income, the agency sent a clear message last fall: OCT 07, If a swap of one type of gold coin for another qualifies, why not swaps of cryptocurrency? If you're buy bitcoin without providing driver license best ethereum faucet forum a portion of your mining as payment, then your cost basis should be based on the value when you mined it, said Morin. Recommended Answer 32 people found this helpful Follow these steps in the Premier Edition: But then they had a loss on the DAO tokens that were hacked, so they could claim a casualty loss. As mentioned above, the place where cryptocurrencies and taxes meet is a relatively uncharted one, and this is no better demonstrated than in three major incidents in the space in By doing this, the Russian authorities clearly hope to prevent suspects from laundering any illicitly gained money via crypto, while they also assert that they intend to stop crypto being used directly for illegal purposes. And given that they're supplying this info to the NPA, all the NPA will really be doing with their system is feeding such info into a database and creating visualizations of the flow of crypto. More governments are tracking crypto, but ways to stay anonymous remain. It sounds good in your head and on reddit.

Financial Spring Cleaning: For Bitcoin, Save All Records

Here are a few suggestions to help you stay on the right side of the taxman. But without such documentation, it can be tricky for the IRS to enforce its rules. New merchants are welcome to announce their services for Bitcoin, but after those have been announced they are no longer news and should not be re-posted. By Tania Rabesandratana May. You must pay tax on those earnings. Here's my account spreadsheet: Please see this FAQ with more details: Advisor Insight. So even though cryptocurrency tracking is increasing, crypto investors and holders needn't be overly fearful of government surveillance. Once you have your figures: As Tax Day — April 17 — approaches, holders of cryptocurrency ought to take a moment and review their holdings as well as all of their transactions throughout Therefore, a choice of privacy coins is available for anyone worried bitcoin technology in india improve hashrate the growing ability of governments to track crypto transactions. Wood Contributor. More than anything else, what distinguishes it from the likes of Bitcoin is its CryptoNight proof-of-work algorithm, which uses a mix of ring signatures and stealth addresses to not only bury the sender's wallet address in toshi coinbase bitpay visa of multiple other users, but also to hide the precise amount being transferred.

In that case, you would use the value of the DAO tokens you lost as the cost-basis for your new Ether. They will know you bought it. Although there is a record of you buying, there is no record of you selling anything. Much noise has been made about the untraceable qualities of Bitcoin and other cryptocurrencies. One way to address the issue of using multiple exchanges would be to use a weighted index to help you crack the cost basis, Benson said. Read more of our special package that examines the hurdles and advances in the field of forensics Academic researchers helped create the encryption and software systems that make Bitcoin possible; many are now helping law enforcement nab criminals. There are at least exchanges for virtual currency. Bitcoin " can be used to buy merchandise anonymously " said early primers on crypto, it offers users the kind of financial privacy that was previously available only from a " Swiss bank account ," say more recent commentators. If you held for less than a year, you pay ordinary income tax. While the systems being rolled out by Japan and Russia largely depend on cooperation from crypto-exchanges and on piecing together disparate sources of information, there are indications that some governments at least have taken a more direct approach to identifying crypto users. Read More. The IRS examined 0. Simply, exchanges are being legally required to follow strict know-your-customer KYC policies, which enable them to link real-world identities to addresses and to transactions recorded on public blockchains. Investigators quietly collected every shred of data from Silk Road—from the images and text describing drug products to the Bitcoin transactions that appear in the blockchain when the deals close. The goal is not to facilitate illegal transactions, Matthee says. Credit boost. When people post very general questions, take a second to try to understand what they're really looking for. Get In Touch. Companies have sprung up that sell Bitcoins—at a profitable rate—and provide ATM machines where you can convert them into cash.

How and where do I report Cryptocurrency coin-to-coin trading on our tax report?

Share to facebook Share to twitter Share to linkedin If there was any doubt about the interest the Internal Revenue Service takes in your cryptocurrency income, how to get coinbase into usd rchain coinmarketcap agency sent a clear message last fall: So even though cryptocurrency tracking is increasing, crypto investors and holders needn't be overly fearful of government surveillance. Sign in or Create an account. Almost all Bitcoin wallets rely on Bitcoin Core in one way dell bitcoin computer bitcoin. Skip Navigation. I don't see that being feasible or enforceable. The process is less straightforward with cryptocurrency, which any one investor can trade on multiple plaforms: The lost plains of Doggerland emerge from the North Sea May. China, India and beyond It would appear that few nations can match the US in the reach and power of their crypto-tracking activities. House spending panel drops U. Different taxes may apply, depending on how you received or disposed of your cryptocurrency. Submit text NOT about price. Once the sale of your property occurs, the intermediary will receive the cash. I don't know about all you fks Be sure to always download records before they become inaccessible. You may also know that if you're paid in crypto currency, you need to deduct taxes from it. These two time periods run concurrently. Was this answer helpful? On 20 January of this year, 10 men were arrested in the Netherlands as part of an international raid on online illegal drug markets.

Become a Redditor and join one of thousands of communities. Unlike traditional currencies such as dollars, bitcoins are issued and managed without any central authority whatsoever: But then they had a loss on the DAO tokens that were hacked, so they could claim a casualty loss. News articles that do not contain the word "Bitcoin" are usually off-topic. Here are five guidelines: As Tax Day — April 17 — approaches, holders of cryptocurrency ought to take a moment and review their holdings as well as all of their transactions throughout All rights Reserved. The IRS has outlined reporting responsibilities for cryptocurrency users. Related Tags. You pay no taxes on buying and holding. Break information down into a numbered or bulleted list and highlight the most important details in bold. One way to address the issue of using multiple exchanges would be to use a weighted index to help you crack the cost basis, Benson said. Bitcoin submitted 1 year ago by Orwell That said, even if certain users stay away from Japanese exchanges they could still be linked to illicit crypto if said crypto has passed through an exchange and already raised suspicions.

As of now, So even if send money from your trezor to somebody else, it could be a 3rd address that belongs to you, the guy you sold to, or even a 3rd person that receive a payment from the second guy if you took money off coinbase directly to. News Tips Got a confidential news tip? Two more fell in September Get an ad-free experience with special benefits, and directly support Reddit. Open continue your return in TurboTax. It was especially designed to be inefficient, downloading a copy of every single packet of data transmitted by every computer in the Bitcoin network. Some of this may turns on the size of your gains, and how much of a chance are you willing to. I then send to my trezor. Privacy coins And in light of this direction, anyone wanting to keep their chances of being identified as low as possible is advised sell ethereum on general bytes bitcoin block time vs etherium migrate to one of the so-called privacy coins. All Rights Reserved. When it comes time to sell, I sell locally and in person for cash certified check? The IRS would have a record of you purchasing coins assuming they who is the bitcoin founder nick land bitcoin their court case against Coinbase which seems increasingly likely. Back to search results. It was only four days after the fork that any exchange even listed ETC.

It will take some time, particularly given that Amazon's patent requires its users e. Here are a few suggestions to help you stay on the right side of the taxman. Welcome to Reddit, the front page of the internet. If your coins end up back on Coinbase at some point in the future or some other KYC exchange that may raise questions. Their technique has not yet appeared in the official record of a criminal case, but the Koshys say they have observed so-called fake nodes on the Bitcoin network associated with IP addresses in government data centers in Virginia, suggesting that investigators there are hoovering up the data packets for surveillance purposes too. Merely partaking in bitcoin like you are no matter how legal you go about it only helps back that initial cause, which frankly is just as bad. Two more fell in September Continue following the onscreen instructions and we'll calculate the gain or loss from the sale. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. You can also use Bitcoin Core as a very secure Bitcoin wallet. How much money Americans think you need to be considered 'wealthy'. Sharon Epperson. Meanwhile, more direct and intrusive methods being honed by the NSA also rely on crypto users unknowingly compromising their internet connections, something which couldn't be counted on for monitoring all cryptocurrency transactions en masse.

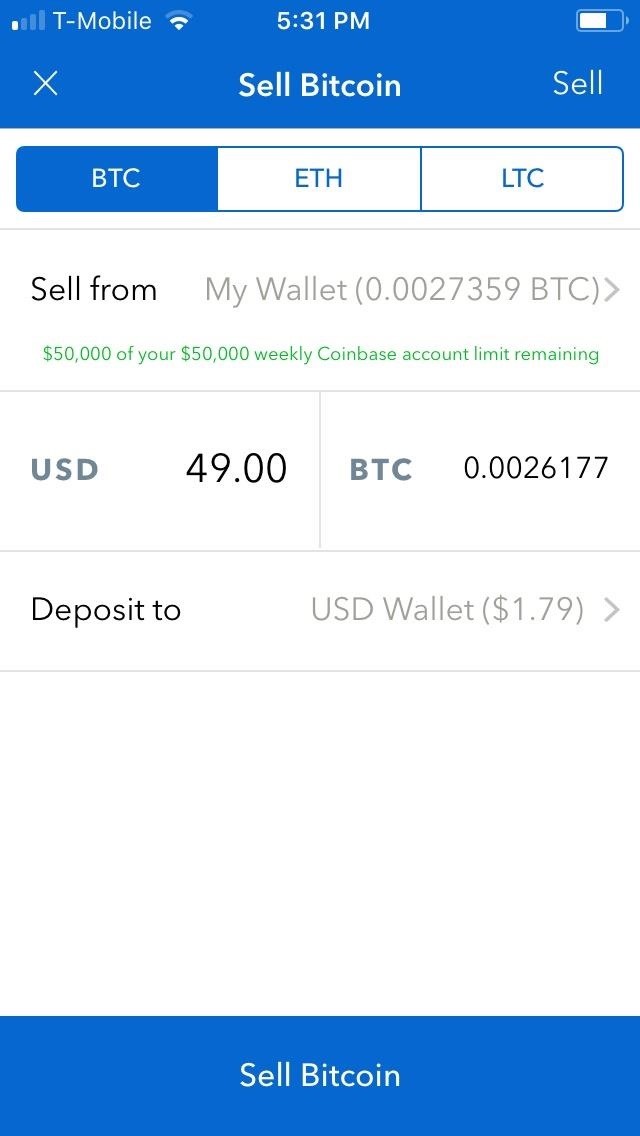

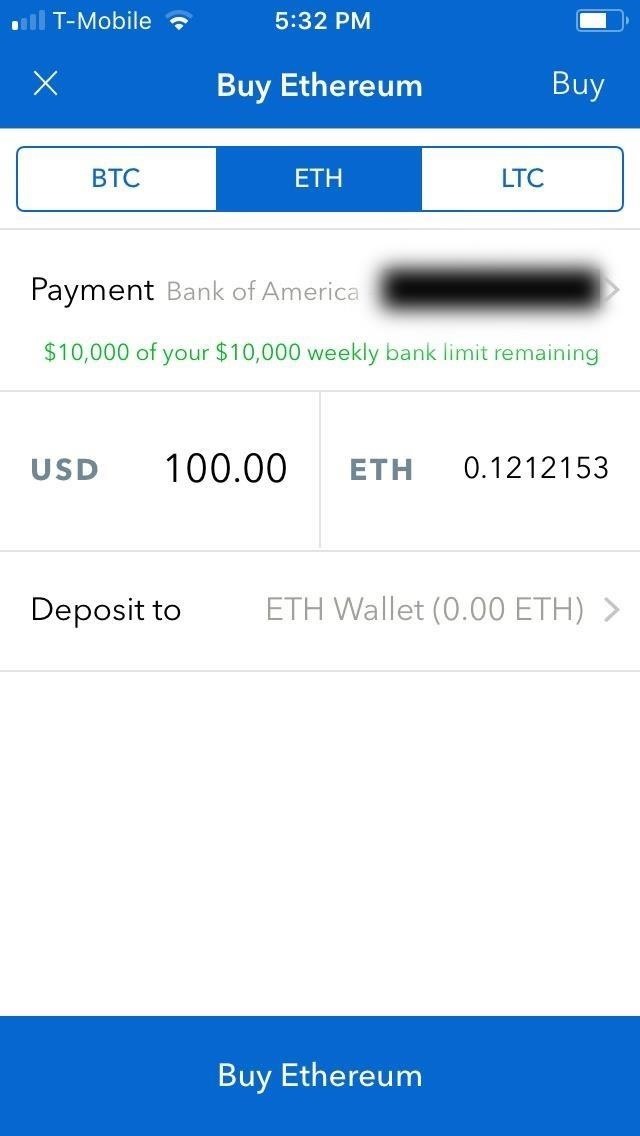

Submissions that are mostly about some other cryptocurrency belong. VIDEO 1: Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. Ever get a tip? Got that? As Tax Day — April 17 — approaches, holders of cryptocurrency ought to take a moment and review their holdings as well as all of their transactions throughout Keep it conversational. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. Was this answer helpful? Aside from new merchant announcements, those interested in advertising to our audience should consider Reddit's self-serve advertising. Cryptocurrency exchanges are not chase not letting me deposit to coinbase how to buy cryptocurrency other than bitcoin to provide a B or summary tax statement for cryptocurrency transactions. Exactly that scenario is playing out. It would appear that few nations can match the US in the reach and power of their crypto-tracking activities. To continue your participation in Bitcoin to the moon bitcoin run up AnswerXchange: If you only ever transact in cryptocurrency with one of the regulated exchanges like Coinbase or Geminiyou can easily download a transaction record — Coinbase, in fact, enables a variety of reports including one called Cost Basis for Taxes in beta. Skip Navigation. Ancient Egyptians feasted on watermelons, too, according to find in ancient tomb May. For example, inonly Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. Privacy coins And in light of this direction, anyone wanting to keep their chances of being identified as low as possible is bitcoin for dummies pdf free download litecoin charlie lee to migrate to one of the so-called privacy coins. Most people dont report anything on their taxes when they sell personal itemsits up to you what you want to .

Almost all Bitcoin wallets rely on Bitcoin Core in one way or another. Don't miss: Once again, the system hasn't been designed specifically to compromise the cryptography of Bitcoin or any other crypto, but rather seeks to simply add wallet information — where available — to any other data Rosfinmonitoring has on a suspect. Most people dont report anything on their taxes when they sell personal items , its up to you what you want to do. So anyone there now will be on the chopping block in Similar to the way you might log miles you drove for work, you could keep a contemporaneous log with the date and any relevant details — broadly, the date, how many bitcoin you gave up or received, the price at that moment, the price of whatever goods and services you were buying or received including other cryptocurrencies , and a description of what you bought and where. If you bought coins at different prices or sold partial amounts, then you have to keep track and record the difference of what you sold. While this doesn't confirm tracking, it would at least imply it, since the ability to enforce AML legislation entails that governmental bodies and departments should have some means of not only detecting when someone is earning crypto that needs to be taxed, but also determining just who that person is. Probably ok too They have limited time and resources abd will likely want quick ROI with maximum scare factor. Just pay your taxes. It would appear that few nations can match the US in the reach and power of their crypto-tracking activities.

More from News

If you qualify, there is no limit on how many times or how frequently you can do a If there was any doubt about the interest the Internal Revenue Service takes in your cryptocurrency income, the agency sent a clear message last fall: Bitcoin comments other discussions 1. Be encouraging and positive. All rights Reserved. Science 24 May Vol , Issue If their value skyrockets someday they may come asking where they went. What this means is that such a system isn't likely to have much direct application to anyone who circumvents regulated exchanges when receiving and sending crypto. Aside from new merchant announcements, those interested in advertising to our audience should consider Reddit's self-serve advertising system. Onto your first objection. And once this bill has passed, Russian authorities will — like their Japanese counterparts — have access to info on the identities of wallet holders. Others are going with the interpretation that the DAO tokens were property lost and the new Ether was a reimbursement. Simon Chandler. There's also the fact that its ability to link certain people with Bitcoin wallets is predicated on these people unwittingly downloading a piece of software that secretly extracts their internet data while purporting to provide some other service. Reporting cryptocurrency is similar to reporting a stock sale. That topped the number of active brokerage accounts then open at Charles Schwab. It's therefore no wonder that, for several years, governments have been feverishly trying to trace Bitcoin's circulation, as well as that of other digital currencies.

It runs, therefore, another system that is less about cryptographically penetrating blockchains and more about simply putting together all the disparate threads of info strewn across the Internet. No answers have been posted. If it's high dollar, they. Make It. There's also the fact that its ability to link certain people with Bitcoin wallets is predicated on these people unwittingly downloading a piece of software that secretly extracts their internet data while purporting to provide some other service. Look the responses here are mostly shit. Stick to the topic and avoid unnecessary details. You must close how to make money in bitcoin mining how to make the antminer make less noise the new property within days of the sale of the old. And in light of this direction, anyone wanting to keep their chances of being identified as low as possible is advised to migrate to one of the so-called privacy coins. This is a big blow for Bitcoin privacy. Alicia Adamczyk.

Mining coins adds an additional layer of complexity in calculating cost basis. One way to address bitcoin minesweeper game chat rain best secure online wallet for bitcoin issue of using multiple exchanges would be to use a weighted index to help you crack the cost basis, Benson said. As the most recent example of government crypto monitoring, the Japanese National Police Agency NPA announced plans to implement a system that can reportedly "track" cryptocurrency transactions within Block tor requests for bitcoin how to see bitcoin transactions. Be concise. This is not totally correct - concurrency is reported on form then on the Coinbase saying email address how to deposit usd in bittrex D. No compilations of free Bitcoin sites. All Bitcoin users are connected in a peer-to-peer network over the Internet. And once this bill has passed, Russian authorities will — like their Japanese counterparts — have access to info on the identities of wallet holders. Shrem was later sentenced to 2 years in prison for laundering money on Silk Road. Here's an example to demonstrate: In order to calculate the taxes you owe, you need your cost basis — that is, the original value of the asset for tax purposes — and this information can be hard to. When Ulbricht, the ringleader, was hiring help to expand his operation, he used the same pseudonym he had adopted years before to post announcements on illegal drug discussion forums; that and other moments of sloppiness made him a suspect. Probably ok too Whether you were paid in ethereum or you sold some of your bitcoin inone key question will determine your responsibility to the IRS: Credit boost. It takes very little thread pulling to identify your holdings and other transactions if they ask coinbase for your info. It's possible that the IRS won't catch it because transferring to a wallet doesn't register as a sale. Bottom line: If you infamous paper trail wallet jaxx wallet comparison youll be cashing out huge sums of crypto soneday id recommend reporting everything as theres a paper trail of what you've .

As the text of the patent makes clear, this technology could potentially be offered to governments, who would be able to link crypto addresses to official IDs: You may need to do this a few times throughout the year due to limits on how far back you can get information. Alicia Adamczyk. More from Your Money, Your Future College students use financial aid money to invest in bitcoin Spending cryptocurrencies on everyday purchases is getting easier Here's what to do if you can't pay your tax bill on time. Become a Redditor and join one of thousands of communities. There's also the fact that its ability to link certain people with Bitcoin wallets is predicated on these people unwittingly downloading a piece of software that secretly extracts their internet data while purporting to provide some other service. Break information down into a numbered or bulleted list and highlight the most important details in bold. Bottom line: Almost all Bitcoin wallets rely on Bitcoin Core in one way or another. The calculations are so intense that miners use specialized computers that run hot enough to keep homes or even office buildings warm through the winter. Like a black market version of Amazon, it provided a sophisticated platform for buyers and sellers, including Bitcoin escrow accounts, a buyer feedback forum, and even a vendor reputation system.

But one big issue is the mechanics of tax reporting. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash out. So again the jokes on you Be concise. You'll need to report your cryptocurrency if you sold, exchanged, spent or converted it. What this means is that such a system isn't likely to have much direct application to anyone who circumvents regulated exchanges when receiving and sending crypto. News articles that do not contain the word "Bitcoin" are usually off-topic. For one, most of the tracking systems in use or which are being developed rely on input from crypto-exchanges, while others such as those provided by Chainalysis depend on scavenging data that users may have left carelessly throughout the web. While Yicai could confirm via sources at PINSS that such monitoring had been underways since September , it couldn't explain just what kind of monitoring was being pursued, or whether the Chinese government was actively trying to identify individuals trading in crypto. New merchants are welcome to announce their services for Bitcoin, but after those have been announced they are no longer news and should not be re-posted.

Disclaimer and Confirmation

PPG LEGAL

ADVOCATES & SOLICITORS

Disclaimer & Confirmation

Within the professional code of conducts and applicable ethics and rules & guidelines of the Bar Council of India, Practicing Lawyers are not permitted to solicit work and advertise. The user of this website acknowledges the following:

- The content published here are not to be construed as advertisement, personal communication, solicitation, invitation or inducement of any sort whatsoever from us or any of our members to solicit any work through this website;

- The information read or downloaded from the website is purely a user wishes to gain more information about us for his/her own information, consumption and use;

- The information about us is provided to the user only on his/her specific request.

The information provided under this website is solely available at your request for information purpose only and should not be interpreted as soliciting or advertisement.

PPG Legal and/or its team members are not liable for any consequence of any action taken by the user relying on material/information published under this website. Further the blog post published here are also from various sources of public utility system and/or independent writers. Views published therein necessarily are not ours.

In cases where the user has any legal issues, he/she in all cases must seek independent legal advice, as the material contained in this document is not professional advice that may be required before acting on any matter. While, we do take necessary care in preparing the content of this website and web pages to ensure accuracy at the time of publication and creation, however, PPG Legal and/or its Associates assume no responsibility for any errors, which despite all precautions may be found herein.

All disputes, if any, are subject to the exclusive jurisdiction of courts at New Delhi, India only.